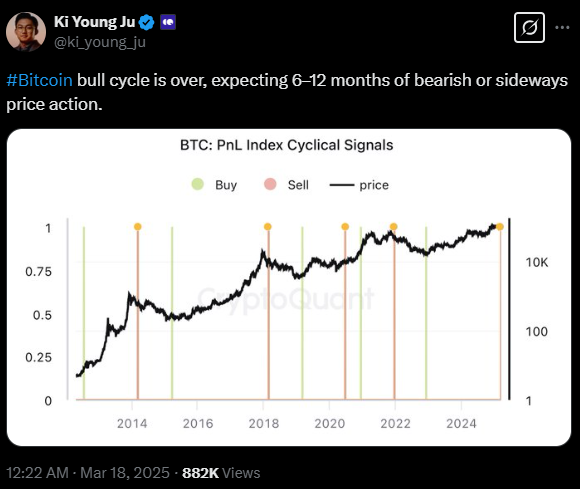

In a sharp reversal from his earlier outlook, CryptoQuant CEO Ki Young Ju now warns that Bitcoin’s bull cycle could already be over, signaling potential 6 to 12 months of bearish or sideways price action. The sudden shift, announced in a March 17 post on X, raises serious questions about Bitcoin’s near-term momentum and the health of the broader crypto market.

Ju’s bearish stance marks a significant departure from his earlier optimism. Two weeks ago, he claimed the bull cycle was “still intact” despite slowing momentum. Now, according to Ju, on-chain metrics paint a much grimmer picture.

Ju explained that every major Bitcoin on-chain indicator has turned bearish—with fresh liquidity drying up and new whale investors offloading Bitcoin at lower price levels.

“Bitcoin bull cycle is over. Expecting 6-12 months of bearish or sideways price action,” Ju stated.

The warning comes as Bitcoin funding rates, which gauge the cost of long and short futures positions, hover near zero—a sign of growing indecision and lack of directional conviction among traders.

This latest data contradicts Ju’s earlier March 4 assessment, where he pointed to neutral readings on key indicators and even highlighted strong mining fundamentals due to more rigs coming online.

Diverging Views – Not Everyone Is Convinced the Rally Is Over

While Ju is sounding the alarm, other analysts remain cautiously optimistic.

Pav Hundal, lead analyst at Swyftx, downplayed the panic while speaking with Cointelegraph, noting that global economic conditions still support risk assets once investor sentiment stabilizes.

“There’s no reason to panic. Money will move to on-risk assets when the market is ready to take on risk,” Hundal explained, suggesting the recent pullback was influenced by geopolitical events, particularly President Donald Trump’s new tariffs.

Some market watchers are pointing to the global M2 money supply hitting new all-time highs as a potential trigger for Bitcoin’s next leg up.

“We are about to see Bitcoin rally again,” crypto analyst Seth posted, highlighting the historical correlation between money supply expansion and Bitcoin price surges.

Is Another Rally Still Possible? Historical Patterns Say Yes

CoinRoutes CEO Dave Weisberger shares the bullish view, arguing that if Bitcoin’s historical relationship to the global money supply holds, new all-time highs (ATHs) could be within reach by late April.

“Expect Bitcoin to hit a new ATH within a month,” Weisberger predicted.

Even more bullish, former Phunware CEO Alan Knitowski suggested that by historical standards, Bitcoin is severely undervalued.

“The lower bound of the historical range should be around $250,000,” Knitowski stated, implying that Bitcoin’s current price around $83,000 is 67% below where it should be.

Meanwhile, Swan Bitcoin CEO Cory Klippsten offered a balanced take, forecasting a better than 50% chance of seeing new all-time highs before June.

Bitcoin’s last record of $109,000 was set in January, just hours before Trump’s presidential inauguration—a historic surge that some believe could repeat under the right macro conditions.

Bitcoin is currently down 14.79% over the past month, trading at $83,030 at the time of writing. With liquidity concerns, shifting whale behavior, and macro uncertainty clouding the outlook, the road ahead appears increasingly volatile.

Yet, Bitcoin’s historical resilience, coupled with a surging global money supply, keeps hope alive for another bullish breakout.

Final Takeaway

CryptoQuant’s bearish signal forces investors to confront a hard truth—Bitcoin’s bull run may have already peaked. However, as competing forecasts show, the crypto market is rarely predictable.

While on-chain data highlights risks, macro trends, and historical patterns suggest the potential for a surprise upside move remains on the table.

In the coming months, institutional flows, geopolitical shifts, and global liquidity conditions will determine whether this cycle is truly over—or merely catching its breath before the next rally.