In a brewing dispute that raises fresh concerns over trust in crypto partnerships, Dohrnii Labs has accused UAE-based exchange Blynex of illegally liquidating its token collateral and breaching a loan agreement, a move that allegedly wiped out significant project funds and triggered market losses.

The case now heads toward potential legal escalation, as Dohrnii vows to hold Blynex accountable.

According to Dohrnii Labs, the trouble began when it deposited 12,649.99 DHN tokens, valued at over $500,000, with Blynex. A portion — 8,650 DHN tokens — was pledged as collateral for a 30-day $80,000 USDT loan.

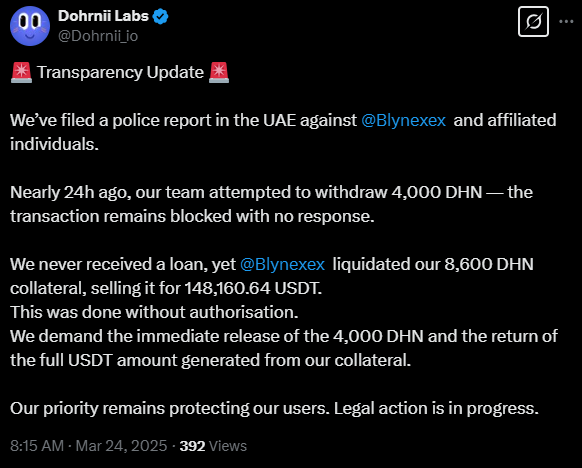

However, Dohrnii claims Blynex never delivered the loan. Instead, the exchange liquidated the entire 8,650 DHN collateral on Uniswap, pocketing 149,151 USDT and causing a steep market price drop for the token.

To make matters worse, Dohrnii alleges Blynex blocked withdrawal of the remaining 4,000 DHN tokens, compounding the financial damage.

Blynex Defends Move as Risk Management — Dohrnii Calls It “Misleading”

Blynex co-founder Mike Baskes defended the liquidation, citing the platform’s automated risk management system. Baskes claimed the system flagged potential losses due to low liquidity, estimating just $315,000 was available in the market.

“The system recognized a high risk of further loss if the collateral wasn’t liquidated immediately,” Baskes explained, insisting the action was necessary.

Dohrnii rejected that explanation, calling it “misleading” and alleging Blynex sold off collateral worth nearly double the loan value — an action the company claims goes beyond risk management and into breach of trust

In response, Dohrnii Labs has filed a police report in the UAE and is preparing broader legal action. The team is engaging local regulators, including VARA and ADGM, while exploring a joint lawsuit with other affected projects.

“Accountability through legal systems and regulatory oversight is non-negotiable,” a Dohrnii representative stated.

The project also revealed Blynex offered to return 80,000 USDT and unlock the remaining tokens — but only if Dohrnii agreed to drop legal action. Dohrnii rejected the offer, arguing the 4,000 DHN tokens belong to users and should never be used as a bargaining chip.

The Takeaway

This dispute underscores a growing concern in the crypto space: what happens when platforms breach trust and liquidate user assets without consent?

With regulatory oversight tightening worldwide, the Dohrnii-Blynex battle could become a landmark case, one that forces the industry to confront uncomfortable questions about accountability, collateral management, and the fragile nature of crypto partnerships.