A recent Delaware business registration has sparked speculation that Canary Capital may be preparing to launch an SUI exchange-traded fund (ETF), signaling growing institutional interest in altcoin-based ETFs.

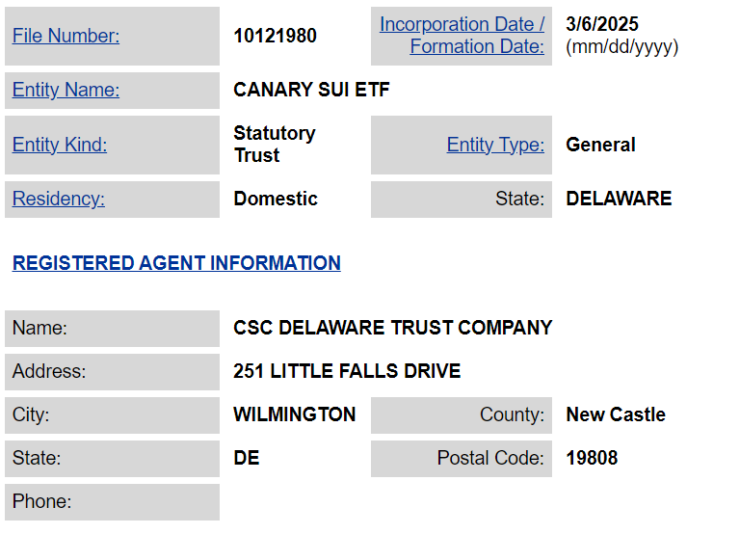

According to Delaware’s official registration portal, “Canary Sui ETF” was registered on March 6, a move that typically indicates that a fund manager is gearing up to file an S-1 registration with the U.S. Securities and Exchange Commission (SEC).

If confirmed, this would position SUI among the latest altcoins attracting institutional attention, following a broader trend of crypto ETF applications aimed at bringing regulated exposure to digital assets.

The potential SUI ETF registration comes shortly after Canary filed an S-1 registration for an AXL ETF on March 6.

Canary has also expressed interest in launching ETFs tracking Hedera (HBAR), Litecoin (LTC), XRP, and Solana (SOL), a sign that altcoin-focused investment vehicles are gaining momentum despite regulatory uncertainties.

In November 2023, an entity named “iShares XRP Trust” was falsely registered, listing BlackRock as the sponsor. This was later exposed as a fraudulent filing, raising concerns about misleading registrations within the crypto investment space.

If Canary’s SUI ETF is genuine, it could represent a major institutional milestone for the Sui blockchain, a Layer 1 network developed by Mysten Labs.

Sui’s Rising Market Performance

The Sui blockchain has been one of the top-performing Layer 1 projects over the past year.

- As of March 5, Sui recorded a one-year price gain of 79%, outpacing Binance Coin (BNB), which posted a 39.7% gain.

- In the past 24 hours, SUI’s price climbed 5.4%, reaching $2.83, reflecting growing investor confidence.

Given its rapid adoption and strong price performance, Sui’s potential ETF could further solidify its standing among institutional investors looking for exposure to emerging blockchain networks.

Adding to the intrigue, the Sui Foundation recently announced plans to collaborate with the World Liberty Financial (WLFI) crypto project, which is backed by U.S. President Donald Trump.

The nature of this collaboration remains unclear, but Trump’s increasing involvement in the digital asset space, including the establishment of a U.S. Strategic Bitcoin Reserve, suggests that regulatory tides may be shifting in favor of crypto adoption.

What’s Next?

If Canary follows through with an SEC filing for a SUI ETF, it would further cement the trend of altcoins entering the institutional investment landscape.

However, regulatory approval remains a significant hurdle, with the SEC still evaluating how to handle ETFs tied to digital assets beyond Bitcoin and Ethereum.

Regardless of regulatory challenges, the institutional appetite for crypto ETFs is growing, and if confirmed, a SUI ETF could be a key step in broadening altcoin investment opportunities.

As the crypto ETF race intensifies, all eyes will be on Canary’s next move and the SEC’s response to this potential expansion of crypto-based investment products.