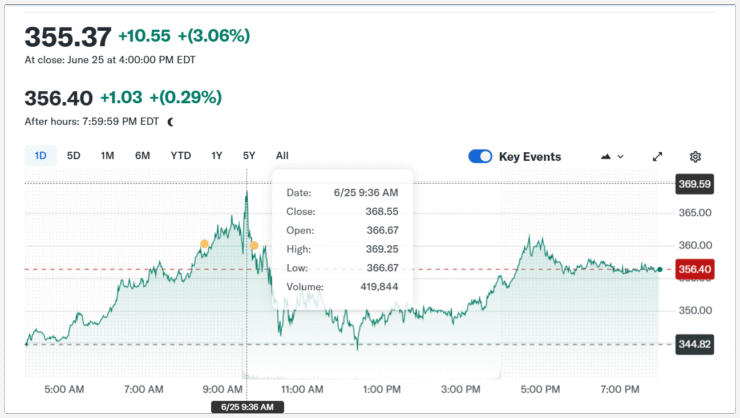

Coinbase Global (COIN) has continued its stellar 2025 run, reaching a new 52-week high and nearing its all-time record set in November 2021. Shares surged 7.1% during Wednesday’s trading session to hit $369.25 before closing at $352—marking a 2% gain on the day.

The rally extends a broader trend of renewed market confidence in digital assets. Since bottoming out in April amid fears triggered by President Donald Trump’s “Liberation Day” tariff shock, Coinbase stock has rebounded sharply—gaining 133% on the back of rising Bitcoin prices, calmer geopolitical conditions, and increasing institutional activity.

Now just 2% away from its record closing high of $357.39, Coinbase is once again being watched as a barometer for overall crypto sentiment.

Solid Earnings and Market Cap Growth Support Rally

Coinbase’s latest surge has pushed its market capitalization to $89.6 billion, ranking it among the most valuable crypto-native companies worldwide. Year-to-date, the stock is up over 42%, helped by a broader crypto recovery led by Bitcoin and Ethereum.

In Q1, Coinbase reported $2.03 billion in revenue, up 24.2% year-over-year. A standout contributor was its subscription and services segment, which grew 36.3% to $698.1 million. Much of this revenue stemmed from stablecoin-related income, driven by its strategic partnership with Circle and active role in the USDC ecosystem.

Despite occasional earnings volatility, Coinbase’s diversified income—across trading, infrastructure, and custodial services—has helped build resilience. Analysts highlight Coinbase’s evolution from a retail exchange into a Web3 financial backbone as a major reason for the continued investor confidence.

Circle IPO Drives Further Optimism

Fueling the recent bullish sentiment is the blockbuster IPO of Circle Internet Group (CRCL), Coinbase’s long-time partner in the USDC stablecoin ecosystem. Circle went public earlier this month at $31 per share and surged past $200 in early trading, drawing attention to the growing relevance of stablecoins.

Coinbase and Circle’s relationship deepened in 2023 when Coinbase took an equity stake in the company and assumed greater responsibility in USDC’s management. As USDC adoption grows globally, Coinbase stands to benefit directly from Circle’s success—especially in the regulated trading and payments sectors.

Circle’s inclusion in the VanEck MVIS Global Digital Assets Equity Index and rising institutional exposure have further boosted investor sentiment around Coinbase, with both firms increasingly viewed as foundational to the future of digital finance.

Quick Facts

- Coinbase stock reached a 52-week high of $369.25 and is up 133% since April.

- Q1 revenue rose 24.2% to $2.03B, with services income up 36.3%.

- Coinbase’s market cap stands at $89.6B, among the top in crypto-native firms.

- Circle’s IPO success has boosted sentiment due to their close USDC partnership.