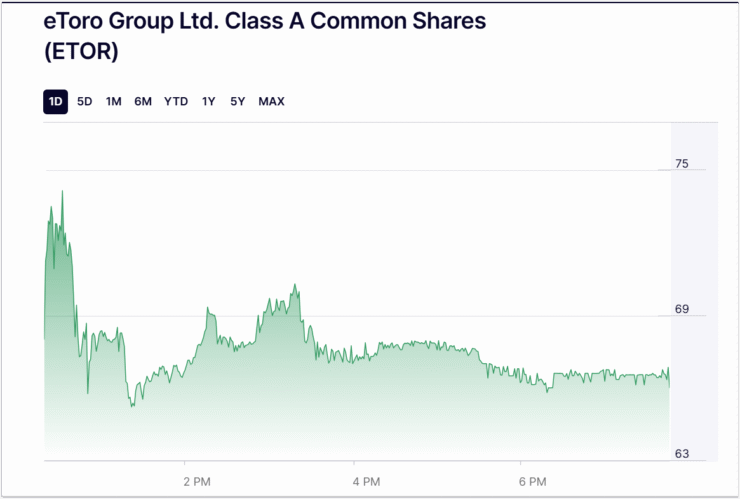

Shares of eToro surged 29% on its first day of trading on the Nasdaq, closing near $67 and pushing the company’s valuation to approximately $5.4 billion. The robust debut comes after the company priced its IPO at $52 per share, selling 6 million shares and raising a total of $310 million in fresh capital.

The Israeli-born platform, which blends stock brokerage services with cryptocurrency trading, now joins a growing list of fintech and crypto-native companies entering public markets—an ambition that once seemed unlikely amid years of regulatory pressure and market turbulence.

eToro’s successful listing represents a broader shift in market sentiment. Regulatory uncertainty that previously discouraged crypto firms from going public is now giving way to cautious optimism, particularly after the approval of U.S.-based Bitcoin ETFs. The landscape has become more hospitable to companies offering crypto infrastructure, encouraging other heavyweights like Circle and Kraken to revive IPO ambitions.

Revenue-wise, eToro operates on a multi-pronged model. It earns from trading fees layered onto spreads, as well as management fees from digital asset transfers and its crypto wallet services. This diversified income structure offers resilience against market volatility, helping the firm navigate previous downturns and attract investor confidence in its public debut.

Crypto Revenue Triples Despite U.S. Setback

eToro reported a sharp increase in digital asset revenue last year, pulling in $12.4 billion in 2024—more than triple its $3.4 billion figure from the previous year. The data, disclosed in a recent SEC filing ahead of its Nasdaq debut, highlights the central role crypto plays in the company’s growth strategy, even as regulatory tensions continue to shape its operations in key markets like the United States.

Despite strong revenue gains, the company’s crypto holdings slightly declined, with $113.2 million in digital assets recorded on its balance sheet at the end of 2024—down marginally from $114.7 million the previous year. Still, the figures reflect a stable crypto treasury strategy amid fluctuating market conditions.

In a shareholder letter accompanying the amended registration document, eToro co-founder and CEO Yoni Assia reiterated the company’s long-standing belief in blockchain innovation. He described crypto as “a revolutionary technology with the potential to decentralize and democratize financial systems on a global scale,” reinforcing the platform’s commitment to digital assets as a core part of its identity.

U.S. Limits Force Strategic Shift for eToro

Founded in 2007, eToro was among the earliest platforms to embrace Bitcoin trading, launching BTC support in 2013 and later expanding to Ethereum and other major cryptocurrencies. At its peak, the platform offered over 70 digital assets to U.S. users. That changed in 2023 following a $1.5 million settlement with the SEC, which alleged that eToro was operating as an unregistered broker and clearing agency.

As part of the settlement terms, eToro limited its U.S. crypto offering to just three tokens—Bitcoin, Ethereum, and Bitcoin Cash—curtailing its broader altcoin portfolio. While the company avoided further enforcement action, the case underlined the regulatory grey zone surrounding crypto classifications in the U.S. and forced eToro to recalibrate its compliance strategy moving forward.

Even so, the platform continues to thrive in global markets, leveraging its international user base and regulatory licenses in Europe, the UK, and Australia to grow its crypto business outside the U.S.

Quick Facts

- eToro stock jumped 29% on its Nasdaq debut, closing near $67.

- The company raised $310 million in its $52-per-share IPO.

- eToro earned $12.4 billion in crypto revenue in 2024.

- U.S. operations were limited to 3 tokens after a 2023 SEC settlement.