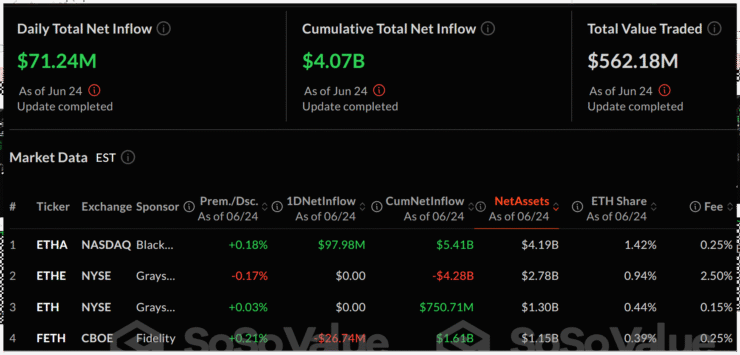

U.S. spot Ethereum ETFs have crossed a cumulative $4 billion in net inflows, nearly a year after their market debut on July 23, 2024. According to data tracked by SosoValue, the milestone was achieved after the products attracted $100.7 million in a single day—the largest daily intake over the past week, even as Middle East tensions weighed on investor sentiment.

Among the issuers, Fidelity’s FETH took the lead, drawing in $60.5 million on June 23. BlackRock’s ETHA, which typically dominates, followed with $25.8 million. Meanwhile, Grayscale’s ETHE and mini ETH products added $9 million and $5.4 million, respectively. Other funds posted no movement for the day.

Market Share Shift Driven by Grayscale Outflows

While the $4 billion figure is impressive, it comes after significant structural outflows. Grayscale’s ETHE fund has lost over $4.3 billion in net assets since it was converted from a trust, reducing its market dominance from nearly 90% at launch to just 30.2% today. Some of this capital has rotated into Grayscale’s lower-cost ETH product, though much of it has flowed into competitors.

BlackRock’s ETHA now leads the field with a 31.8% share, followed by Fidelity’s FETH at 18%. Grayscale’s newer ETH offering trails at 15.5%. Despite early criticism from skeptics, ETF analysts are calling the launch a success.

“Spot Ethereum ETFs just surpassed $4 billion… Seems pretty successful to me,” said ETF Store President Nate Geraci on X.

So far, cumulative trading volume has hit $89 billion, and daily turnover remains elevated—closing at $840 million on Monday, even though that’s a decline from the February high of $1.5 billion.

Still Far Behind Bitcoin’s ETF Surge

Despite this achievement, Ethereum ETFs still lag far behind their Bitcoin counterparts. U.S. spot Bitcoin ETFs reached $34.7 billion in net inflows within their first 11 months and now sit at $47.3 billion in total net contributions.

Bitcoin funds brought in $350.8 million on Monday alone, led once again by BlackRock’s IBIT, which has recorded a 10-day streak totaling $2.8 billion in inflows. However, when adjusting for Ethereum’s smaller market cap—$290.3 billion versus Bitcoin’s $2.1 trillion—the gap is less stark on a relative basis.

As of the latest market data, Bitcoin is trading around $105,091, up 3.2% on the day, while Ethereum has climbed 6.3% to $2,403, buoyed by ETF momentum and broader investor interest.

Quick Facts

- U.S. Ethereum ETFs have crossed $4 billion in net inflows.

- Fidelity and BlackRock now dominate ETH ETF market share.

- Grayscale’s ETHE has lost over $4.3 billion in outflows.

- Bitcoin ETFs remain well ahead, with $47.3 billion in inflows to date.