A growing coalition of crypto industry leaders is calling on Congress to intervene in what it sees as a dangerous legal overreach by the U.S. Department of Justice (DOJ) a move they claim could criminalize blockchain software development.

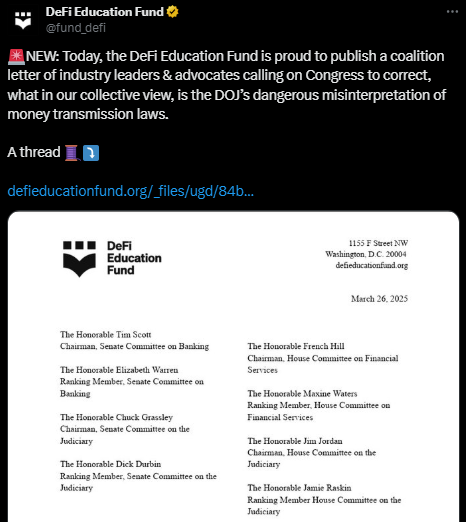

In a letter sent on March 26 to key congressional committees, 34 crypto firms and advocacy groups warned that the DOJ’s interpretation of money transmission laws, used to indict Tornado Cash developers, sets a chilling precedent for open-source developers across the United States.

The letter, led by the DeFi Education Fund and signed by prominent players such as Kraken and Coinbase slammed the DOJ’s approach as “unprecedented and overly expansive.” It argues that the department’s legal position means “essentially every blockchain developer could be prosecuted as a criminal.”

The coalition is urging Congress to press the DOJ to align with long-standing guidance from the Financial Crimes Enforcement Network (FinCEN), which states that developers who don’t control user funds are not money transmitters.

By ignoring this guidance and pursuing criminal charges against non-custodial software developers, the DOJ is injecting confusion and legal risk into the digital asset space, the letter warns.

Tornado Cash at the Center of the Fight

The controversy stems from the DOJ’s August 2023 indictment of Tornado Cash developers Roman Storm and Roman Semenov on charges of money laundering and operating an unlicensed money-transmitting business.

Storm has pleaded not guilty and is seeking to have the charges dismissed. Semenov remains at large. The DOJ has since leveled similar charges against the founders of Samourai Wallet, a privacy-focused Bitcoin app.

The crypto coalition claims these cases are rooted in a misinterpretation of U.S. Code Title 18 Section 1960, which criminalizes operating an unlicensed money-transmitting business. They argue this section must be read alongside Title 31 Section 5330, which clearly defines who must be licensed and by FinCEN’s own guidance, non-custodial developers don’t qualify.

Conflict Between Government Agencies

The heart of the issue, according to the letter, is a policy disconnect between FinCEN and the DOJ. While one agency recognizes the limitations of regulatory scope, the other is effectively rewriting the rules through prosecution.

“This conflicting interpretation creates an unclear, unfair position for law-abiding industry participants and innovators,” the letter stated, warning that failure to address it will have chilling effects on software development in the U.S.

This isn’t just about Tornado Cash. In January, Michael Lewellen, a fellow at Coin Center, filed a lawsuit against Attorney General Merrick Garland, arguing that applying money transmission laws to non-custodial software violates the First Amendment and oversteps constitutional boundaries.

Lewellen is seeking to preemptively protect his own open-source release, saying the DOJ’s actions have already begun to criminalize similar technologies.

What’s Next

The crypto industry’s appeal to Congress highlights a pivotal regulatory crossroads. If left unchallenged, the DOJ’s stance could push developers offshore, stunt innovation, and erode the United States’ position as a leader in blockchain technology.

The outcome of this legal and legislative battle may determine whether privacy-preserving protocols and decentralized applications can be developed within U.S. borders—or whether the next generation of digital infrastructure will be built elsewhere.

For now, developers, investors, and policymakers alike are watching closely. Because what’s at stake is more than one mixer—it’s the future of open-source crypto innovation in America.