Coinbase is demanding transparency from the U.S. Securities and Exchange Commission (SEC), filing a Freedom of Information Act (FOIA) request to uncover how much the agency has spent on enforcement actions against crypto firms.

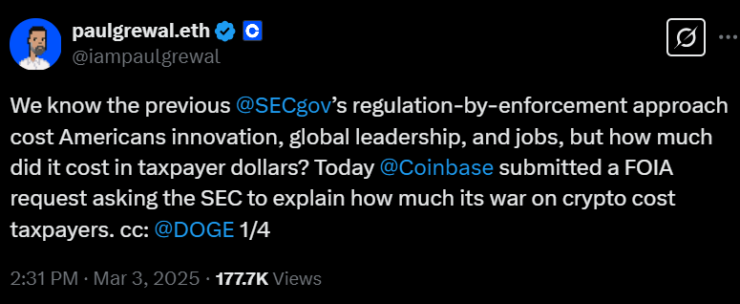

In a March 3 statement on X, Coinbase Chief Legal Officer Paul Grewal confirmed that the exchange formally requested details on the SEC’s investigations and enforcement actions against crypto companies from April 17, 2021, to January 20, 2025.

“We’re asking for full transparency,” Grewal stated, emphasizing that the request seeks to reveal how many enforcement actions the SEC has pursued, how many employees and third-party contractors were involved, and the total cost of these efforts.

The move comes as Coinbase and other crypto firms push back against the SEC’s enforcement-driven approach, questioning whether the agency’s crackdown is truly about investor protection or an expensive campaign against the industry.

Why This Matters

- The SEC has ramped up legal action against major crypto firms, including Coinbase, Binance, Kraken, Ripple, and Uniswap.

- Legal battles have cost companies millions, but the financial burden on U.S. taxpayers remains unknown.

- Recent court setbacks for the SEC suggest misallocated enforcement resources, leading critics to call for a shift in regulatory strategy.

SEC’s Crypto Enforcement Under Fire

Under Chair Gary Gensler, the SEC has taken a “regulation by enforcement” approach, bringing lawsuits against crypto firms rather than establishing clear rules. However, a series of legal defeats and dismissals suggest that the agency may have overreached.

Key SEC Lawsuit Developments:

- February 2025: The SEC dropped cases against Coinbase, Consensys, Robinhood, and Kraken, raising questions about why these cases were pursued in the first place.

- Ripple Case: The SEC suffered a partial defeat in its lawsuit against Ripple Labs, with the court ruling that XRP is not a security when sold on secondary markets.

- Uniswap Investigation Dropped: The agency abandoned its probe into Uniswap Labs, indicating a shift away from blanket enforcement strategies.

Despite these legal setbacks, the SEC continues to push for stricter crypto oversight, claiming that most digital assets qualify as securities under existing laws.

Coinbase’s Broader Fight for Regulatory Clarity

Coinbase’s FOIA request is part of its ongoing battle for clearer crypto regulations. The company has been one of the most vocal critics of the SEC’s approach, advocating for Congress to establish a formal regulatory framework instead of leaving rulemaking to enforcement actions.

- In 2023, Coinbase sued the SEC for failing to provide clear guidelines for digital asset firms.

- The exchange has actively lobbied lawmakers to pass crypto-specific legislation that clarifies the status of digital assets.

- CEO Brian Armstrong has repeatedly called out the SEC, urging a “pro-innovation stance” rather than an “anti-crypto crackdown”.

What’s Next?

With growing political and legal scrutiny, the SEC may soon face congressional pressure to justify its spending on crypto enforcement.

- The FOIA request could force the SEC to disclose whether its crackdown has been cost-effective or wasteful.

- Congress may intervene, pushing for a new regulatory framework that reduces reliance on lawsuits.

- Crypto industry leaders could leverage this data to further challenge the SEC’s authority over digital assets.

Final Takeaway

Coinbase’s FOIA request signals a turning point in the battle over U.S. crypto policy. If the SEC is forced to reveal the full financial burden of its enforcement actions, it could shift the conversation toward more balanced regulation one that fosters innovation instead of fear. Will this expose a costly and ineffective “war on crypto,” or will it justify the SEC’s actions? The answer could shape the future of crypto regulation in the U.S.