Digital asset investment products drew a record $3.3 billion in inflows last week, according to CoinShares’ latest report, marking the sixth consecutive week of major institutional activity. The surge has propelled the sector into uncharted territory, led by products managed by giants like BlackRock, Fidelity, and Grayscale.

Assets under management briefly hit a new all-time high of $187.5 billion, fueled by inflows and rising crypto valuations. Year-to-date inflows have now reached $10.5 billion—far surpassing the previous record of $7.5 billion set earlier this month.

The broader crypto market responded in kind, with total capitalization climbing over 6% to exceed $3.5 trillion. Bitcoin broke past $111,800, adding to bullish sentiment and helping reinforce the perception of crypto as a maturing institutional asset class.

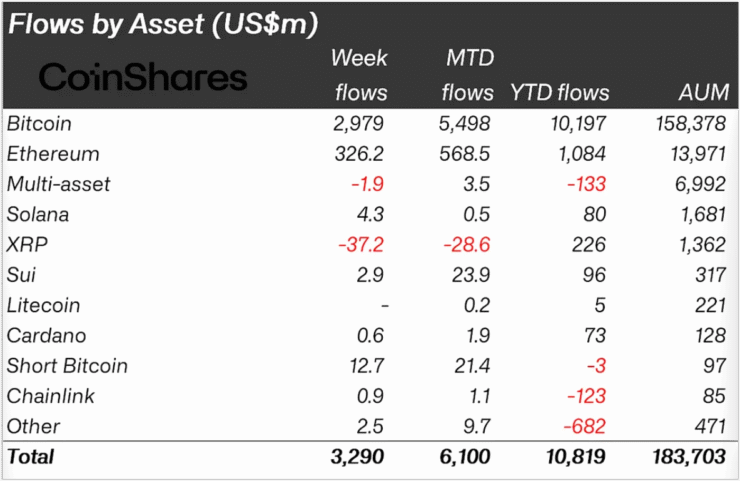

Bitcoin and Ethereum Lead Weekly Inflows as XRP Sees Largest Outflows

Bitcoin attracted $2.9 billion in inflows—its strongest week of 2025 so far—further solidifying its role as the dominant investment vehicle in the crypto space. Ethereum followed with $326 million in inflows, its best week in more than three months.

CoinShares previously labeled Ethereum a “standout performer,” and last week’s capital rotation suggests institutional confidence is returning to the second-largest asset.

In contrast to Bitcoin and Ethereum, XRP suffered its worst week of institutional redemptions, with $37.2 million in outflows. The shift ended an 80-week streak of inflows and appears to reflect investor rotation out of altcoins amid Bitcoin’s renewed momentum.

The record exit underscores changing sentiment as traders shift capital toward more established narratives around Bitcoin and Ethereum during this rally cycle.

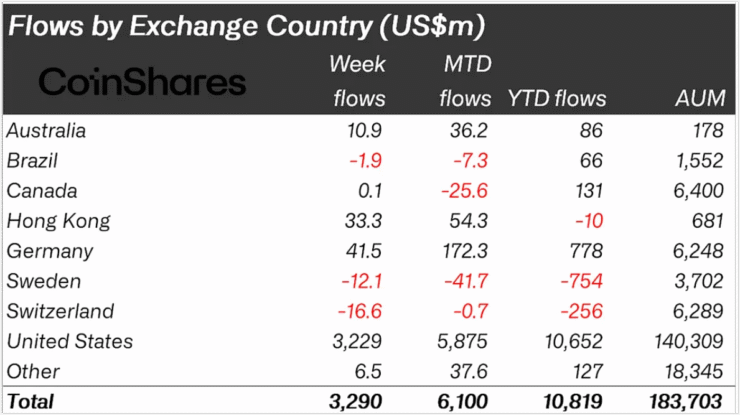

U.S. Dominates Regional Flows

The U.S. accounted for $3.2 billion of total inflows, once again establishing itself as the global center of crypto investment demand. Other regions also showed positive sentiment: Germany saw $41.5 million in inflows, Hong Kong added $33.3 million, and Australia brought in $10.9 million.

Meanwhile, Switzerland recorded $16.6 million in outflows, likely tied to profit-taking after recent market highs.

Short-Bitcoin products—used to bet against the market—recorded $12.7 million in inflows, the highest since December 2024. The rise suggests that while investor sentiment remains bullish, some are hedging against potential near-term corrections.

Quick Facts

- Crypto investment products saw $3.3 billion in weekly inflows.

- Bitcoin led with $2.9 billion; Ethereum followed with $326 million.

- XRP had $37.2 million in outflows, ending an 80-week streak.

- U.S. accounted for 97% of inflows; Switzerland saw profit-taking.

- Short-Bitcoin products had their best week since December 2024.