The cryptocurrency market is experiencing a significant downturn, with daily trading volumes dropping from a post-election peak of $126 billion to approximately $35 billion, marking a 70% decline. This retraction brings trading activity back to levels observed before the U.S. presidential election in November 2024.

In the immediate aftermath of President Donald Trump’s election victory on November 5, 2024, the crypto market witnessed an unprecedented surge. Bitcoin, for instance, soared to an all-time high of over $109,000, fueled by optimism surrounding the administration’s pro-crypto stance and promises to position the U.S. as the “crypto capital of the planet.”

However, as the initial enthusiasm waned, trading volumes began to decline. The total market capitalization of cryptocurrencies which reached approximately $3.9 trillion at its peak, has since fallen to about $2.9 trillion, representing a 25% decrease. Analysts attribute this downturn to several factors, including the fading of post-election euphoria and uncertainties introduced by recent tariff announcements targeting major U.S. trading partners, which have dampened investor sentiment across both traditional and cryptocurrency markets.

Market Awaits Policy Signals as Trading Activity Sinks

The sharp decline in crypto trading volumes may be signaling a broader market recalibration. Analysts say sustained periods of low volume often precede heightened volatility, especially when large institutional players decide to reallocate capital in thinner markets. With daily volumes now hovering near pre-election levels, some view the slowdown as a potential setup for more pronounced market movements ahead.

Industry participants suggest the current stagnation reflects a broader sense of uncertainty around regulatory direction. Despite the Trump administration’s pro-crypto rhetoric, clear policy frameworks have yet to be unveiled. Questions surrounding digital asset classification, tax treatment, and oversight responsibilities remain unresolved, leaving many investors reluctant to take new positions.

Meanwhile, the relatively stable market capitalization—down from recent highs but not in freefall—suggests an accumulation phase may be underway. Rather than engaging in active trading, some market participants appear to be quietly building positions while awaiting clearer signals from Washington.

With key regulatory updates expected in the coming weeks, particularly around stablecoins and digital asset compliance, many see the current quiet period as temporary. Whether it precedes a bullish breakout or renewed volatility remains to be seen.

Major Altcoins Extend Weekly Losses as Sentiment Weakens

The broader crypto market has endured another difficult week, with most major altcoins extending their downward trajectory amid cooling sentiment and macro uncertainty.

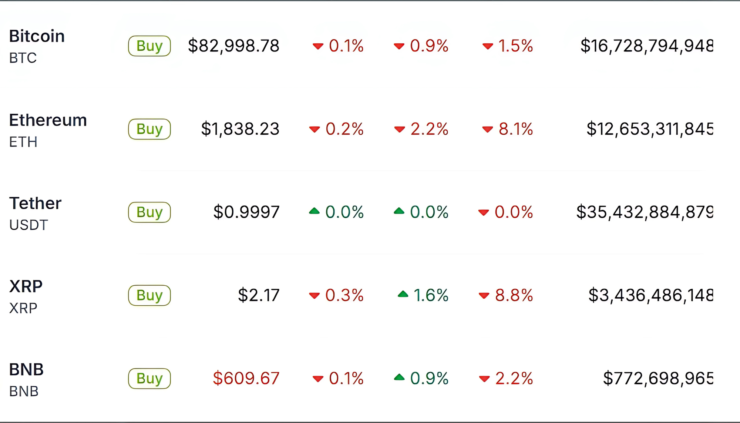

Bitcoin (BTC), still commanding the top spot, is trading just under $83,000, having shed 1.5% over the past 7 days, with daily and hourly changes also marginally in the red. Ethereum (ETH) fared worse, plunging 8.1% on the week to $1,837, reflecting mounting bearish pressure as capital continues to rotate away from risk-on assets.

Among high-cap altcoins, Solana (SOL) saw a 3.4% weekly decline, hovering at $125.84, while BNB dropped 2.2% to around $609.54. XRP followed suit, sliding nearly 9% on the week, despite a brief 1.5% daily uptick to $2.18—likely driven by speculative bounce plays.

Meanwhile, Dogecoin (DOGE) stood out as a rare bright spot, managing a 1.6% weekly gain even as most of the market dipped, now priced at $0.171. The memecoin’s resilience hints at possible rotation into more speculative assets as larger tokens continue to correct.

Quick Facts:

- Daily crypto trading volumes have decreased by 70%, from $126 billion post-election to $35 billion currently.

- Bitcoin’s price surged to over $109,000 following the election but has since experienced fluctuations.

- The total crypto market capitalization has declined by 25%, from $3.9 trillion to $2.9 trillion.

- Similar volatility has been observed in the memecoin market, with assets like Fartcoin experiencing rapid rises and falls.