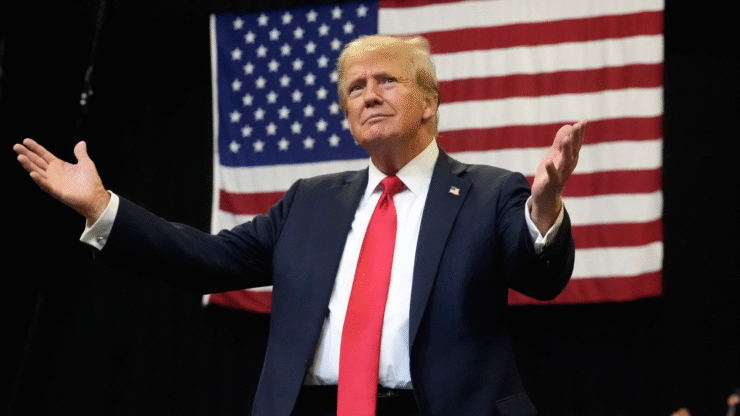

New filings from the Federal Election Commission (FEC) reveal that top cryptocurrency firms and executives contributed millions to President Donald Trump’s 2025 inauguration, just weeks before a sweeping regulatory shift that favored the digital asset industry.

According to documents released by the Trump-Vance Inaugural Committee on April 20, Uniswap CEO Hayden Adams donated over $245,000, while Solana Labs contributed $1 million. Ethereum development studio Consensys also joined the effort with a $100,000 donation, all made in January, shortly after Trump’s electoral victory.

They weren’t alone. Other crypto industry leaders—including Coinbase, Ripple Labs, Kraken, Ondo Finance, and Robinhood—were also listed as contributors, marking a coordinated display of support from digital asset firms.

The Inaugural Committee disclosed over $239 million in donations between November 15 and April 20, making it one of the most well-funded inaugurations in U.S. history. Major tech and corporate donors included McDonald’s, Meta, OpenAI CEO Sam Altman, Apple CEO Tim Cook, Nvidia, Coca-Cola, ExxonMobil, Delta, FedEx, Target, and PayPal—all contributing $1 million each.

The crypto contributions drew attention after the SEC—now led by Trump appointee Paul Atkins—formally dropped its investigation into Uniswap and ended its lawsuit against Consensys just weeks later. The February decisions marked a clear pivot away from the aggressive enforcement stance pursued under former SEC Chair Gary Gensler.

Industry insiders see this as a powerful signal that the Trump administration is emerging as a strong crypto ally, offering a more favorable political and regulatory environment for U.S.-based digital asset companies.

Politics, Tokens, and Trump Family Ties to Crypto

As Trump deepens his alignment with the crypto industry, concerns are mounting over the interplay between politics, personal business, and digital assets.

In January, the former president launched a Solana-based memecoin, shortly followed by Melania Trump’s debut of her own token—moves that have sparked criticism from lawmakers and crypto insiders alike. Many argue these initiatives risk blurring ethical lines between presidential power and private gain.

Adding to the scrutiny, the Trump family is reportedly tied to World Liberty Financial, a new crypto firm issuing a USD-pegged stablecoin. The project emerges just as Congress debates new legislation on stablecoin regulation—further heightening concerns about potential conflicts of interest.

Crypto PACs Gear Up for 2026 Midterms

The crypto industry’s political reach extends far beyond donations. In 2024 alone, crypto-backed political action committees (PACs) spent more than $131 million to influence congressional races.

Leading the charge is the Fairshake PAC, which is stockpiling over $100 million—much of it funded by Coinbase, Ripple, and other top industry players—in anticipation of the 2026 midterms.

While critics raise concerns about disproportionate influence, industry advocates argue that these efforts are necessary to secure regulatory clarity and legislative support for innovation in the U.S.

As the regulatory and political landscape continues to evolve, crypto’s growing role in American politics underscores its ambition to shape not just markets—but public policy.

Quick Facts

- Uniswap, Solana Labs, Consensys, and others donated millions to Trump’s inauguration.

- The SEC has dropped lawsuits and investigations against firms tied to these donations.

- Crypto-backed PACs spent $131 million in 2024 and are preparing for 2026 elections.

- The Trump family’s involvement in stablecoin projects has drawn ethics concerns.