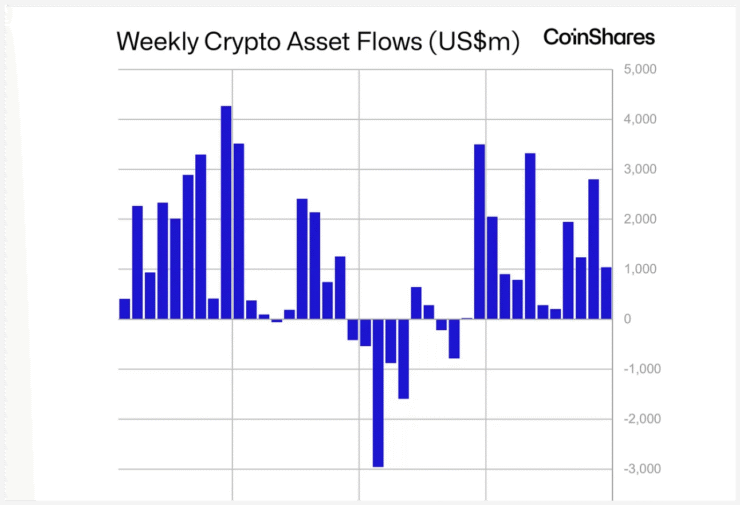

Investor enthusiasm for digital asset investment products remains undiminished, with the sector logging more than $1 billion in inflows last week alone.

According to CoinShares’ latest report, crypto investment vehicles attracted $1.04 billion in net new capital, driving total assets under management (AUM) to a record-setting $188 billion. The surge extends the current inflow streak to an impressive 12 consecutive weeks.

Since the rally began in April, inflows have totaled $18 billion, underscoring persistent demand despite ongoing volatility and regulatory uncertainty in some jurisdictions.

Weekly trading volumes remained robust at $16.3 billion, aligning closely with the 2025 year-to-date average. Analysts say this sustained activity highlights both renewed institutional interest and a broadening base of retail participation.

While Bitcoin-focused products continued to dominate, the report noted that diversified crypto funds have also attracted fresh allocations as investors seek exposure beyond the sector’s flagship asset.

U.S. Institutions Drive Majority of Inflows

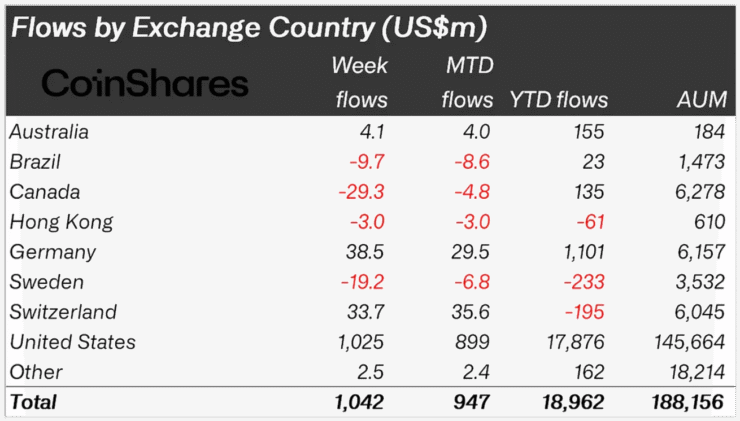

The United States remains the epicenter of capital flows into digital asset funds, accounting for nearly the entire inflow figure last week.

Data from Sosovalue shows that U.S.-listed spot Bitcoin exchange-traded funds led the charge, with products managed by BlackRock, Fidelity, and ARK 21Shares capturing the lion’s share of allocations.

These vehicles have become the primary gateway for many institutional investors, offering regulated exposure to Bitcoin without the operational complexity of direct custody.

Germany and Switzerland also contributed to the positive momentum, recording inflows of $38.5 million and $33.7 million, respectively. Both jurisdictions have established frameworks for crypto investment vehicles, helping attract capital from European wealth managers and family offices.

By contrast, sentiment in Canada and Brazil remained subdued. Canadian crypto funds saw outflows of $29.3 million last week, while Brazilian products shed $9.7 million. CoinShares analysts attributed the pullback to localized market dynamics and profit-taking after strong performances earlier in the year.

Overall, the data suggests that while the U.S. dominates flows, Europe continues to build steady support, and some emerging markets remain cautious amid shifting regulations and currency pressures.

Institutional Adoption Cements New Market Cycle

The sustained inflows and record-high AUM reinforce the view that digital assets are maturing as an investable asset class, increasingly integrated into diversified portfolios alongside equities and fixed income.

Analysts point to several drivers behind the latest wave of institutional adoption. Chief among them are the successful launches of spot Bitcoin ETFs in the U.S., which have eased regulatory concerns and provided a more familiar structure for asset managers.

Additionally, Bitcoin’s performance as a perceived hedge against inflation and currency debasement has resonated with investors seeking alternatives to traditional safe havens.

Ethereum and multi-asset products have also benefited from the momentum, as allocators look to capture upside in broader Web3 and decentralized finance ecosystems.

While some observers caution that the pace of inflows may moderate if prices correct or macro conditions tighten, many see the current cycle as evidence of a more durable trend.

“The scale and consistency of inflows highlight that digital assets are moving beyond speculative trading and into mainstream investment strategies,” CoinShares wrote in its report.

As the market heads deeper into 2025, industry participants will be watching whether the inflow streak can be sustained—and whether regulatory clarity continues to improve in jurisdictions still grappling with how to treat this evolving asset class.

Quick Facts

- Crypto funds drew $1.04 billion in inflows last week, pushing AUM to a record $188 billion.

- U.S. products led the surge, with BlackRock, Fidelity, and ARK 21Shares ETFs attracting most capital.

- Canada and Brazil saw modest outflows, contrasting with gains in Europe and the U.S.