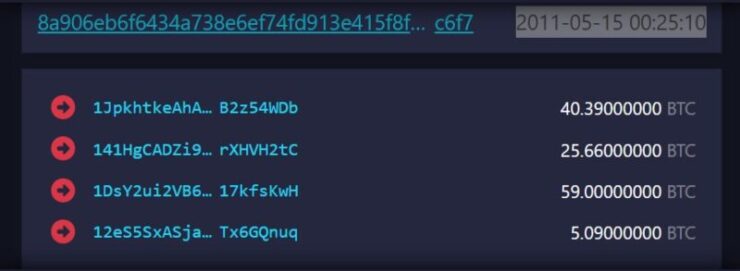

Bitcoin wallets that have remained untouched for over 14 years have recently transferred approximately $22 million worth of Bitcoin. These wallets, created when Bitcoin was trading for just around $1, moved a total of 250 BTC this past Monday, sending shockwaves through the crypto community.

According to blockchain data, the Bitcoin in question had been dormant since 2011, a time when the cryptocurrency was still in its early stages of adoption. Blockchain data indicates that these wallets used legacy addresses, which were some of the first to be implemented when Bitcoin’s protocol was launched. These addresses, which have become rare in modern Bitcoin transactions, further indicate the historical nature of these holdings.

The transfer of such an amount after 14 years raises several questions. Who owns these wallets? Why now, after so long? More importantly, what impact could the movement of these long-dormant funds have on the broader Bitcoin market?

Theories Behind the Movement

Several theories have emerged to explain the reactivation of these old wallets. Some analysts believe that the owner or owners may have been waiting for a price surge to maximize profits. Others speculate that the move may indicate a larger shift in Bitcoin’s market dynamics, as older Bitcoin holders—who purchased the currency during its early, cheaper days—begin to cash out as the asset gains more mainstream acceptance.

Bitcoin’s rise in value has been a key factor in the growing number of transactions from dormant wallets. As the price of Bitcoin skyrocketed over the past few years, it became an increasingly lucrative asset for early adopters to finally liquidate. At today’s price, 250 BTC is worth nearly $22 million, and the movement of such a large amount of Bitcoin, though not unusual in itself, does raise concerns about the potential volatility it could cause, especially given the influence that large holders can have on the market.

For many, the sudden activity in these wallets raises concerns about what might happen if more dormant wallets are activated. Could there be an influx of Bitcoin entering the market in the coming weeks, flooding exchanges and causing a dip in prices?.

Increasing Trend of Dormant BTC Wallet Re-Activation

One of the addresses linked to this transfer has been identified as being connected to British fintech Revolut, but the ultimate destination of the funds remains unclear. The earliest wallet involved in this transfer received 50 BTC in February 2011 when Bitcoin was priced just over $1. At today’s prices, this means the investor has seen unrealized gains of over 8,310,400%. Back in 2011, Bitcoin saw rapid fluctuations in price—surpassing $30 before crashing to just above $4 by the end of the year.

While the identities of the wallet holders remain unknown, it’s noteworthy that large holders of Bitcoin, also known as “whales,” have been increasingly active. Last month, for instance, an address holding 50 BTC from 15 years ago—when Bitcoin was valued at about $0.10 per coin—began moving coins worth approximately $5 million in total.

Market Implications

The movement of these funds is likely to have short-term implications for the market. It could spark increased trading activity, with some investors fearing that the large transfer could be an early sign of massive sell-offs. This is a common fear when large Bitcoin wallets are activated after long dormancy periods, as they could flood the market with significant amounts of BTC. On the other hand, this could also signal a maturation of the market, with long-term holders now willing to sell as Bitcoin becomes more widely adopted and integrated into mainstream finance.

Bitcoin is currently trading for $87,608 after recovering following a dip as low as $81k on Monday.

Quick Facts:

- Dormant Bitcoin wallets holding $22 million were activated after 14 years.

- The funds moved during a period of significant price surges in the Bitcoin market.

- The reactivation of these wallets may signal a shift in market sentiment as early adopters begin to cash out.