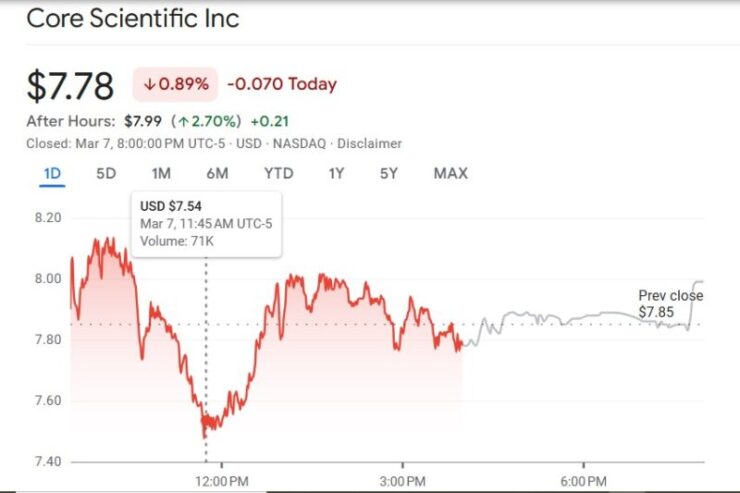

Bitcoin mining firm Core Scientific (CORZ) saw its stock plunge 18% on March 6, following reports that Microsoft had scaled back its commitments to CoreWeave, a key partner of the company.

The move comes amid growing concerns over CoreWeave’s operational challenges, including missed deadlines and delays in supplying materials crucial for scaling artificial intelligence models.

CoreWeave, which is preparing for an initial public offering (IPO), has been heavily reliant on Microsoft, its largest customer. Recent filings indicate that Microsoft accounted for 35% of CoreWeave’s revenue in 2023, with that figure surging to 62% in 2024.

While CoreWeave has denied any contract cancellations, Microsoft’s decision to reduce its commitments has raised doubts about the firm’s financial stability and growth prospects.

Core Scientific had previously entered a $100 million agreement with CoreWeave in March 2024 to provide data center services, marking a strategic move to diversify revenue streams ahead of the Bitcoin halving.

As part of the deal, Core Scientific planned to lease a Tier 3 data center in Austin, Texas, with a capacity of up to 16 megawatts. However, with Microsoft scaling back its reliance on CoreWeave, concerns have emerged regarding the impact on Core Scientific’s future revenue generation.

Despite its recent struggles, Core Scientific remains one of the largest publicly traded Bitcoin mining firms. According to Arkham Intelligence, the company currently holds 755.6 BTC, valued at approximately $66.7 million. Its Bitcoin reserves have been steadily increasing since December 2024, indicating efforts to strengthen its financial position in an increasingly volatile market.

CoreWeave Pushes Back Against Reports of Microsoft Scaling Down Commitments

CoreWeave has denied the reports suggesting that Microsoft has reduced its commitments to the AI cloud provider ahead of its highly anticipated initial public offering (IPO). The Financial Times earlier cited anonymous sources claiming that Microsoft had withdrawn certain agreements due to CoreWeave’s failure to meet delivery deadlines and ongoing supply issues, raising concerns about the firm’s reliability.

According to these sources, Microsoft, while still maintaining key contracts with CoreWeave, had lost some confidence in the company’s ability to execute its commitments effectively. Despite this, CoreWeave issued a strong rebuttal, dismissing these claims as misleading. In a statement to DCD, the company asserted,

We pride ourselves in our client partnerships and there have been no contract cancellations or walking away from commitments. Any claim to the contrary is false and misleading.”

CoreWeave’s Upcoming IPO and Financial Outlook

CoreWeave, initially founded as a cryptocurrency mining operation in 2017, pivoted to artificial intelligence services in 2019. The company is preparing for an initial public offering (IPO) that could value it at over $35 billion, with plans to raise approximately $4 billion.

However, CoreWeave faces challenges, including significant debt and a heavy reliance on major clients like Microsoft, which accounted for 62% of its revenue in 2024.

The news of Microsoft’s reduced commitments to CoreWeave has had ripple effects across the cryptocurrency mining sector. Shares of other Bitcoin mining companies also experienced declines on March 6, with Cipher Mining (CIFR) dropping nearly 9%, and both CleanSpark (CLSK) and Bitfarms (BITF) falling by 5%.

These developments occur amid broader market concerns, including potential economic recessions and ongoing geopolitical tensions, which continue to pose challenges for risk assets like cryptocurrencies.

Quick Facts:

- Core Scientific’s shares fell 18% following Microsoft’s reduction in commitments to CoreWeave.

- CoreWeave is preparing for an IPO valued at over $35 billion, despite facing significant debt and reliance on major clients.

- The cryptocurrency mining sector is experiencing increased volatility amid broader market uncertainties.