Ethereum’s struggles are deepening, with ETH dropping more than 53% from its December 2024 peak of $4,100. Now trading at $1856, the second-largest cryptocurrency faces mounting pressures from ETF outflows, rising operating costs, and macroeconomic uncertainty. Analysts warn that if selling pressure persists, Ether could retest the critical $1,800 support level a move that would have serious implications for the broader crypto market.

Despite the broader crypto market showing signs of a potential bull cycle, Ether has been unable to regain momentum. Several key factors according to yahoo finance are keeping ETH stuck in a downward spiral:

- High Ethereum Network Fees – Analysts from Bitfinex highlight that elevated transaction costs are discouraging developers from launching new projects. This lack of fresh innovation is impacting Ethereum’s overall ecosystem growth.

- Escalating U.S.-EU Tariff Tensions – Rising fears of a potential trade war are creating broader market uncertainty. With U.S. import tariffs tightening and Europe preparing counter-tariffs on $28 billion worth of goods, risk assets—including cryptocurrencies—are feeling the impact.

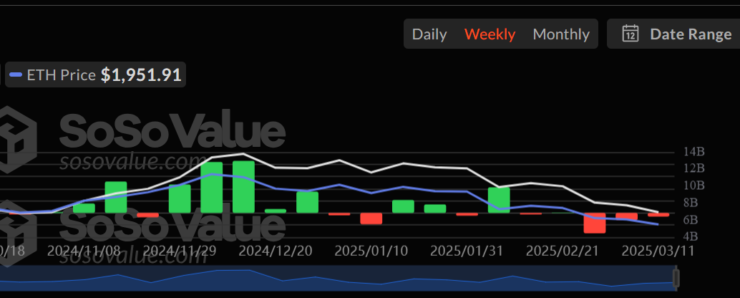

- Massive ETF Outflows – U.S. spot Ether ETFs have experienced net negative outflows for four consecutive weeks. Last week alone, investors pulled out $119 million, according to Sosovalue data. This trend has pushed ETH below the crucial $2,200 support level, a significant price point that had previously helped sustain Ethereum’s bull market recovery.

The current price action suggests Ether is at a crossroads. If selling pressure intensifies, ETH could slide further toward $1,800, a level considered a crucial support zone by analysts. A drop below this mark could trigger further liquidation events, intensifying volatility in the market.

Some experts believe Ethereum’s current downturn signals an early bear market cycle, even as Bitcoin continues to show strength. Others argue that the price dip is part of a broader macro correction—one that could eventually reset Ethereum’s trajectory for future gains.

Despite ETH’s short-term struggles, institutional investors are still betting on long-term gains. Firms like VanEck project a $6,000 price target for ETH by 2025, alongside a Bitcoin price forecast of $180,000. While these predictions paint a bullish long-term outlook, Ethereum’s current price reality is far from optimistic.

Investor sentiment remains heavily influenced by ETF outflows and economic conditions, making short-term recovery uncertain. Unless ETF outflows reverse and network activity picks up, Ethereum could face continued downward pressure in the coming weeks.

What’s Next for Ether?

For now, all eyes are on Ethereum’s $1,800 support level. If it holds, ETH could stabilize and begin forming a recovery pattern. However, if outflows persist and macroeconomic conditions worsen, a deeper correction could be in play.

With ETF trends, institutional moves, and global market factors shaping the next phase, Ethereum investors will need to navigate one of the most uncertain periods in recent months. Whether Ethereum rebounds or continues its downward spiral will likely depend on how external pressures play out in the coming weeks.