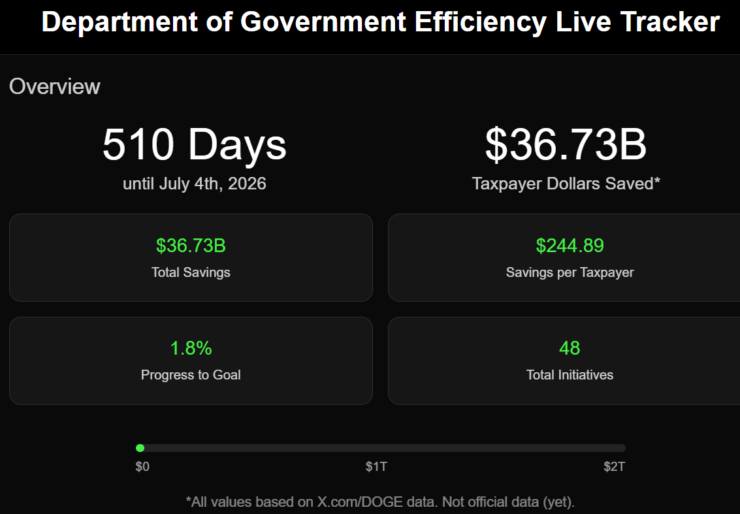

Elon Musk’s Department of Government Efficiency (DOGE) has already saved $36.7 billion for U.S. taxpayers, igniting discussions among crypto industry leaders about the potential of blockchain technology to enhance government spending transparency.

According to Doge-tracker data, these savings represent just 1.8% of Musk’s $2 trillion cost-cutting goal, a plan he outlined during a January 9 interview with political strategist Mark Penn. As government inefficiencies come under greater scrutiny, Coinbase CEO Brian Armstrong is advocating for a blockchain-powered U.S. Treasury, arguing that it could revolutionize financial oversight and prevent wasteful spending.

Brian Armstrong Calls for Blockchain Transparency in Government Spending

Applauding DOGE’s early successes, Brian Armstrong took to X (formerly Twitter) on February 9, emphasizing the need for on-chain transparency in government finances.

“Great progress DOGE,” Armstrong wrote.

“Imagine if every government expenditure was done transparently on-chain. Would make it much easier to audit.”

Blockchain technology offers a publicly verifiable and immutable ledger, ensuring real-time access to financial transactions. This level of transparency could help prevent fraud, eliminate inefficient spending, and allow taxpayers to track exactly how their money is allocated.

How a Blockchain-Based Treasury Could Work

A decentralized treasury system could revolutionize government spending in several key ways:

- On-chain verification – All transactions would be recorded on a public blockchain, allowing anyone to audit and verify expenditures in real time.

- Automated spending proposals – Smart contracts could require public voting on certain spending decisions, ensuring greater democratic control over budget allocations.

- Fraud prevention – Transparent transactions would make it easier to detect suspicious activity, reducing opportunities for corruption and mismanagement.

Armstrong and other crypto advocates believe that moving government finances onto a blockchain could increase accountability and reduce financial inefficiencies.

Musk’s DOGE Uncovers $50 Billion Loophole in Government Spending

As part of its broader cost-cutting mission, Musk’s Department of Government Efficiency has already uncovered a massive loophole in federal spending.

In a February 8 X post, Musk revealed that DOGE discovered an estimated $50 billion per year in entitlement payments being made to individuals without Social Security numbers or temporary identity numbers.

“When I asked if anyone at Treasury had a rough guess for what percentage of that number is unequivocal and obvious fraud, the consensus in the room was about half—so $50 billion per year, or $1 billion per week!! This is utterly insane and must be addressed immediately.”

Government and DOGE Reach Agreement on Financial Reforms

Following DOGE’s findings, Musk’s non-governmental agency and the U.S. Treasury reached a joint agreement to improve financial oversight.

Key reform measures include:

- Mandatory payment categorization codes – Previously, government payments frequently lacked classification, making auditing difficult.

- Payment rationale requirements – Transactions must now include a clear reason for disbursement, preventing funds from being allocated without accountability.

- Enhanced fraud prevention updates – The DO-NOT-PAY list, which identifies suspicious entities, will now be updated weekly or daily, instead of the previous annual updates.

Could Blockchain Solve Government Spending Inefficiencies?

Musk’s revelations have strengthened arguments for implementing blockchain in public finance. A blockchain-based U.S. Treasury could:

- Eliminate misclassified payments through a public, tamper-proof ledger.

- Prevent fraudulent transactions by requiring on-chain identity verification.

- Increase trust and efficiency by allowing taxpayers to track every dollar spent.

While full-scale blockchain integration remains a distant possibility, the growing support from industry leaders like Armstrong and Musk suggests that decentralized financial oversight could become a major policy discussion in the coming years.

Final Thoughts

As DOGE continues to expose inefficiencies in government spending, the push for greater financial transparency is gaining momentum. Armstrong’s vision of a blockchain-powered U.S. Treasury could serve as a blueprint for a more accountable and efficient government financial system.

With billions in wasteful spending already identified, the debate over whether blockchain technology should be used to track and manage public funds is only just beginning.