Quick Facts:

- Bitcoin dropped 0.4% to $97,000 following Trump’s tariff announcement.

- Ethereum, Solana, XRP, and BNB all posted losses, with Solana Meme coins experiencing the steepest decline.

- U.S. stock futures also declined, while the Dollar Index (DXY) strengthened as traders sought safe-haven assets.

The cryptocurrency market took a sharp downturn on Sunday evening after President Donald Trump announced a fresh round of tariffs, imposing a 25% levy on imported steel and aluminum. The move, aimed at protecting domestic manufacturing, sent shockwaves through global markets, with Bitcoin and major altcoins tumbling as investors reacted to the increasing economic uncertainty.

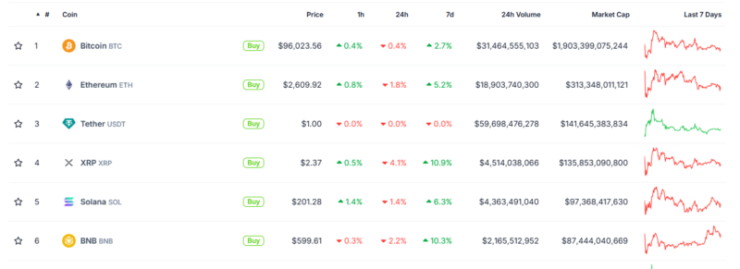

Bitcoin fell below $98,000, marking a 0.4% drop from its previous 24-hour high of $98,300. Ethereum followed suit, slipping 1.8% to $2,609, while Solana plunged 1.4% to $201. The market-wide sell-off also saw XRP decline by 4.1% to $2.37, while BNB dipped 2.2% to $599.

The tariff announcement amplified fears of escalating trade tensions between the U.S. and its key trading partners, particularly China and the European Union, both of which have warned of retaliatory measures. Traders responded by rotating out of risk assets, causing Bitcoin and altcoins to slide amid broader macroeconomic uncertainty.

Solana Memecoins Hit Hard as Broader Crypto Market Declines

As the broader crypto market nosedives following Trump’s tariff announcement, Solana-based memecoins are seeing some of the steepest losses, extending the downward pressure across digital assets.

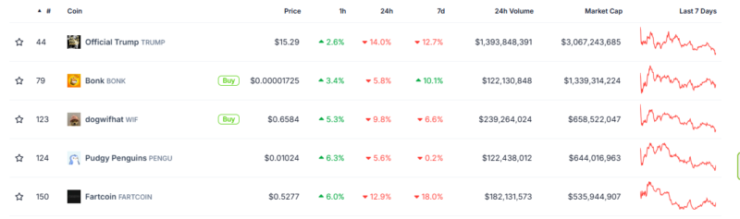

Among the hardest hit are Bonk (BONK), Dogwifhat (WIF), and Official Trump (TRUMP)—all of which have been trending downward over the past 24 hours. BONK dropped 5.8% to $0.00001725, WIF tumbled 9.8% to $0.6584, and TRUMP saw a sharp 14% decline to $15.29. The broader Solana ecosystem also took a hit, with SOL itself sliding 1.4% to $201.28 as market-wide liquidations intensified.

Tariffs Shake Market Confidence

The newly announced 25% tariffs on steel and aluminum mark the latest escalation in Trump’s aggressive trade policies, following last weekend’s tariff threats against Canada and Mexico. The initial announcement sent shockwaves across global markets, triggering an immediate sell-off in risk assets, including cryptocurrencies, before a last-minute one-month delay on implementation calmed fears and allowed for a partial crypto rebound. However, Trump’s latest move suggests that the trade war is far from over, renewing anxieties among investors and market participants.

Following the announcement, the Nasdaq and S&P 500 futures also turned red, inciting wider market concerns over the economic fallout of Trump’s trade policies. The U.S. Dollar Index (DXY) surged as investors sought refuge in traditional safe-haven assets, further pressuring crypto prices.

Despite the short-term volatility, most analysts remain optimistic about Bitcoin’s long-term trajectory, arguing that the digital asset still serves as a hedge against broader economic instability.