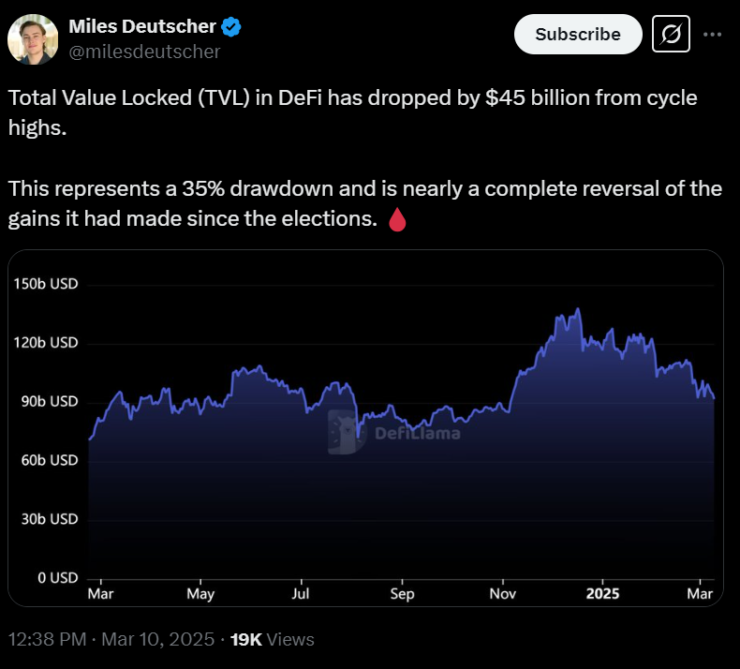

The decentralized finance (DeFi) sector is facing a brutal downturn, with Total Value Locked (TVL) plummeting by $45 billion, wiping out all gains made since Donald Trump’s election in November 2024.

At its peak on Dec. 17, DeFi TVL stood at $138 billion. Now, just three months later, that number has collapsed to $92.6 billion, as noted by analyst Miles Deutscher.

The rapid decline raises urgent questions: What’s behind the DeFi sell-off? Is this a temporary shakeout or a sign of deeper market troubles?

While Solana has taken much of the blame due to its fading memecoin hype, Ethereum has been hit just as hard.

Despite Bitcoin surging to $109,000 on Trump’s inauguration day (Jan. 20), Ether (ETH) failed to reach a new all-time high, remaining well below its November 2021 peak of $4,787.

Data from DeFiLlama reveals that Ethereum’s TVL alone has dropped by $30.6 billion since its cycle high. This decline persists despite bullish catalysts like Ethereum spot ETFs and Trump’s executive order to establish a strategic Bitcoin reserve.

The disconnect between Bitcoin’s rally and Ethereum’s struggles has left investors uneasy.

Ethereum’s $1.8 Billion Outflow

Ethereum saw a massive net outflow of nearly 800,000 ETH ($1.8 billion) from exchanges in the week of March 3, according to IntoTheBlock.

This seven-day outflow is the largest since December 2022, occurring despite ETH dropping 10% to a low of $2,007. Typically, such outflows indicate long-term accumulation, as investors move funds into DeFi protocols or staking platforms.

Still, before March 3, Ethereum saw consistent net exchange inflows, indicating investors were selling during the downturn. Juan Pellicer, senior research analyst at IntoTheBlock, noted that ETH’s drop to $2,100 may have triggered an accumulation phase, prompting investors to withdraw from exchanges.

Ethereum’s rollup-centric roadmap has improved network efficiency but also fragmented liquidity, a major concern for DeFi.

The upcoming Pectra upgrade aims to fix this by:

- Doubling the number of blobs, reducing transaction costs for layer-2 networks.

- Introducing account abstraction, making smart contract wallets more seamless across Ethereum and L2s.

- Enhancing interoperability, consolidating liquidity, and reducing friction in fund movements.

However, the Pectra rollout hit an obstacle on March 5 when it launched on the Sepolia testnet. Ethereum developer Marius van der Wijden reported errors on Geth nodes, leading to empty blocks being mined. The issue stemmed from a deposit contract triggering an incorrect event type, though a fix has since been deployed.

While the upgrade promises long-term improvements, delays and technical setbacks may dampen investor confidence in the short term.

What’s Next?

The $45 billion wipeout in DeFi TVL signals serious liquidity outflows, but is this just a temporary reset?

Key factors to watch:

- Regulatory uncertainty: The U.S. and EU are tightening scrutiny on DeFi protocols, potentially impacting liquidity and adoption.

- Macroeconomic trends: Federal Reserve decisions on interest rates could dictate risk appetite for DeFi investments.

- Ethereum’s roadmap: If Pectra stabilizes and improves L2 efficiency, it could restore market confidence.

For now, DeFi stands at a pivotal moment. Either the market stabilizes and recovers, or the sector faces a prolonged liquidity squeeze that could reshape its future.