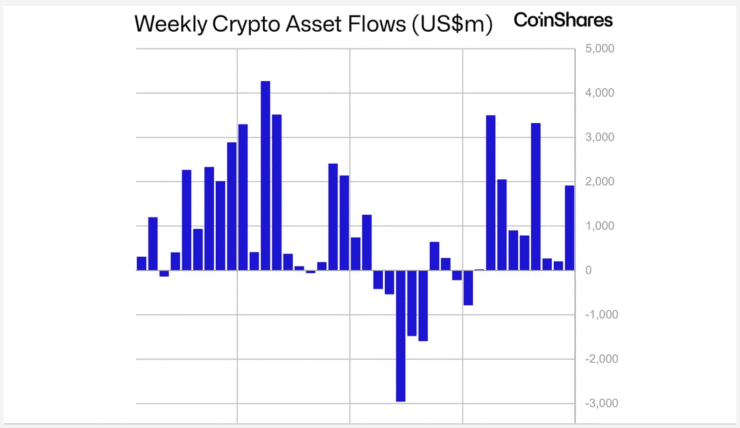

Global crypto investment products attracted $1.9 billion in net inflows last week, marking the ninth consecutive week of capital growth despite mounting geopolitical tensions. The latest data from CoinShares shows that top asset managers—including BlackRock, Fidelity, Grayscale, Bitwise, 21Shares, and ProShares—were among the primary beneficiaries.

CoinShares Head of Research James Butterfill noted the sector’s remarkable resilience in his weekly commentary. “Despite geopolitical concerns weighing on sentiment, crypto continued to attract capital—mirroring gold’s behavior,” he wrote.

This latest inflow brings total year-to-date allocations to a record $13.2 billion. Meanwhile, total assets under management (AUM) across crypto investment products now stand at $179 billion. Analysts view the trend as a sign of growing investor confidence and a shift toward recognizing crypto as a viable hedge during periods of economic and political uncertainty.

Bitcoin Funds Bounce Back With $1.3B Inflows

Bitcoin products led the market’s rebound last week, drawing $1.3 billion in net inflows after two consecutive weeks of modest losses. The surge was almost entirely driven by U.S.-listed spot Bitcoin ETFs, which added $1.37 billion on their own—offsetting minor outflows across European and emerging markets. Total AUM for Bitcoin-based products has now reached $156.7 billion.

Even short-Bitcoin strategies gained modest traction, with $3.7 million in inflows signaling ongoing speculative interest on both sides of the trade.

Ethereum ETF Rally Continues—With a Pause

Ethereum products continued their bullish momentum, securing $585 million in new capital last week. This extends one of ETH’s strongest inflow periods since February, with over $2 billion added in recent weeks—around 14% of its current $14.9 billion in total AUM.

Much of the growth was fueled by U.S. spot Ethereum ETFs, which contributed $528.2 million last week alone. However, the streak of daily net inflows—lasting 19 consecutive trading sessions—ended Friday with a modest $2.1 million in outflows, suggesting a short-term breather.

Other altcoins also saw activity. XRP funds recorded $11.8 million in net inflows—their first in three weeks—while Sui-linked products attracted $3.5 million.

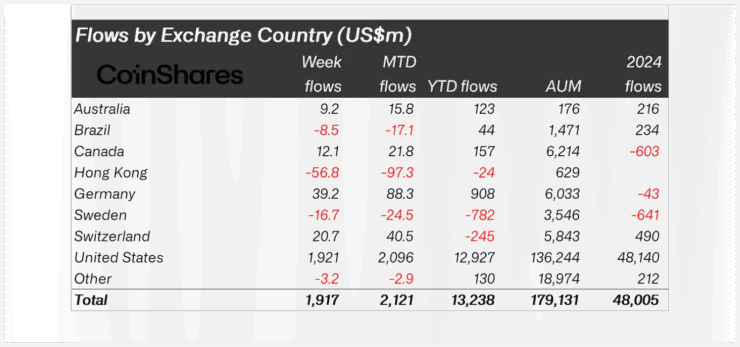

Regional Flows Highlight Growing Divide

The U.S. once again dominated regional activity with $1.9 billion in fresh inflows, reflecting strong institutional appetite. Germany, Switzerland, and Canada followed with $39.2 million, $20.7 million, and $12.1 million, respectively.

In contrast, outflows were recorded in Hong Kong and Brazil, with losses totaling $56.8 million and $8.5 million. The divide underscores a growing geographic split in sentiment: while Western institutions deepen their exposure to crypto, enthusiasm appears to be cooling in some emerging markets.

Crypto Funds Evolve as Institutional Portfolios Mature

The sustained inflow streak reflects a maturing digital asset class that is increasingly integrated into traditional investment frameworks. Bitcoin and Ethereum, in particular, are being embraced not just as high-risk assets but as legitimate portfolio components—especially amid global macro uncertainty.

If current momentum continues, analysts say the narrative will keep shifting. Crypto is no longer just about outsized returns—it’s becoming a core asset for long-term portfolio resilience.

Quick Facts

- Weekly inflows: $1.9 billion across crypto investment funds

- Total 2024 inflows: $13.2 billion, AUM at $179 billion

- Bitcoin ETFs led with $1.3 billion in fresh capital

- Ethereum products added $585 million, $2B in recent weeks

- U.S. dominated regional flows; Hong Kong saw $56.8M outflows