El Salvador has continued its daily Bitcoin acquisition strategy, adding 17 BTC since March 1, even as the International Monetary Fund (IMF) pressures the country to curb its public sector involvement in cryptocurrency.

According to the El Salvador Bitcoin Office, the nation’s Bitcoin treasury now holds over 6,105 BTC, valued at more than $527 million at current market prices. While the government has maintained a steady pace of purchasing 1 BTC per day, it made an exception on March 3 by acquiring 5 BTC in a single day, reinforcing its commitment to Bitcoin despite international push-back.

This accumulation comes months after El Salvador struck a $1.4 billion loan agreement with the IMF in December 2024. As part of the deal, the country agreed to rescind Bitcoin’s status as legal tender and limit its public sector’s direct involvement with the cryptocurrency.

However, the government’s continued purchases indicate that it is still leveraging Bitcoin as a key financial asset, even while complying with some of the IMF’s demands.

Despite these agreements, President Nayib Bukele’s administration remains bullish on Bitcoin, continuing to integrate the digital asset into its economic strategy while drawing both praise and criticism on the global stage.

The IMF intensified its stance on March 3, issuing a fresh demand for El Salvador to halt Bitcoin acquisitions and prohibiting the country from issuing debt or tokenized securities linked to BTC.

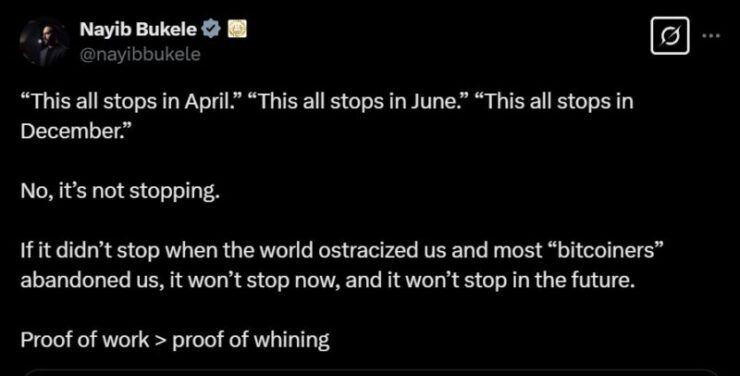

In response, President Nayib Bukele dismissed the IMF’s demands, stating that the country will continue purchasing Bitcoin, characterizing the organization’s repeated warnings as mere “whining.”

IMF’s Perspective on Recent Purchases

Despite its ongoing Bitcoin accumulation, the Salvadoran government remains within the parameters of its agreement with the IMF, according to recent statements from fund representatives, as reported by Reuters.

A spokesperson for the International Monetary Fund (IMF) clarified that while El Salvador has continued increasing its Bitcoin reserves, these purchases have not yet breached the conditions set by the $1.4 billion loan agreement.

The government has assured the IMF that Bitcoin accumulation at the level of the overall public sector will not continue, aligning with the agreed-upon restrictions.

Bitcoin analyst John Dennehy revealed that the IMF agreement was officially approved on January 29 and published in El Salvador’s official gazette the following day.

However, the terms do not take full effect until April 30, 2025. This timeline suggests that El Salvador’s Bitcoin purchases could face stricter scrutiny once the agreement is fully implemented.

Quick Facts:

- El Salvador has continued its daily Bitcoin accumulation, adding 17 BTC since March 1, bringing its total reserves to over 6,111 BTC.

- In December 2024, El Salvador secured a $1.4 billion loan from the IMF, agreeing to rescind Bitcoin’s status as legal tender and limit public sector involvement in BTC.

- Despite the agreement, El Salvador bought 5 BTC in a single day on March 3, reinforcing its commitment to Bitcoin as a strategic asset.