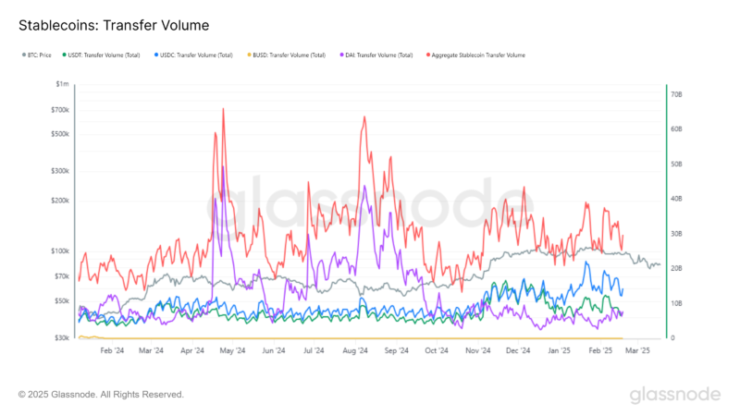

While speculative crypto assets have faced mounting pressure in recent weeks, Ethereum’s stablecoin ecosystem continues to exhibit resilience and sustained utility. On-chain data shows that stablecoin transaction volume on Ethereum has maintained strong momentum, averaging approximately $800 billion per month over the past four months.

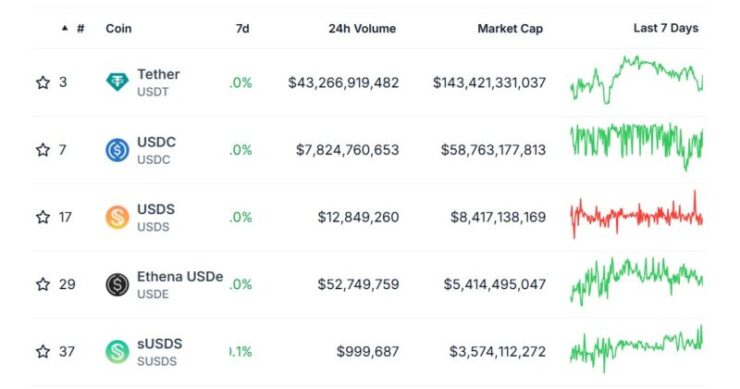

A significant driver of this activity is the continued dominance of USDC and USDT, which together accounted for a staggering $740 billion out of February’s $850 billion total stablecoin volume. This concentration demonstrates the market’s clear preference for established, reliable stablecoin options with strong liquidity and regulatory compliance.

Additionally, user engagement remains high. The number of addresses actively transferring stablecoins has steadily climbed, recently surpassing 600,000 unique addresses in a single week—a metric signaling sustained network participation.

Ethereum currently hosts around $35 billion in USDC and $67 billion in USDT, reinforcing its position as the primary settlement layer for digital dollar transactions. Despite the rise of competing Layer 1 blockchains and Layer 2 solutions, Ethereum’s robust infrastructure and network effects continue to secure its leadership in the stablecoin space.

Ethereum Retains Over 60% of Stablecoin Market Share

Despite the rise of alternative blockchains, Ethereum maintains a 63% share of all stablecoin volume across major networks, according to recent analytics. This dominance reflects both the maturity of Ethereum’s ecosystem and the stickiness of liquidity already embedded within its protocols.

While networks like Solana and Tron have made inroads in the stablecoin sector—particularly in retail-driven markets—Ethereum remains the preferred choice for large-scale transactions and institutional-grade financial products. Notably, high-profile projects, including MakerDAO and Aave, continue to rely heavily on Ethereum for their stablecoin-related operations.

Industry Trend: Stablecoins Driving DeFi Growth

The continued rise in stablecoin volumes—especially on Ethereum—reflects the central role these assets play in powering the broader DeFi ecosystem. Stablecoins like USDC and USDT are critical for facilitating trading, lending, and yield farming, offering market participants a reliable, dollar-pegged medium of exchange.

Stablecoins have emerged as one of the clearest examples of product-market fit within the crypto industry, offering a reliable bridge between traditional finance and decentralized ecosystems. Their appeal lies in several key advantages over legacy financial systems, which have fueled their rapid adoption and sustained growth—particularly on the Ethereum network.

Unlike traditional payment systems bound by banking hours, stablecoins facilitate 24/7, near-instant settlement, allowing transactions to occur seamlessly across time zones. They also provide significantly lower fees for cross-border transfers, positioning them as a competitive alternative to conventional remittance services. Additionally, the programmable nature of stablecoins enables complex financial products, such as lending protocols and automated payments, through the use of smart contracts.

Moreover, stablecoins have proven instrumental in promoting financial inclusion, offering access to digital dollars for populations underserved by traditional banking infrastructure globally.

Regulatory clarity is gradually catching up with stablecoin innovation. In the U.S., policymakers are advancing a stablecoin bill aimed at establishing clear guidelines for issuers and ensuring consumer protections. This push toward formal oversight could further legitimize key players like Tether (USDT), Circle (USDC), Paxos (USDP), and PayPal (PYUSD)—solidifying their positions within both crypto markets and the broader financial system.

Quick Facts:

- Ethereum processed over $740 billion in USDT and USDC stablecoin transactions in February. 2025.

- Ethereum currently holds over 60% of the total stablecoin market share across major blockchains.

- Layer 2 networks and competitors like Solana and Tron are challenging Ethereum’s dominance with lower fees and faster speeds.

- Stablecoins remain essential to DeFi growth, powering liquidity, trading, and lending protocols.