Cryptocurrency markets remained cautious on Monday as traders awaited details of President Donald Trump’s upcoming “Liberation Day” tariff announcement, scheduled for April 2. The event—expected to introduce a sweeping package of reciprocal trade tariffs—has raised concerns among global investors about a potential escalation in trade tensions.

Bitcoin briefly dipped to a two-week low before recovering to around $83,465, up 1% on the day, according to data from bitbo.io. Other major cryptocurrencies followed suit: Ethereum rose 1.1% to $1,840, while Solana climbed 1.4% to just over $125. XRP, BNB, Dogecoin, and Cardano also posted marginal gains, though trading volumes remained subdued.

The volatility comes amid speculation that the White House may unveil aggressive new tariffs targeting U.S. trade partners. Analysts warn that the move could trigger retaliatory measures and inject instability into global financial markets. According to CNN and The Guardian, the tariff initiative could mark a shift in the administration’s trade strategy, with ripple effects extending into equities, commodities, and digital assets.

Bitcoin remains down more than 23% from its all-time high of $108,800, set on January 20, during President Trump’s inauguration. Meanwhile, broader markets are also reflecting rising anxiety. On Monday, the S&P 500 briefly entered correction territory—falling more than 10% from its recent peak—before recovering some losses later in the session.

“The market is in a wait-and-see mode,” said Min Jung, an analyst at Presto Research.

“Until the specifics of the tariff package are known, both traditional and crypto markets are likely to remain highly sensitive to headlines.”

Jung added:

“There’s a mix of sentiment—some investors believe the impact may be less severe than initially feared, viewing the recent dip as a potential ‘buy the dip’ opportunity. However, many traders are still opting to remain on the sidelines until there’s greater clarity. The market’s next move will largely hinge on the tone and substance of the actual announcement.”

Quarter Ends with Caution as Analysts Weigh Tariff Risk and Market Sentiment

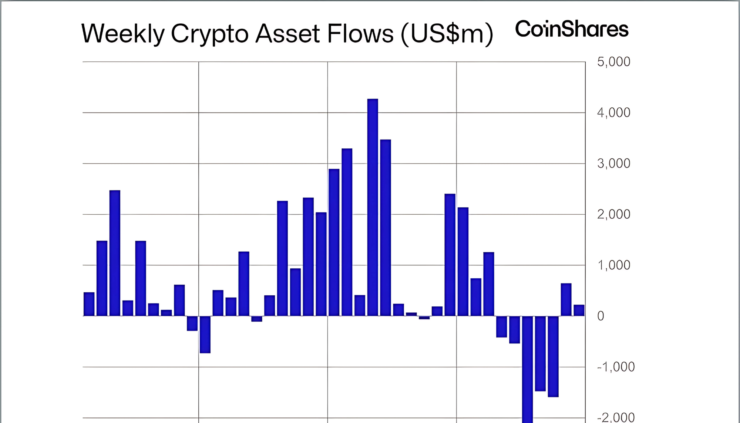

The start of the week marked a noticeable shift from the more encouraging flows seen days earlier. According to a new CoinShares report, institutional investors poured $195 million into Bitcoin-linked investment products last week—a signal some interpret as tentative optimism. The firm described recent buying activity as “positive but cautious,” reflecting a market still grappling with macroeconomic uncertainty.

While some analysts believe the market has already priced in Trump’s tariff rhetoric, others remain concerned about the unpredictability of the April 2 “Liberation Day” announcement. The White House’s evolving trade posture has made it difficult for investors to assess the full extent of possible fallout—particularly across assets sensitive to inflation and global supply chain disruptions.

Traditional safe-haven assets appear to be signaling a more defensive positioning. Gold surged to a new all-time high, trading above $3,153 per ounce after gaining more than 1% on the day. The rally underscores investor caution ahead of further policy shifts.

The tariff-related uncertainty also caps a turbulent first quarter for the crypto market. According to CoinGlass, Bitcoin ended Q1 down approximately 11% from its January opening, while Ethereum posted a more substantial quarterly loss of about 45%.

As Q2 begins, both traditional and digital asset markets remain on edge. The crypto sector, in particular, is closely tracking developments in Washington. While recent inflows into Bitcoin investment products suggest some returning confidence, unresolved concerns around the scope and impact of the administration’s trade agenda continue to weigh heavily on sentiment.

With the “Liberation Day” announcement imminent, market participants are bracing for a pivotal moment—one that could shape the direction of digital assets in the months to come.

Quick Facts

- President Trump’s “Liberation Day” tariff package is set to be unveiled on April 2, with a focus on reducing U.S. reliance on foreign imports.

- Bitcoin recovered above $83,000 after dipping to a two-week low, even as overall crypto market cap fell nearly 2% in the past 24 hours.

- Analysts warn of short-term headwinds for digital assets due to rising inflation concerns and global economic uncertainty tied to trade policies.

- Correlations between crypto and equity markets suggest that broader financial reactions to the tariff package may directly influence crypto prices.