Crypto investor sentiment has staged a strong comeback following signs of easing global tariff tensions, but analysts caution that structural vulnerabilities in the market could still spark sudden weekend downturns.

Risk appetite notably returned to the crypto sector this week after U.S. President Donald Trump signaled a potential reduction in tariffs on Chinese goods, suggesting that trade barriers could “come down substantially.” The shift in tone helped lift Bitcoin and broader market confidence.

However, analysts from Bitfinex warned that the improved sentiment does not eliminate underlying risks tied to weekend liquidity gaps.

“Sentiment improvements reduce fragility, but they do not eliminate structural risks like thin weekend liquidity,” they stated.

They further explained that weekends historically remain prone to sharp price swings, particularly when market depth is low and open interest is elevated. Unexpected macroeconomic developments could also amplify volatility during these fragile trading windows, despite the broader optimism surrounding tariff negotiations.

“Historically, weekends remain vulnerable to sharp moves—especially when open interest is high and market depth is low,” the analysts added.

In short, while the market outlook has brightened, crypto traders are being urged to remain cautious, as weekends continue to pose outsized risks to market stability.

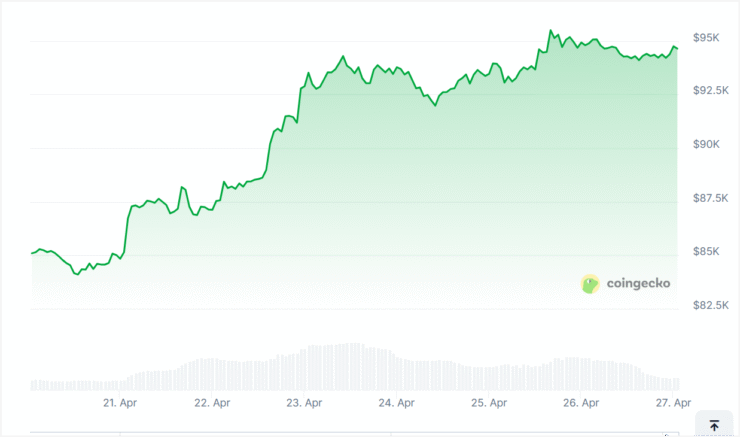

Bitcoin’s Rally Faces Hurdles Despite 11% Weekly Rebound

While Bitcoin managed to outperform broader financial markets following a sharp $3.5 trillion selloff in U.S. stocks earlier this month, its momentum faltered on Sunday, April 6. After initially resisting downward pressure, Bitcoin eventually dipped below $75,000. Analysts attribute the decline to two key factors: the persistent lack of weekend liquidity and Bitcoin’s role as one of the few highly liquid assets available for rapid de-risking moves.

This correction came on the heels of warnings from U.S. Federal Reserve Chair Jerome Powell, who noted that President Trump’s proposed tariff policies could fuel inflation and weigh on economic growth.

Since then, Bitcoin has posted a strong recovery of nearly 11% over the past week, currently trading around $94,000. Yet, market dynamics continue to reveal vulnerabilities—especially around weekend trading periods.

Marcin Kazmierczak, co-founder and COO of blockchain oracle platform RedStone, emphasized that despite the return of positive sentiment, structural weaknesses remain.

“While improved sentiment creates a more stable foundation, cryptocurrency markets are still susceptible to rapid movements during periods of reduced trading volume,” he said.

Crypto Markets May Have Priced In Tariff Fears, but Volatility Still Looms

After weeks of uncertainty, there are signs that cryptocurrency investors have fully absorbed tariff-related risks, potentially setting the stage for a more stable market—though volatility remains a lingering threat.

According to Aurelie Barthere, principal research analyst at crypto intelligence firm Nansen, the crypto sector may have “maxed out” its reaction to U.S.-China trade tensions. Speaking to Cointelegraph, Barthere explained,

“While many remain uncertain about where things are headed over the next month or so, it also seems like markets were just waiting for the slightest signal that we’re back in the game.”

She added that the sustainability of the recent upswing depends heavily on Bitcoin and other assets breaking through key resistance levels.

“It could have legs, as markets now seem to believe there’s a ‘Trump put’ under equities, the U.S. dollar, and Treasurys,” she noted, referring to growing confidence that the Trump administration would act to stabilize markets if necessary. However, she also warned that fresh volatility could emerge as trade negotiations continue.

Nansen’s earlier projections suggested a 70% chance that crypto markets would bottom out and begin a new recovery by June, contingent largely on the resolution—or escalation—of tariff talks.

Quick Facts

- Bitcoin (BTC) has seen a near 11% recovery this week amid easing tariff tensions.

- Analysts warn of potential weekend volatility due to structural liquidity weaknesses.

- Market sentiment has improved, but caution is advised as low weekend liquidity can trigger sharp movements.

- Experts suggest that markets may have priced in tariff-related fears, with future gains depending on breaking key resistance levels.