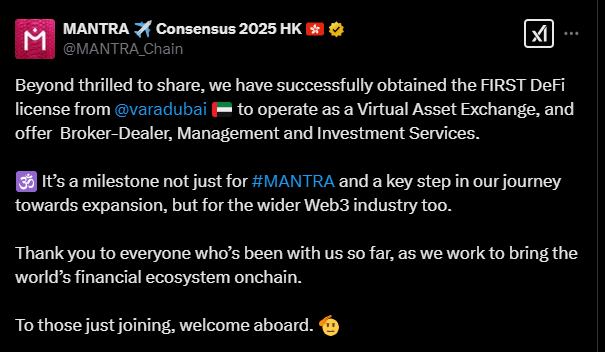

Decentralized finance (DeFi) platform MANTRA has officially secured a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its mission to bridge the gap between decentralized and traditional finance. This license grants MANTRA the authority to operate as a virtual asset exchange while offering broker-dealer and investment management services in the region, cementing its foothold in the Middle East.

The approval aligns with MANTRA’s broader strategy to focus on tokenizing real-world assets (RWAs), a growing sector in the DeFi space. By enabling seamless integration of traditional assets into blockchain ecosystems, MANTRA aims to simplify access to diversified financial products for institutional and qualified investors.

John Patrick Mullin, CEO of MANTRA, highlighted the strategic importance of this regulatory milestone:

“This has been in the works for nearly 3 years. A world first approval that underpins our commitment to a compliant-approach to digital assets & RWAs. This is what happens when you build for multiple cycles.” Mullin said.

With the VASP license, MANTRA now has the regulatory clarity to offer compliant financial products tailored to institutional investors, further reinforcing Dubai’s reputation as a global hub for blockchain innovation and investment.

Strategic Partnerships and Technological Advancements

MANTRA is not just focusing on regulatory alignment—it’s also making strategic partnerships to bolster its real-world asset (RWA) tokenization efforts. In a major move last month, MANTRA signed an agreement with UAE-based real estate giant DAMAC Group to bring at least $1 billion worth of the firm’s assets onto blockchain networks. This collaboration aims to bridge the gap between traditional real estate and decentralized finance, opening new avenues for property investment and liquidity.

In 2024, MANTRA also strengthened its technological foundation by integrating Google as a primary validator and infrastructure provider for its blockchain. Beyond the technical partnership, MANTRA and Google are collaborating on an accelerator program focused on RWAs, aimed at encouraging further innovation and development in the space. This initiative is expected to attract new projects and developers eager to explore the growing intersection of traditional finance and blockchain.

With these strategic collaborations and a clear regulatory framework, MANTRA is positioning itself at the forefront of the DeFi sector’s evolution, driving mainstream adoption of blockchain-based financial services.

Dubai’s Progressive Regulatory Environment

Dubai’s forward-thinking regulatory framework has been instrumental in attracting blockchain and crypto enterprises. The establishment of VARA and the issuance of VASP licenses reflect the emirate’s dedication to fostering a robust digital asset ecosystem. By providing clear guidelines and support, Dubai positions itself as a global hub for digital innovation, offering companies like MANTRA a conducive environment for growth and development.

MANTRA’s strategic move into Dubai is indicative of a broader trend among DeFi platforms seeking to expand their global reach. By securing licenses in crypto-friendly jurisdictions, these platforms aim to offer compliant financial products to a diverse clientele, including institutional and qualified investors. This trend not only enhances the legitimacy of DeFi services but also promotes the integration of traditional financial systems with decentralized technologies, fostering a more inclusive and innovative financial landscape.

Quick Facts:

- MANTRA has obtained licensure from Dubai’s VARA, enabling it to operate as a virtual asset exchange and offer investment services in the region.

- In partnership with DAMAC Group, MANTRA plans to tokenize over $1 billion in real estate assets, bringing them onto blockchain platforms.

- MANTRA has integrated Google as a primary validator and infrastructure provider for its blockchain network, enhancing its technological capabilities.

- The emirate’s progressive regulatory environment continues to attract blockchain enterprises, solidifying its status as a global digital asset hub.