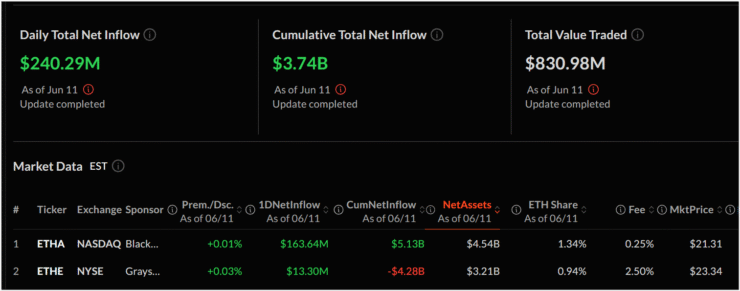

Ethereum spot ETFs in the U.S. saw a dramatic surge in investor interest on Wednesday, pulling in over $240 million in net inflows—eclipsing the $164.5 million recorded by their Bitcoin counterparts. This marks the 18th straight day of positive flows into Ethereum-based ETFs, reinforcing the asset’s growing appeal among institutional players.

Leading the charge was BlackRock’s iShares Ethereum Trust (ETHA), which attracted a staggering $163.6 million in new capital. Fidelity’s Ethereum fund followed with $37.2 million, while smaller inflows were also recorded by Grayscale’s Mini Ethereum Trust, its ETHE product, and Bitwise’s BITW fund. The strong inflows suggest that Ethereum is gaining traction not just as a speculative asset but as a cornerstone of long-term digital portfolios.

Market analysts point to a combination of factors behind the surge. As Bitcoin approaches record highs and altcoins rally across the board, Ethereum is being reevaluated as a relative value play—especially amid optimism that U.S. regulators may soon allow exemptions for DeFi-related instruments. “ETH looks undervalued in comparison,” said Nick Ruck, research director at LVRG, noting that the SEC’s shifting tone on decentralized finance has sparked fresh institutional interest.

The streak of inflows and strong ETF demand comes at a pivotal time for Ethereum, as attention shifts from pure price speculation to broader use cases in tokenization, smart contracts, and stablecoin infrastructure.

Ethereum Volume Tops Bitcoin on DeFi Optimism

Regulatory tailwinds and growing institutional confidence in decentralized finance (DeFi) are fueling a fresh wave of interest in Ethereum. Securities and Exchange Commission (SEC) Commissioner Paul Atkins recently made headlines by voicing strong support for DeFi during a Crypto Task Force roundtable, stating that the right to self-custody of digital assets is a “foundational American value” that must be preserved in the digital age.

His remarks come at a time when stablecoin frameworks and DeFi protocols are gaining traction both legislatively and in the private sector, creating a more favorable environment for decentralized platforms. This growing regulatory clarity appears to be translating into market action—Ethereum’s derivatives volume surpassed $106 billion in recent trading sessions, outpacing Bitcoin’s $80.5 billion, according to data from Coinglass.

Ethereum’s spot price briefly broke above $2,800 on Wednesday, its highest level since February, before pulling back slightly to $2,769 by the close of the day.

Ethereum Upgrade and ETFs Attract Institutional Buyers

Ethereum’s recent momentum is being bolstered not just by ETF inflows, but also by foundational improvements to the network itself. The Pectra upgrade, rolled out earlier this year, tackled persistent issues around scalability and transaction costs—two barriers that had long frustrated developers. With these upgrades in place, the Ethereum ecosystem is becoming more efficient and attractive for both builders and institutional investors alike.

That growing appeal is resonating across the industry. Laura K. Inamedinova, Chief Growth Officer at Gate.io, noted during a recent Coinrockmedia podcast that Ethereum is poised to become the next major on-ramp for traditional finance.

“Ethereum ETFs will likely be staked soon,” she said.

“There’s going to be a wave of smart money coming in—capital that’s strategic, not speculative.”

This view underscores a broader shift in how Ethereum is being positioned in the eyes of institutional investors. With the network now technically stronger and ETF adoption accelerating, Ethereum is shedding its label as a high-beta altcoin and emerging as a programmable layer for real-world financial infrastructure.

Quick Facts

- Ethereum spot ETFs pulled in over $240 million on Wednesday.

- BlackRock’s ETHA led inflows with $163.6 million.

- Ethereum derivatives volume topped $106B, beating Bitcoin.

- Ethereum price briefly passed $2,800, a 4-month high.

- SEC support and network upgrades are fueling institutional interest.