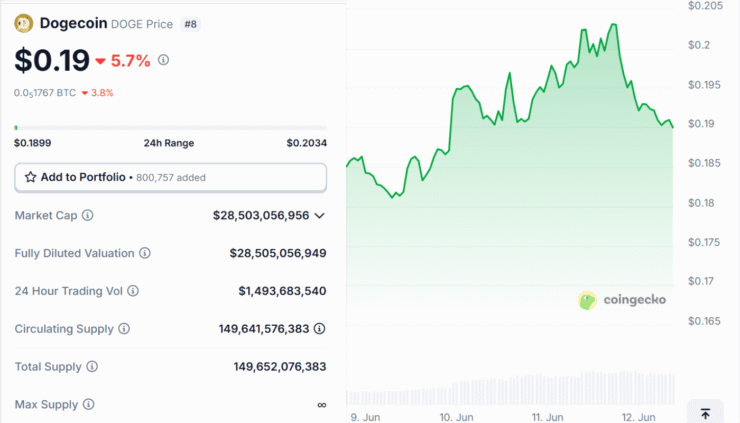

Dogecoin is back in the spotlight after a surprise political-tech development triggered a sharp price rally. The meme coin jumped over 6% on the day, briefly crossing the $0.20 mark before settling around $0.195—its highest level in weeks. The catalyst? A rare public concession from Elon Musk, who reportedly issued a private apology to Donald Trump, signaling a truce between the two influential figures.

This unexpected reconciliation comes as speculation around crypto-friendly ETF approvals heats up, adding fuel to Dogecoin’s sudden breakout. With trading volume soaring over 827% in 24 hours to nearly $1.65 billion, the surge wasn’t just a flash in the pan—it reflected renewed investor conviction. Dogecoin also successfully breached a key resistance level at $0.19, suggesting technical strength behind the rally.

Market analysts point to Musk’s shift in tone as a key driver. His admission that his previous comments about Trump may have “gone too far” has been interpreted by investors as a de-escalation of tensions that had threatened to spill over into Musk’s business ventures. Trump had earlier hinted at potential consequences for SpaceX contracts—an issue that spooked markets in recent weeks. With that cloud lifted, sentiment quickly turned bullish, especially for Dogecoin, which has historically moved in sync with Musk’s public actions.

The spillover effect was also felt in Ethereum, which experienced a brief price lift amid broader optimism. While ETH’s gains were more modest, the combined narrative of political détente and renewed ETF enthusiasm created an upward draft that pulled several major altcoins along for the ride.

ETF Bets and Greed Index Fuel Dogecoin Momentum

Dogecoin’s rally gained further legitimacy this week as Bloomberg analysts, led by Eric Balchunas, significantly raised the odds of a spot ETF approval for the meme coin—now pegged at 80%. That figure surpasses the approval probabilities of more traditional altcoins like Cardano and Polkadot, each sitting at 75%. The shift signals a growing institutional appetite for what was once dismissed as a retail-only novelty.

The upgrade isn’t based on hype alone. The presence of CFTC-regulated Dogecoin futures strengthens the argument for a spot ETF, giving regulatory agencies a clearer pathway to greenlight DOGE-based investment products. If approved, it could unlock a wave of capital from institutional players, including pension funds and wealth managers—investors typically barred from directly holding volatile crypto assets.

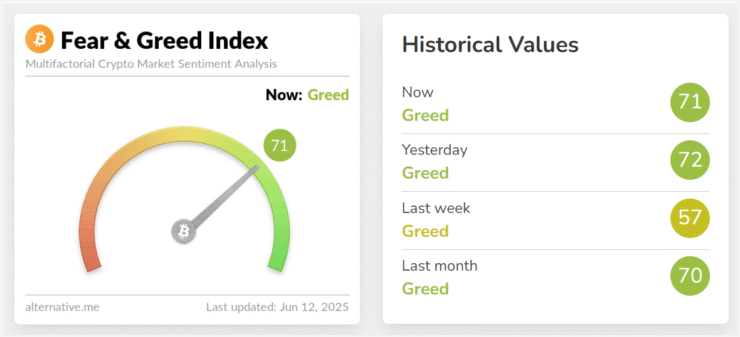

Adding to the bullish backdrop, the Crypto Fear & Greed Index has climbed sharply to 71, moving deeper into “greed” territory from 57 just a week prior. This surge reflects a broader risk-on appetite across crypto markets, with meme coins leading the charge. Alongside Dogecoin, speculative tokens like SPX6900 have soared—up 80% in the past month—while a new crop of Trump-themed coins and Doge-inspired assets ride the momentum.

Ethereum Sees Gains on ETF and Policy Momentum

Ethereum posted a 2.3% gain in the last 24 hours, briefly touching $2,880 before settling around $2,819, as fresh capital poured into ETH-focused investment products. According to market data, more than $125 million flowed into Ethereum ETFs on Tuesday alone—marking a notable shift in both retail and institutional positioning toward the asset.

The rally appears to be fueled by a combination of on-chain accumulation and growing optimism around U.S. regulatory developments. Political pressure is mounting on the Securities and Exchange Commission to clarify Ethereum’s classification, especially as lawmakers push the bipartisan CLARITY Act closer to a vote. If passed, the legislation would formally designate Ethereum as a commodity under CFTC oversight, potentially removing a major source of regulatory uncertainty that has long weighed on investor confidence.

Quick Facts

- Dogecoin rose over 6%, briefly crossing $0.20 before settling lower.

- Trading volume surged 827% to nearly $1.65 billion.

- Bloomberg analysts now give DOGE an 80% ETF approval chance.

- Fear & Greed Index rose from 57 to 72 in one week.

- Ethereum ETFs saw $125 million in inflows on Tuesday alone.