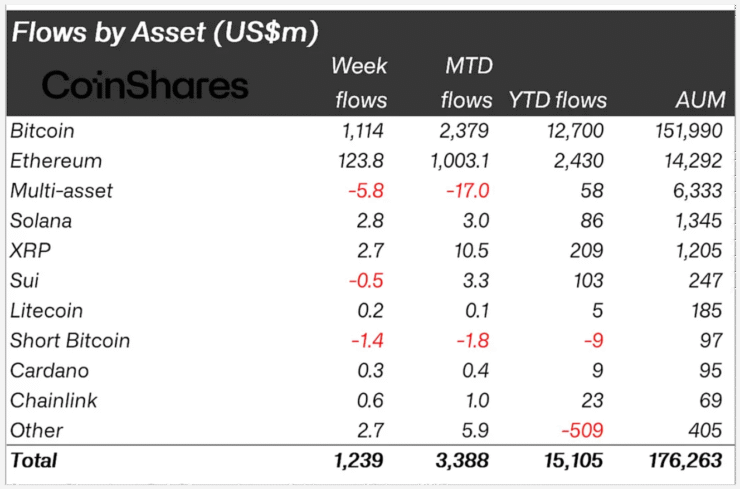

Investor appetite for exchange-traded crypto products (ETPs) remained resilient last week, even as Bitcoin and Ether prices fell sharply. According to CoinShares, global crypto ETPs attracted $1.24 billion in net inflows during the five trading days ending June 21, bringing year-to-date inflows to a record $15.1 billion.

Total assets under management edged up to $176.3 billion, slightly higher than the previous week’s $175.9 billion. Despite rising tensions in the Middle East and increased market volatility, CoinShares’ head of research James Butterfill said institutional enthusiasm remained intact—signaling confidence in crypto as a long-term asset class.

Bitcoin-backed ETPs recorded $1.1 billion in inflows last week, marking their second consecutive week of strong interest—even as BTC prices slid nearly 5%, from $108,800 to $103,000, per CoinGecko.

Butterfill noted that outflows from short-Bitcoin products totaled just $1.4 million, suggesting a shift toward bullish positioning. The data points to a growing perception among institutional investors that recent price weakness represents a strategic entry point, rather than a signal to retreat.

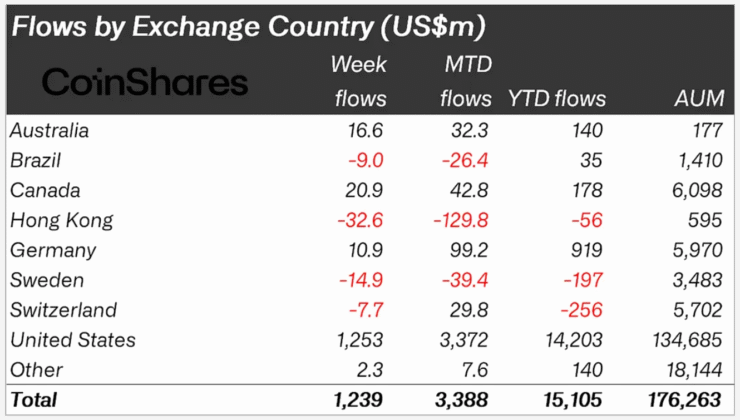

U.S. and Canada Dominate Institutional Allocations

Regionally, the U.S. and Canada led inflows by a wide margin. U.S.-based ETPs attracted $1.2 billion, while Canadian funds brought in $20.9 million. Together, the North American markets accounted for over 95% of all inflows during the week.

In contrast, European markets showed mixed signals. German funds added just $10.9 million—significantly lower than in previous weeks—while Switzerland, Brazil, and Australia recorded minor outflows. The uneven distribution highlights regional differences in crypto sentiment amid global uncertainty.

Ethereum also remained a strong performer, recording its ninth straight week of inflows. The asset attracted $124 million last week, bringing the cumulative total for this streak to $2.2 billion—its longest run of positive flows since mid-2021.

Crypto Sentiment Cools Amid Geopolitical Tensions

While institutional flows remained solid, market sentiment among retail investors showed signs of strain. The Crypto Fear & Greed Index dipped into “Fear” territory on Sunday for the first time in a month, reflecting caution in response to escalating U.S.–Iran tensions. By Monday, the index had rebounded to “Neutral,” indicating mixed market emotions.

Butterfill attributed the late-week slowdown in investor enthusiasm to a combination of the Juneteenth holiday and geopolitical concerns. Still, crypto markets have proven notably resilient: the previous week saw $1.9 billion in digital asset fund inflows—an indication that institutional interest remains steady even in the face of global unrest.

Quick Facts

- Crypto ETPs saw $1.24 billion in inflows last week

- Year-to-date ETP inflows have hit a record $15.1 billion

- Bitcoin products brought in $1.1 billion despite a 5% price dip

- Ethereum marked its ninth consecutive week of inflows, totaling $2.2 billion