The crypto market is bracing for heightened volatility this week as over $428 million worth of tokens are set to be unlocked across several major projects. Among the most closely watched token unlocks are those from Solana (SOL), Worldcoin (WLD), and MANTRA (OM)—events that traders and analysts believe could inject fresh selling pressure and impact broader market sentiment.

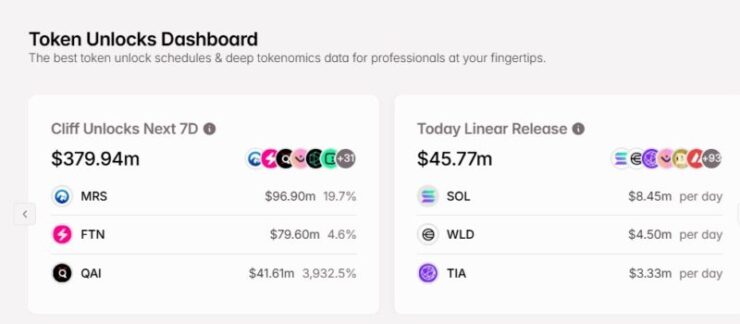

According to data from TokenUnlocks, the cumulative value of tokens scheduled to be unlocked this week totals approximately $428.6 million. The most substantial of these unlocks include:

- $201 million in Solana (SOL) tokens

- $101 million in Worldcoin (WLD) tokens

- $8 million in MANTRA (OM) tokens

These scheduled releases stem from various vesting schedules and token distribution plans established by the projects during their launch phases. Such unlocks often aim to gradually distribute tokens to investors, team members, or early contributors.

However, when significant quantities are released into circulation at once, markets can experience increased selling pressure, as some recipients may choose to liquidate their holdings.

Market participants are particularly concerned about Solana’s unlock, given its sizable share of the week’s total. With SOL already experiencing considerable price fluctuations in recent months, this influx of tokens has sparked caution among traders anticipating potential downward price movements.

Worldcoin and MANTRA Unlocks Add to Market Anxiety

Alongside Solana, Worldcoin (WLD) and MANTRA (OM) unlocks are also under scrutiny. Worldcoin, co-founded by OpenAI’s Sam Altman, will release around 19.4 million WLD tokens, representing nearly 5% of its circulating supply.

Given WLD’s high-profile backing and controversial biometric data-based identity system, the unlock may lead to renewed attention and volatility in WLD trading pairs.

MANTRA, a lesser-known but rapidly growing project focused on decentralized finance (DeFi) and real-world asset tokenization, will unlock approximately 8.38 million OM tokens. While smaller in scale compared to SOL and WLD, this event still has the potential to influence OM’s liquidity and price dynamics in the short term.

Token Unlocks and Market Liquidity Challenges

The looming token unlocks are not isolated incidents. Over the past few months, the crypto industry has witnessed a series of large token releases, particularly from projects launched during the last bull cycle. High-profile examples include recent unlocks from projects like Aptos, Sui, and dYdX, which have similarly contributed to short-term market jitters.

The Incoming token unlocks and their impact on the market are poised to raise concerns about market liquidity and the potential for price corrections, especially in cases where newly unlocked tokens flood exchanges. As more projects end their lock-up periods, traders increasingly monitor these events to adjust their strategies and manage risk.

The cumulative effect of these token unlocks, combined with macroeconomic factors and ongoing regulatory developments, could usher in heightened market volatility in the coming weeks. Historically, large token unlocks have been correlated with increased price swings, especially when investor sentiment is already fragile.

Furthermore, with Bitcoin and major altcoins struggling to maintain bullish momentum, the added supply pressure from unlocks may exacerbate any existing downward trends. Analysts advise traders to closely monitor token unlock schedules and project-specific fundamentals to anticipate potential market moves.

Quick Facts:

- Over $428 million worth of tokens, including SOL, WLD, and OM, will be unlocked this week.

- $201 million Solana tokens and $101 million Worldcoin tokens are among the largest scheduled unlocks.

- Large token unlocks may introduce selling pressure and heighten market volatility.

- Similar token unlock trends in recent months have contributed to liquidity concerns across the crypto space.