The ongoing legal battle between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken another turn, with the regulatory agency requesting an additional 28 days to review Coinbase’s appeal. The SEC’s latest filing suggests that the newly established crypto task force could play a key role in determining the outcome of this high-profile case.

SEC Requests More Time for “Appropriate Review”

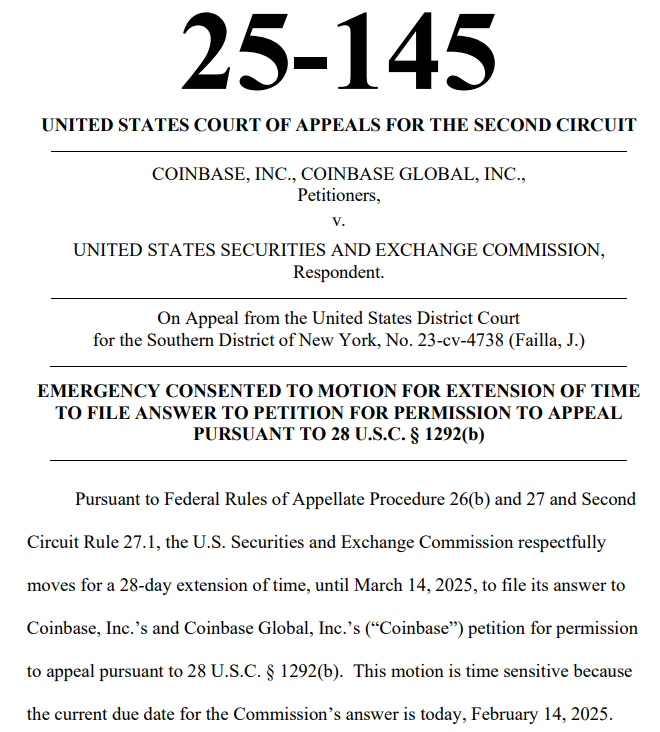

In a Feb. 14 court filing, the SEC formally requested an extension to March 14, arguing that additional time was needed to conduct an “appropriate review” of crypto-related issues. The agency emphasized that its newly formed crypto task force might help resolve both the district court proceedings and the appellate review.

“The crypto task force’s work may affect and could facilitate the potential resolution of both the underlying district court proceeding and potential appellate review,” the SEC stated in its filing.

Coinbase, which has been locked in a legal dispute with the SEC since June 2023, agreed to the extension, signaling a potential shift in regulatory discussions. The request comes just days after the SEC and Binance jointly sought a 60-day pause in their case, also citing the task force’s role in shaping digital asset regulations.

Coinbase’s Appeal to Define Crypto’s Legal Status

Coinbase has been pressing for regulatory clarity, and on Jan. 21, the exchange asked a U.S. appeals court to rule that crypto trades on its platform do not qualify as securities. This request seeks to preemptively resolve the SEC’s lawsuit, which claims that Coinbase illegally offered unregistered securities.

The crypto exchange argued that determining whether secondary market transactions of digital assets should fall under securities laws is of immense importance to the industry. Coinbase believes that without a clear regulatory framework, the crypto industry will continue to face legal uncertainty, deterring innovation and institutional participation.

Coinbase’s appeal follows a March 2024 ruling by Judge Katherine Failla, who denied the exchange’s motion for judgment. However, she later approved an interlocutory appeal, pausing district court proceedings until the Second Circuit Court of Appeals reviews Coinbase’s challenge.

The SEC’s Crypto Task Force: A Potential Turning Point?

The SEC’s formation of a crypto task force in January has injected fresh optimism into the industry, with hopes that it could expedite regulatory clarity and provide a structured path forward for digital asset firms.

The task force is led by Commissioner Hester Peirce, who has been a vocal advocate for pro-crypto regulations. Peirce, often dubbed “Crypto Mom” for her support of blockchain innovation, has frequently criticized the SEC’s enforcement-heavy approach to crypto regulation.

The task force’s creation was announced by Commissioner Mark Uyeda, who is currently serving as acting SEC chairman. Many industry participants view this as a shift towards a more constructive approach to regulating digital assets.

Implications for Crypto Regulation and Market Outlook

The extension request suggests that the SEC may be re-evaluating its stance on crypto litigation, potentially due to internal policy shifts or external political pressure. If the task force proposes clearer guidelines, it could lead to negotiated settlements rather than prolonged court battles.

For Coinbase and the broader crypto industry, this development could be a double-edged sword. While it signals potential progress in regulatory discussions, it also means that legal uncertainty could persist for months as the SEC reviews its framework.

Key questions remain:

- Will the SEC reconsider its lawsuits against Coinbase and other exchanges?

- How will the task force’s findings influence future crypto regulations?

- Could the legal battle set a precedent for how the U.S. government approaches crypto assets?

As the legal fight continues, all eyes remain on March 14, when the SEC is expected to file its updated response. With the SEC’s response due on March 14, its decision could define how digital assets are regulated in the U.S. and set the tone for crypto’s future worldwide.