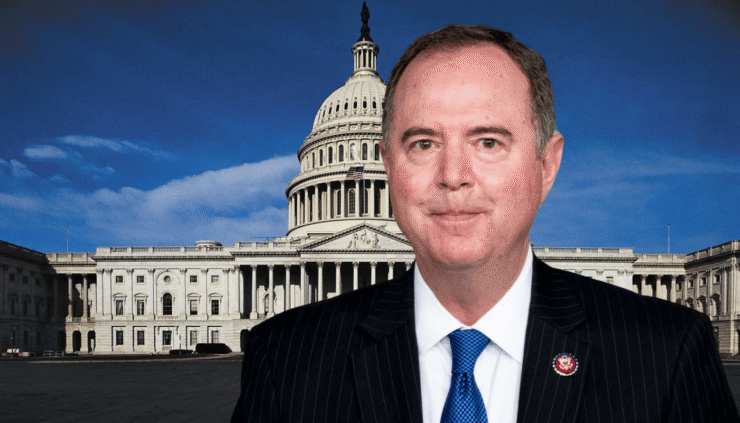

California Senator Adam Schiff has introduced new legislation aimed at preventing public officials from profiting off cryptocurrencies—an effort directly targeting U.S. President Donald Trump’s expanding involvement in the digital asset space.

Unveiled on Monday, the Curbing Officials’ Income and Nondisclosure (COIN) Act seeks to prohibit current and former top federal officials—including the president, vice president, and immediate family members—from issuing, promoting, or financially benefiting from digital assets while in office and for a specified period afterward.

The proposal comes amid growing scrutiny over Trump’s crypto-related ventures. Public disclosures revealed the president earned over $57.4 million through World Liberty Financial (WLF), a digital asset platform linked to his family. Trump’s involvement in memecoins and NFT promotions has further amplified ethical concerns.

“President Donald Trump’s cryptocurrency dealings have raised significant ethical, legal, and constitutional concerns over his use of the office of the presidency to enrich himself and his family,” Schiff stated.

“That’s why I am introducing legislation to prevent the financial exploitation of any digital assets by public officials, including the president and the First Family.”

The bill echoes a similar proposal from Representative Maxine Waters in the House, underlining growing Democratic concerns about conflicts of interest between public service and private crypto ventures. However, with Democrats in the minority in both chambers and Trump likely to veto any legislation that reaches his desk, the bill faces an uphill battle. Overriding a veto would require a two-thirds majority in both the House and Senate—a highly unlikely scenario under current conditions.

Schiff Bill Targets Stablecoins and Post-Term Profiteering

The COIN Act not only targets crypto activities during a president’s term but also imposes strict restrictions before and after public service.

If passed, it would bar the president, vice president, and their immediate family members from launching, endorsing, or promoting any form of cryptocurrency—including memecoins, NFTs, and stablecoins—from 180 days before entering office until two years after leaving. This would be the most expansive federal effort yet to erect a firewall between digital asset ventures and government power.

A key focus of the bill is payment stablecoins, spurred by recent revelations about World Liberty Financial’s launch of the USD1 stablecoin. In March, an Abu Dhabi-based firm revealed plans to use the token in a $2 billion transaction with Binance, raising further alarms in Washington.

Trump family members reportedly reduced their ownership stake in WLF from 75% to 40% between December and June—likely profiting from the company’s surging valuation. A report from the nonpartisan State Democracy Defenders Action estimated Trump’s current digital asset portfolio at $2.9 billion, making up roughly 40% of his total net worth.

Quick Facts

- Senator Adam Schiff introduced the COIN Act to ban top U.S. officials from crypto involvement.

- The bill targets Trump’s ties to World Liberty Financial and his reported $2.9B in crypto assets.

- If passed, the law would bar crypto promotions from 6 months before to 2 years after office.

- Legislative passage is unlikely due to Republican control and expected veto from Trump.