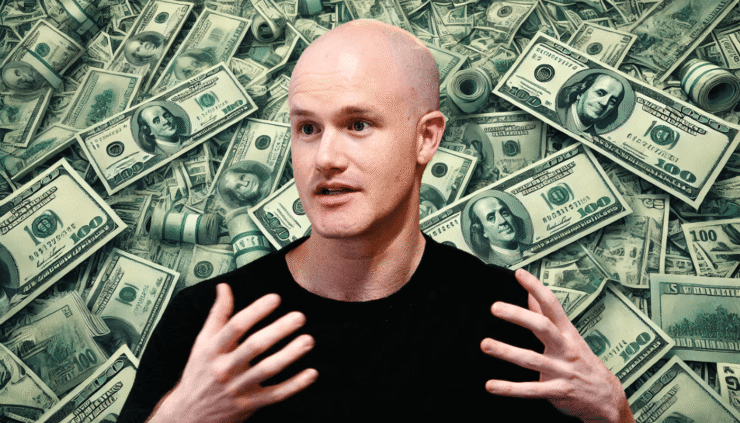

Coinbase CEO Brian Armstrong has issued a stark warning about the trajectory of U.S. fiscal policy, cautioning that Bitcoin could become the world’s default reserve currency if the national debt spiral continues unchecked. His comments arrive as America’s public debt surpasses $37 trillion, fueling fears of long-term economic instability and weakening confidence in the U.S. dollar.

Taking to X on Tuesday, Armstrong wrote, “I love Bitcoin, but a strong America is also super important for the world,” urging policymakers to embrace fiscal responsibility. His remarks echo rising concerns among business leaders and economists who see the mounting debt and political inertia as catalysts for global de-dollarization.

Armstrong’s comments follow the passage of a Republican-led budget—often dubbed the “big, beautiful bill”—which slashes social spending, extends tax cuts, and boosts defense funding. Critics argue the bill prioritizes political optics over financial sustainability, potentially setting the stage for inflation, inequality, and further erosion of U.S. economic credibility.

Against this backdrop, Bitcoin’s appeal is growing. With a fixed supply and immunity to inflationary policy, the cryptocurrency is increasingly viewed as a hedge by institutional investors, sovereign wealth funds, and even state governments. Once considered a fringe experiment, Bitcoin is now being positioned as a financial lifeboat amid fears of fiat failure.

Experts and Elon Musk Slam “Big, Beautiful Bill” as Reckless

The controversial spending package has sparked backlash from across the political and financial spectrum. A coalition of six Nobel Prize-winning economists, including Paul Krugman and Joseph Stiglitz, published a June letter condemning the bill’s fiscal framework. They warned it could inflate the debt by over $3 trillion, exacerbate income inequality, and deepen the nation’s long-term financial vulnerabilities.

Tesla CEO Elon Musk also joined the chorus of criticism, calling the legislation a “massive, outrageous, pork-filled Congressional spending bill” and a “disgusting abomination”. His remarks, shared widely on X, underscored the bill’s unpopularity among innovation leaders and fiscal conservatives alike.

With global economic uncertainty already mounting, analysts argue the bill could further erode international confidence in the U.S. dollar, accelerating moves by other nations to diversify their reserves into alternatives like Bitcoin and gold. All eyes now turn to the Senate, where the fate of the bill—and potentially the dollar’s global status—hangs in the balance.

Bitcoin Seen as Lifeline Amid Inflation and Debt Spiral

As fiscal pressure builds, Bitcoin is gaining traction not only as a speculative asset but as a structural counterbalance to fiat-based systems.

Kadan Stadelmann, CTO of Komodo Platform, said in a recent interview that Bitcoin was “built for moments like this,” when traditional currencies are strained by unchecked money printing and soaring liabilities.

“Bitcoin stands in opposition to fiat currency,” he explained.

Stadelmann argued that the U.S. dollar, like many fiat currencies, is trapped in a cycle of debt accumulation, adding hundreds of billions annually with no meaningful reform in sight.

He warned that continued erosion of trust in central banks could prompt a massive capital migration into decentralized assets like Bitcoin. Such a shift, he said, would likely trigger a supply crunch, potentially driving prices higher and accelerating the transition to decentralized finance.

With economic warning lights flashing and legislative dysfunction deepening, Bitcoin’s original promise as a hedge against fiat collapse may now be moving from theory to reality.

Quick Facts

- Brian Armstrong warns that unchecked U.S. debt could elevate Bitcoin to reserve currency status.

- U.S. national debt has crossed $37 trillion, with recent budget legislation exacerbating concerns.

- Six Nobel laureates and Elon Musk have denounced the spending bill as reckless and inflationary.

- Analysts warn the bill could accelerate global moves away from the U.S. dollar.

- Bitcoin is gaining favor as a hedge against inflation, fiscal mismanagement, and political risk.