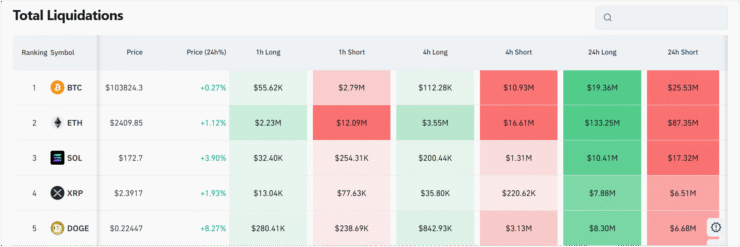

Crypto markets were hit with a dramatic leverage washout on Thursday, as over $1.12 billion in positions were liquidated within 24 hours—triggered by a sudden rally in Bitcoin, Ethereum, and Solana. Traders who bet against the surge found themselves caught off guard, with short positions accounting for the bulk of the damage.

According to CoinGlass, approximately $777 million in shorts were liquidated, compared to $350 million in long positions. In a rare twist, Ethereum surpassed Bitcoin in liquidation volume, with an estimated $439 million in shorts wiped out as ETH surged sharply—highlighting how altcoins are increasingly leading volatility across crypto markets.

Bitcoin also rallied past the $100,000 mark but saw a slightly more measured liquidation response, suggesting fewer traders were aggressively shorting its movement. The unwinding of positions highlights the high-risk environment in leveraged trading, especially during sudden macro shifts and institutional inflows.

Ethereum Rallies 25% After Pectra Upgrade, Outpaces Bitcoin

Ethereum’s rally this week has taken center stage. The asset surged 25% in seven days to briefly top $2,448 on Friday, marking its highest price since March. The climb follows the successful deployment of the Pectra upgrade, a major network enhancement aimed at boosting Ethereum’s scalability and reducing operational inefficiencies.

With the upgrade acting as a bullish catalyst, Ethereum’s price movement sparked widespread liquidations—topping all assets with $439 million in shorts liquidated. It’s a clear signal that many traders misjudged the upgrade’s immediate market impact.

Bitcoin, while less explosive, also saw strong upward momentum—reaching $103,890 on Friday. Roughly $307 million in BTC positions were liquidated during the rally, as bulls reclaimed control after weeks of sideways action.

Solana, Dogecoin See Double-Digit Gains and Heavy Liquidations

The broader crypto rally extended beyond Bitcoin and Ethereum, with Solana and Dogecoin posting significant gains. Solana rose 12%, while Dogecoin climbed 11%—both supported by retail enthusiasm and macro optimism. However, their rapid appreciation also triggered notable short liquidations.

Solana traders saw $40 million in liquidated positions within 24 hours, while Dogecoin added another $19 million to the tally. According to CoinGlass, the largest single liquidation during the day was a $12 million short position against Bitcoin.

With markets reacting to a mix of technical upgrades, institutional inflows, and renewed geopolitical confidence, analysts warn that volatility could remain elevated into the weekend.

Quick Facts

- Over $1.12 billion in leveraged crypto positions were liquidated within 24 hours, with short traders absorbing most of the losses.

- Ethereum led the liquidation charts with $439 million in short positions wiped out following its Pectra upgrade.

- Bitcoin surpassed $103,000, triggering $307 million in liquidations as traders failed to anticipate the rally.

- Solana and Dogecoin saw $40 million and $19 million in liquidations, respectively, after posting double-digit gains.