Binance founder Changpeng “CZ” Zhao is once again calling on crypto exchanges to implement inheritance features, arguing that digital asset succession is a neglected area of Web3 security.

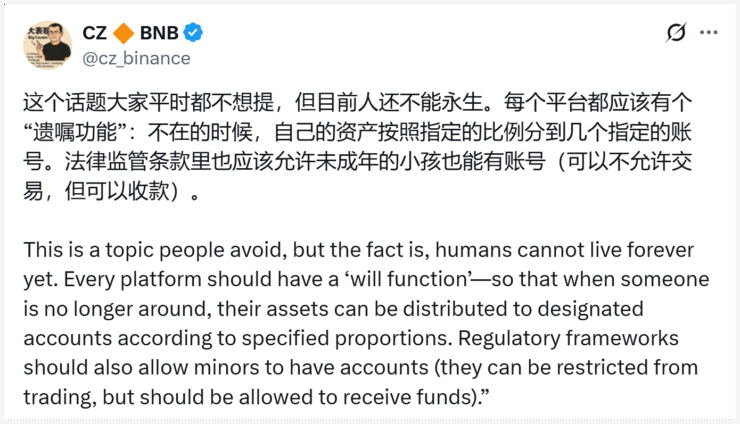

In a recent post on X, CZ stated that “humans cannot live forever,” and emphasized the need for a built-in “will function” that allows users to assign beneficiaries and specify asset allocations in the event of death. The comments align with mounting concerns over billions of dollars in crypto lost due to inaccessible wallets after user deaths.

CZ’s remarks coincided with Binance’s June 12 update introducing a new emergency contact and inheritance feature. The tool enables users to nominate a trusted contact who is notified after a period of inactivity. If the user is confirmed to have passed, the contact can initiate a claim to recover the funds.

This product rollout reflects a broader push toward responsible custodianship in crypto. As digital assets become more embedded in everyday finance, platforms are being urged to offer secure, legal options for intergenerational wealth transfer—something traditional finance has long provided.

Though Binance’s move was met with praise, inheritance tools remain rare in crypto, and CZ’s public appeal may prompt competitors to act. Regulators are also beginning to examine long-term ownership structures, making estate planning a rising priority for digital asset holders.

Community Welcomes Feature, Urges Better Legacy Support

Binance’s inheritance update has drawn widespread praise, with many crypto users calling it a step forward in digital asset management. On X, CryptobraveHQ described the tool as “really thoughtful,” pointing to estimates that over $1 billion in crypto goes unclaimed annually due to sudden deaths and inaccessible wallets.

However, users also pointed out the limitations of current solutions. One user, Uniswap12, noted that crypto accounts hold more than just tokens—they can represent social identities, content, and reputation. “It’s not just tokens. It’s access to digital identity—articles, relationships, reputation,” the user wrote, suggesting that legacy solutions should account for full account transfer, similar to how mobile numbers are inherited.

This broader vision of digital succession continues to gain traction as crypto increasingly becomes intertwined with personal and professional identities.

Experts Stress Need for Crypto Estate Planning

With crypto holdings growing in value, estate lawyers are sounding the alarm: investors risk locking out heirs if assets are not properly documented in legal succession plans.

Dubai-based lawyer Irina Heaver warned that many families have permanently lost access to digital wealth after the unexpected death of a crypto holder. “A lot of people simply don’t plan for it,” she said, urging holders to treat digital assets as seriously as traditional real estate or stocks.

Estate planning professionals note that most crypto investors fall between ages 27 and 42—an age group that rarely prepares for death. Still, without proactive planning, families are often left helpless, especially if wallet details or private keys are missing.

Lawyer Hennessy added that merely listing crypto in a will isn’t enough. Detailed technical instructions—including private keys, access to multi-sig wallets, and backup codes—are crucial. Without these, even a legal will may be insufficient for unlocking digital assets after death.

Quick Facts

- CZ urges platforms to adopt inheritance tools for crypto.

- Binance launches new feature with emergency contact access.

- Over $1B in crypto reportedly lost yearly after user deaths.

- Lawyers stress clear estate plans, private key instructions.