Bitcoin and Ethereum staged a sharp recovery Monday evening after President Donald Trump declared a “total ceasefire” between Iran and Israel, temporarily easing the geopolitical tensions that rattled global markets throughout the weekend.

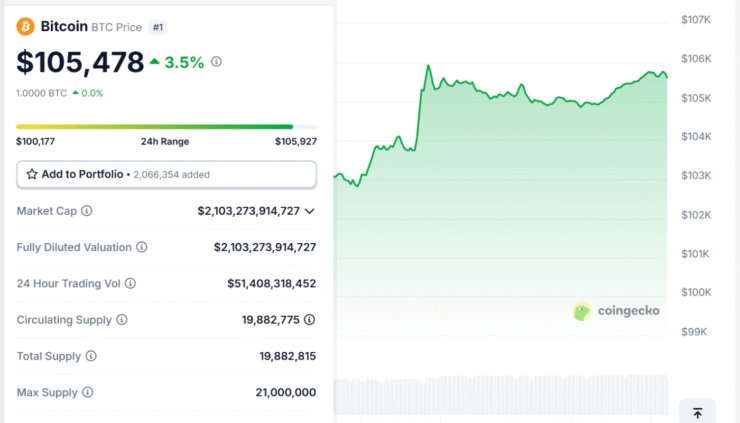

Bitcoin surged back above $105,000—up nearly 4.5% in 24 hours—after dipping as low as $98,500 on Sunday, its lowest point in over six weeks. Ether posted even stronger gains, jumping nearly 9% to reclaim the $2,400 range. The broader altcoin market followed suit: Solana rose nearly 10% to $144.80, while XRP climbed over 7% to $2.16, reflecting a rapid return of risk appetite.

While traders cautiously welcomed the ceasefire, uncertainty still lingers over whether Bitcoin can sustain a push toward the $110,000 mark. Some analysts note that despite the recent rebound, the market remains sensitive to any signs of renewed conflict or macroeconomic stress.

In the derivatives market, Bitcoin’s volatility triggered $193 million in liquidations from over-leveraged long positions—about 0.3% of the total $68 billion in open interest. Still, this level of liquidation is relatively modest, with similar drawdowns having occurred several times in the past month, suggesting that investors are becoming more resilient to sudden swings.

Yet not everyone is convinced the worst is over. Some traders remain wary that any disruption to the fragile ceasefire—or renewed macro instability—could quickly reverse the current bullish sentiment.

Trump’s Ceasefire Deal Eases Market Panic, but Tensions Simmer

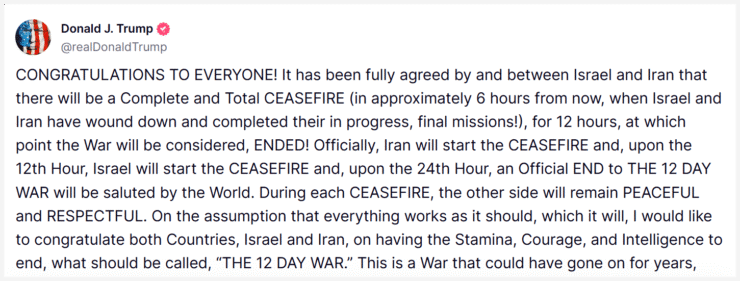

Tensions between Iran and Israel, which had escalated into a series of missile and drone attacks in recent weeks, took a pivotal turn Monday evening as U.S. President Donald Trump announced a ceasefire agreement between the two nations.

The geopolitical unrest, compounded by a U.S. military intervention over the weekend, had sparked widespread uncertainty across global markets—including crypto, which saw steep price drops as risk-off sentiment took hold.

But around 6 p.m. ET on Monday, Trump posted to Truth Social that Iran and Israel had “fully agreed” to a ceasefire framework. According to his statement, the plan would unfold in stages: Iran would halt military activity first, followed by Israel twelve hours later. After 24 hours, both sides would declare a complete cessation of hostilities, officially ending what Trump dubbed the “12-Day War.”

The announcement injected fresh optimism into financial markets, with crypto assets rallying in the hours that followed. Still, analysts warn that the core geopolitical issues remain unresolved and could reignite with little warning—keeping markets on edge.

Fed Rate Cut Bets Rise as Oil Falls and Crypto Rebounds

Investor sentiment shifted sharply on Monday as easing geopolitical tensions and falling oil prices bolstered optimism around U.S. monetary policy. Brent crude, which surged to $77 per barrel over the weekend amid Middle East conflict, pulled back significantly following the ceasefire news. Meanwhile, the S&P 500 jumped 1%, reflecting renewed confidence in global markets.

Following reports of a retaliatory strike in Qatar and subsequent de-escalation, traders increasingly bet on the likelihood of interest rate cuts by the Federal Reserve. According to the CME FedWatch Tool, the chance that the Fed will maintain its 4.25% benchmark rate through November has dropped to just 8.4%, compared to 17.1% a week ago. Meanwhile, the probability of a cut to 3.75% or lower has surged to 53%.

This monetary policy shift has helped bolster risk-on sentiment, further supporting crypto’s rebound. While a full rally to $110,000 may not materialize immediately, Bitcoin’s decisive bounce above the $100,000 level indicates that institutional conviction remains strong despite short-term global uncertainty.

Quick Facts

- Bitcoin and Ethereum rebounded sharply after a Trump-brokered ceasefire calmed global tensions.

- BTC rose above $105,000 and ETH climbed back to $2,400, as risk appetite returned.

- Traders now expect the Fed to cut rates, with odds of a drop to 3.75% rising to 53%.

- Market analysts remain cautious as geopolitical uncertainty could still reverse the gains.