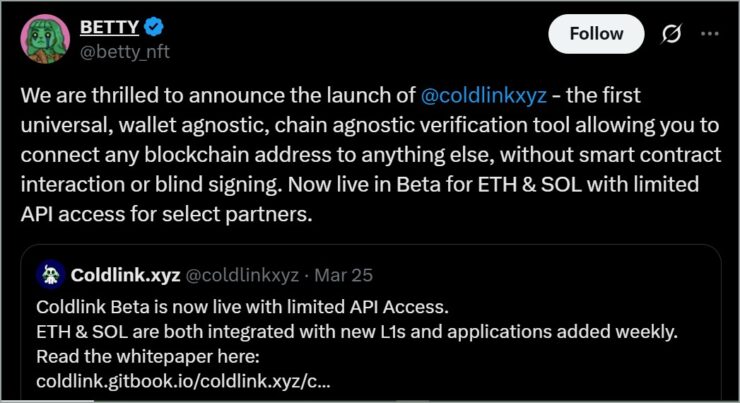

DFZ Labs, the team behind the Ethereum-based NFT brand Deadfellaz, has introduced a new tool called Coldlink — a blockchain-native asset verifier that allows users to connect real-world and Web2 assets to their crypto wallets without risking token security.

Now in beta, Coldlink enables users to authenticate ownership of on-chain assets without blind-signing or engaging with potentially risky smart contracts — a common vulnerability across Web3 platforms. By eliminating the need for permissions or wallet approvals, Coldlink creates a safer method for linking offline items and digital assets.

“To ‘Coldlink’ something is to connect any digital asset safely to anything else without granting permissions to the wallet holding the asset,” DFZ Labs CEO Betty said.

DFZ Labs says the tool will eventually enable broader real-world applications, such as verifying token ownership to unlock IRL rewards or experiences—without requiring complex Web3 setups or developer integration. The tool is designed to be lightweight, secure, and highly adaptable across use cases.

Unlocking Real-World Use Cases Without Compromising Wallet Security

DFZ Labs began developing Coldlink in 2022 with a clear objective: to empower users to safely engage with digital and physical experiences, such as gaming or collectibles, without exposing their on-chain assets to risk. Now, the tool is poised to expand what’s possible in the blockchain space, bridging online and offline environments through secure identity linkage.

Coldlink enables connections that would otherwise require users to expose their wallets to smart contract risks. With this tool, a user could link a crypto wallet to a PO box and receive physical merchandise without revealing personal identity. Or they might attach ownership of a music NFT to a physical concert ticket number, unlocking perks or exclusive access—all without signing a transaction or granting wallet permissions.

While platforms like Delegate.xyz have introduced wallet delegation models for asset security, DFZ Labs argues that Coldlink goes further.

“There is no smart contract interaction, no blind signing,” said CEO Betty.

“It’s a safer, quicker, cheaper, and more interoperable solution that fits directly into existing systems.”

On a technical level, Coldlink uses unique tracer transactions paired with serialized database entries to establish a secure verification layer. This infrastructure sidesteps the need for heavy on-chain interactions, reducing both cost and complexity. Betty added that while the underlying approach has existed for years, DFZ is the first to package it as a scalable, interoperable tool for mainstream blockchain adoption.

Coldlink Launches Public Beta, Offering Cross-Chain Capabilities

As DFZ Labs gears up for broader rollout, Coldlink is now entering a public beta phase, inviting anyone with a Solana or Ethereum wallet to test its linking capabilities at Coldlink.xyz. The launch allows users to initiate secure, verifiable connections from wallet addresses they control, ensuring link creation always originates from the rightful owner.

However, while users can only generate links from their own wallets, Coldlink opens the door for others to connect to those wallets. This unique functionality could allow, for instance, someone to lend access to their NFT (such as a Bored Ape) for an event without transferring ownership or exposing the asset to risk.

Coldlink’s beta also lays the groundwork for weekly feature rollouts, including additional blockchain integrations, new asset types, and expanded real-world object linkages. The tool is already being tested by over 150 top Web3 projects—including PunksDAO and NFC Lisbon—who are exploring advanced custom integrations.

Quick Facts:

- DFZ Labs has launched a blockchain tool to authenticate and link real-world items without risky wallet approvals.

- The system is designed to protect users while verifying physical assets via blockchain.

- The tool addresses rising demand for NFT utility and secure on-chain asset representation.

- The launch ties into the broader trend of real-world asset tokenization in crypto and traditional sectors alike.