In one of the first major U.S. tax enforcement cases involving NFTs, a Pennsylvania man has pleaded guilty to concealing more than $13 million in profits from CryptoPunks NFT trades. The plea marks a significant step in the federal government’s efforts to bring digital asset markets into regulatory compliance.

Waylon Wilcox, 45, admitted to failing to report income from the sale of 97 high-value CryptoPunks NFTs between 2021 and 2022. Prosecutors say Wilcox earned $7.4 million in 2021 and $4.9 million in 2022 from these sales but falsely declared zero digital asset income on his federal returns.

According to the U.S. Attorney’s Office for the Middle District of Pennsylvania, Wilcox’s actions resulted in approximately $3.3 million in unpaid taxes. His guilty plea comes just days ahead of the April 15 filing deadline for U.S. taxpayers—underscoring the IRS’s ongoing crackdown on crypto-related tax evasion.

Under current IRS guidelines, taxpayers must report gains or losses on all digital asset transactions, including NFTs. Wilcox now faces a maximum sentence of six years in federal prison. However, his guilty plea could reduce the actual time served.

“IRS Criminal Investigation is committed to unraveling complex financial schemes involving virtual currencies and non-fungible token (NFT) transactions designed to conceal taxable income,” said Philadelphia field office special agent in charge Yury Kruty in a press release.

CryptoPunks Still Command Market Spotlight Amid NFT Decline

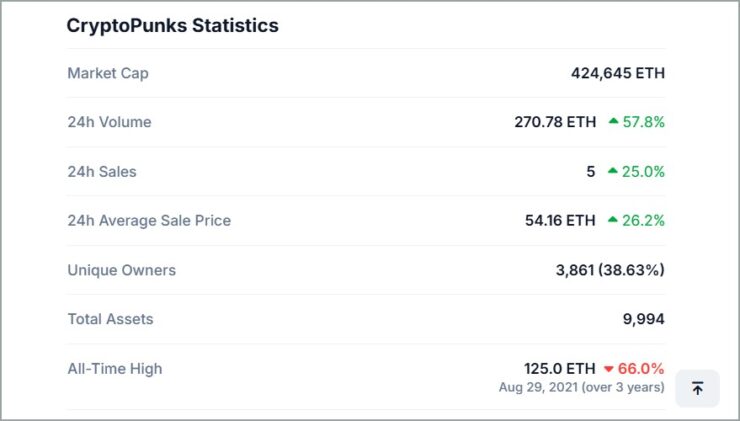

The case against Wilcox surfaces during a period of declining interest in the NFT market, which has struggled to regain momentum since its explosive 2021–2022 bull run. Nonetheless, CryptoPunks—the iconic NFT collection launched in 2017—continues to hold investor attention as the most valuable project in the space by market capitalization, according to CoinGecko.

Despite the broader slowdown, CryptoPunks remain active on trading platforms. However, the volatility persists. A recent high-profile trade resulted in a $10 million loss for the seller, spotlighting how unpredictable the NFT landscape remains.

In Ethereum terms, CryptoPunk floor prices have climbed modestly from recent lows. Yet, when measured in dollars, they have barely budged due to ETH’s price stagnation—rising from approximately $66,900 to $68,800 over the past six months.

Meanwhile, controversy continues to brew within the CryptoPunks community. Yuga Labs—the firm behind Bored Ape Yacht Club and current owner of the CryptoPunks IP—faced backlash in May 2023 after launching a spin-off collection called Super Punk World. Following the negative response, Yuga CEO Greg Solano announced that the company would halt further development and instead focus on preserving CryptoPunks’ legacy through cultural partnerships with museums and art institutions.

With the IRS turning its attention toward the NFT space and enforcement actions gaining traction, the Wilcox case could mark a precedent-setting moment for how digital asset investors are expected to comply with federal tax obligations going forward.

Quick Facts

- Waylon Wilcox pleaded guilty to hiding over $13 million in NFT profits from the IRS.

- He faces up to six years in federal prison, with sentencing pending.

- The IRS is intensifying efforts to enforce tax compliance in the cryptocurrency and NFT sectors.