Ethereum has surged into the ranks of the world’s most valuable assets, overtaking the market capitalizations of Coca-Cola and Alibaba following the successful deployment of its long-awaited Pectra upgrade.

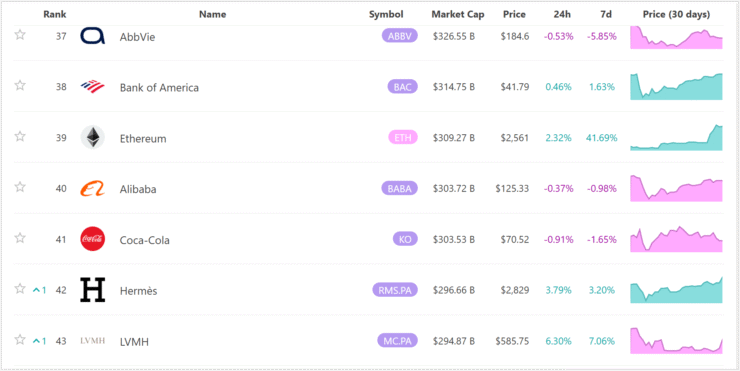

As of May 12, Ether (ETH) was trading near $2,550, with a total market capitalization exceeding $308 billion, according to data from 8marketcap. In comparison, Coca-Cola’s market cap stood at $303.5 billion and Alibaba’s at $303.7 billion—placing ETH among the top 40 most valuable tradable assets globally.

The rally was largely fueled by excitement surrounding the Pectra upgrade, which brought substantial improvements to Ethereum’s core infrastructure. These included enhanced data storage for layer-2 rollups, increased validator staking capacity, and expanded functionality for smart wallets—boosting Ethereum’s performance, scalability, and usability.

Ethereum Rolls Out Pectra Upgrade After Delays

Ethereum’s long-awaited Pectra upgrade went live on the mainnet on May 7, following months of rigorous testing and a series of delays. Originally slated for March 2025, the deployment was pushed back after multiple failed testnet launches.

The initial rollout on the Holesky testnet on February 24 failed to finalize due to unforeseen technical issues. A second attempt on the Sepolia network on March 5 was also disrupted—this time by an external attacker who triggered the generation of empty blocks. Developers eventually launched a new testing environment, dubbed “Hoodi,” which allowed them to finalize preparations for the successful mainnet launch.

Key features introduced in the Pectra upgrade include:

- The ability for externally owned accounts (EOAs) to function as smart contracts.

- Support for gas payments using ERC-20 tokens.

- An increase in the validator staking cap from 32 ETH to 2,048 ETH.

- Higher throughput for layer-2 rollups through additional data blob capacity per block.

Since the upgrade, ETH has posted a dramatic price increase—rising from approximately $1,786 on May 7 to $2,550 by May 12, marking a 42% gain in just five days.

Security Concerns Emerge After Pectra Deployment

Despite the upgrade’s success, cybersecurity experts have flagged potential risks introduced by the Pectra update—particularly around a new transaction structure that may expose users to off-chain exploits.

The enhanced transaction model enables increased flexibility, but it also allows for off-chain message signing. Analysts warn that attackers could exploit this feature to initiate unauthorized fund transfers from externally owned accounts without requiring traditional on-chain approvals.

Solidity auditor Arda Usman has been among the most outspoken on the issue, warning that malicious actors could potentially drain user balances through cleverly crafted payloads exploiting off-chain message execution.

No major incidents have been reported so far, but experts are urging caution as users, developers, and protocols begin to adopt the new features.

Quick Facts

- Ethereum’s market cap surged past $308 billion on May 12, surpassing Coca-Cola and Alibaba.

- The Pectra upgrade went live on May 7, introducing smart EOAs, gas fee flexibility, and scalability improvements.

- ETH rose 42% in five days following the upgrade, climbing from $1,786 to $2,550.

- Security experts warn that new off-chain transaction types may expose users to potential exploits involving externally owned accounts.