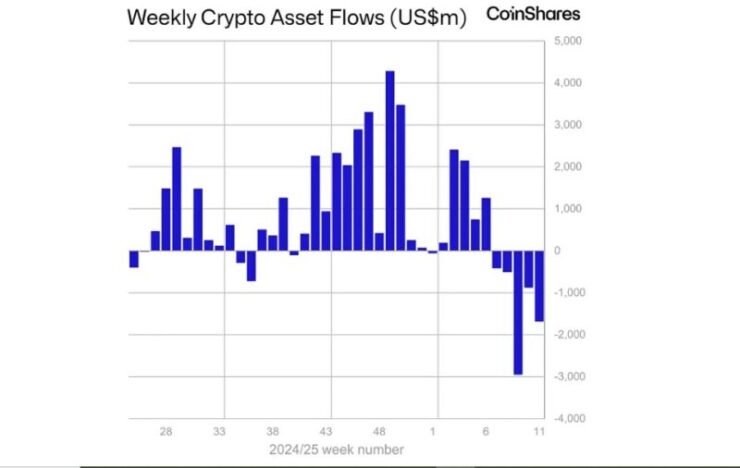

Cryptocurrency exchange-traded products (ETPs) witnessed $1.7 billion in outflows last week, marking the fifth consecutive week of investor pullback. According to CoinShares, this ongoing streak has extended to 17 days—the longest recorded since 2015. Despite this bearish trend, total year-to-date inflows remain slightly positive at $912 million, showing mixed investor sentiment.

Bitcoin ETPs bore the brunt of the outflows, losing $978 million just last week. Over the last five weeks, cumulative outflows from Bitcoin ETPs alone have reached $5.4 billion, dragging year-to-date (YTD) inflows down to $612 million.

This sharp decline highlights investors’ retreat amid mounting macroeconomic pressures and ongoing concerns about crypto regulations.

Ethereum and Solana ETPs also witnessed negative flows, with Ether-based products seeing $175 million in outflows and Solana losing $2.2 million. Interestingly, XRP-based ETPs bucked the trend slightly, reporting $1.8 million in inflows, signaling resilience despite the broader market downturn.

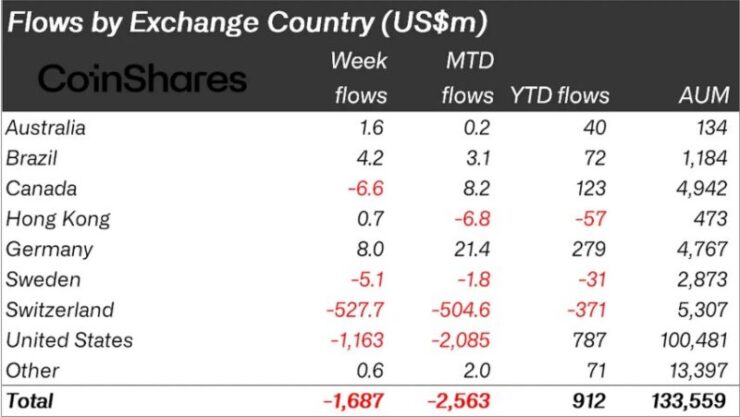

Regional Breakdown: U.S. and Switzerland Lead Outflows

The U.S. and Switzerland have sharply led the recent wave of crypto ETP outflows. U.S.-listed funds saw the steepest decline with $1.16 billion exiting in the past week alone, pushing March’s month-to-date (MTD) outflows to a hefty $2.08 billion. Switzerland followed closely, logging $527.7 million in weekly outflows.

Germany presented a bright spot, recording $8 million in weekly inflows and $21.4 million MTD inflows, solidifying its year-to-date (YTD) gains at $279 million. Canada showed mixed results, shedding $6.6 million over the week but still positive for March with $8.2 million inflows.

Brazil, Australia, and Hong Kong exhibited smaller yet notable movements. Brazil secured $4.2 million in weekly inflows, while Hong Kong and Sweden trended negative, losing $5.1 million.

The global cumulative weekly outflows hit $1.69 billion, bringing the total MTD outflows to $2.56 billion. Despite this bearish momentum, YTD flows remain positive at $912 million, largely buoyed by early-year gains in U.S. and German markets.

Broader Market Implications

The downturn in ETP flows mirrors a larger cooling across crypto markets, with many investors hesitant to re-enter positions amid economic instability and the Federal Reserve’s hawkish policy stance. The trend could also impact upcoming ETF approval decisions as U.S. regulators delay greenlighting new products tied to altcoins like XRP, Solana, and Dogecoin.

While XRP showed strength amidst the slump, the decline in crypto ETPs raises questions about near-term bullish catalysts, especially as institutional players reassess their exposure.

Quick Facts:

- Crypto ETPs faced $1.7 billion in outflows last week, marking the fifth consecutive week of losses.

- Bitcoin ETPs lost $978 million, with total outflows reaching $5.4 billion in five weeks.

- XRP ETPs reported minor inflows of $1.8 million, bucking the broader negative trend.

- The 17-day outflow streak is the longest since CoinShares began records in 2015.