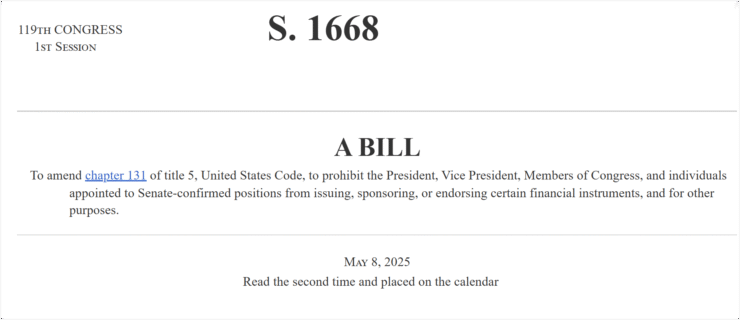

A coalition of 20 Senate Democrats has introduced sweeping legislation aimed at curbing potential conflicts of interest in the cryptocurrency sector, particularly among high-ranking U.S. government officials. The proposal—titled the End Crypto Corruption Act of 2025—would impose strict limitations on digital asset involvement for federal leaders and their families.

Under the bill, individuals holding senior federal positions—including the President, Vice President, members of Congress, Senate-confirmed appointees, and senior Executive Office staff—would be prohibited from issuing, promoting, or endorsing any form of cryptocurrency. The restrictions would also extend to their spouses and dependent children, signaling the bill’s intent to establish a firm ethical boundary between public office and private digital asset interests.

The legislation arrives amid mounting scrutiny of President Donald Trump’s crypto-related business ventures, which some lawmakers argue raise serious transparency and influence concerns. The bill also makes reference to Elon Musk, currently affiliated with the Department of Government Efficiency (DOGE), though Musk has publicly stated the agency has no official ties to the memecoin sharing its acronym.

New Ethics Bill Proposes Penalties for Crypto Endorsements

Beyond restrictions, the End Crypto Corruption Act proposes both civil and criminal penalties for senior officials who promote or issue cryptocurrencies while in office. While the bill permits the sale of previously held assets, it bans promotional activity during public service and for one year after leaving office. The provisions apply not only to officials themselves but also to their immediate families.

The bill mirrors similar legislation introduced in the House earlier this year and comes as the Senate continues to debate the terms of a broader stablecoin regulatory framework. Several Democratic lawmakers have voiced concerns that the current version of the stablecoin bill lacks sufficient safeguards around anti-money laundering enforcement and oversight of foreign issuers.

The ethics bill also targets recently launched memecoins associated with President Trump and First Lady Melania Trump. Issued just before Trump’s second inauguration, the tokens have stirred controversy following the President’s announcement that top holders would receive invitations to an exclusive White House dinner. Critics say the move undermines the integrity of public office by blurring the line between personal enrichment and presidential duty.

Questions Mount Over Trump’s Crypto Ties

Questions are also mounting over President Trump’s leadership role at World Liberty Financial—a digital asset firm reportedly tied to his sons and senior administration officials. The company is behind the issuance of WLD1, a U.S.-based stablecoin now at the center of growing Senate scrutiny.

Lawmakers are especially concerned about a reported $2 billion partnership involving WLD1 and a major Abu Dhabi investment fund. The deal, allegedly in collaboration with Binance, seeks to expand WLD1 internationally—raising red flags about foreign influence and regulatory evasion.

“Our concerns about Binance’s compliance obligations are even more pressing given recent reports that the company is using the Trump family’s stablecoin to partner with foreign investment companies,” Democratic senators wrote in a formal inquiry letter last week.

Senator Elissa Slotkin (D-MI), a co-sponsor of the bill, stressed the urgency of addressing what she described as blatant conflicts of interest. Speaking to Michigan Advance, she stated:

“We’ve got a more immediate crocodile closer to the boat, and that’s the president of the United States, selling his own currency and marketing his own currency and using it as a form of payment to line his pockets.”

Quick Facts

- The End Crypto Corruption Act of 2025 prohibits senior federal officials and their families from promoting or issuing cryptocurrencies.

- The bill introduces penalties for violations, including a one-year post-office promotional ban.

- The legislation targets President Trump’s and Melania Trump’s involvement in memecoins and stablecoins tied to foreign investment.

- Lawmakers have raised concerns about a $2 billion deal involving WLD1, Binance, and Abu Dhabi investment firms.