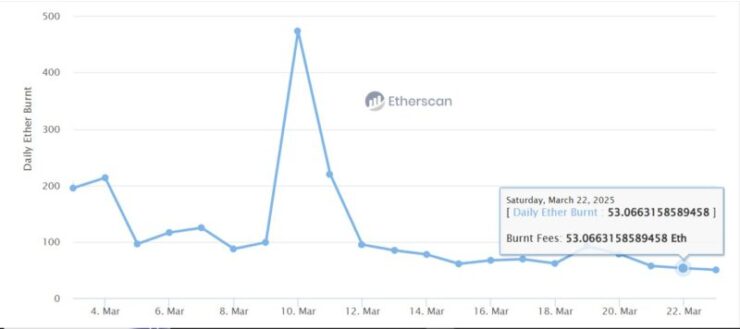

The Ethereum network has experienced a significant decrease in its daily ETH burn rate, reaching an all-time low of 53.07 ETH (approximately $106,000) on Saturday. This decline highlights a reduced demand for network block space, as on-chain metrics such as active addresses, transaction volumes, and transaction counts have all shown a downward trend in recent weeks, marking one of the clearest indicators of slowed on-chain activity in recent months.

This burning mechanism, introduced through Ethereum’s EIP-1559 upgrade, was designed to reduce inflationary pressure by removing a portion of ETH used in base transaction fees from circulation. During periods of high network usage, the mechanism has historically turned Ethereum into a deflationary asset, as more ETH is burned than issued.

However, current data shows that with network activity down, the supply of ETH is now projected to grow by approximately 0.76% annually, based on the trailing seven-day burn rate. This shift underscores how Ethereum’s deflationary properties are directly tied to user engagement and network congestion—both of which appear to be waning at present.

Declining On-Chain Activity

The reduction in ETH burn rate is closely linked to a broader decrease in on-chain activity. Notably, the number of active Ethereum addresses involved in transactions dropped to a year-to-date low of 361,078, indicating waning user engagement. Additionally, the creation of new wallets has fallen to its lowest daily count this year,, signaling reduced user engagement across the ecosystem.

Additionally, transaction fees on Ethereum have plummeted by nearly 50% over the past week, according to analytics from IntoTheBlock. While Ethereum is known for its variable gas fees, typically driven by network congestion, the current drop is not merely cyclical. Rather, it reflects a substantial decline in overall network demand.

This slowdown extends to wallet activity as well, with new wallet creation hitting year-to-date lows—another clear indicator of weakening participation. As Ethereum plays a foundational role in the decentralized finance (DeFi) and NFT markets, the decrease in activity has sparked broader discussions about user retention and evolving competition from alternative blockchain platforms.

Ethereum Faces Scalability Pressures

Ethereum’s ongoing scalability challenges continue to influence user behavior and on-chain dynamics. Over the years, the network has pursued a rollup-centric strategy, encouraging much of its transaction load to migrate to Layer 2 solutions. While this approach has alleviated some congestion, it has also contributed to an exodus of users, decentralized applications, and transaction volume to faster, lower-cost blockchain competitors like Solana, Avalanche, and Binance Smart Chain.

The recent sharp drop in Ethereum’s transaction fees—down by nearly 50%—is a direct result of these shifting dynamics, as lower demand has softened the network’s typical congestion. Analysts suggest that the cooling market, combined with the rise of scalable alternatives, is raising questions about Ethereum’s long-term utility and its ability to maintain its dominance.

Currently, Ethereum is trading near $2,016 reflecting a year-to-date decline of around 38%, one of the steepest drops among major cryptocurrencies.

Quick Facts:

- Ethereum’s daily ETH burn rate hit a record low of 53.07 ETH, approximately $106,000.

- Active Ethereum addresses dropped to a year-to-date low of 361,078.

- Ethereum transaction fees decreased by 50% over the past week, indicating reduced network congestion.

- This slowdown extends to wallet activity as well, with new wallet creation hitting year-to-date lows.