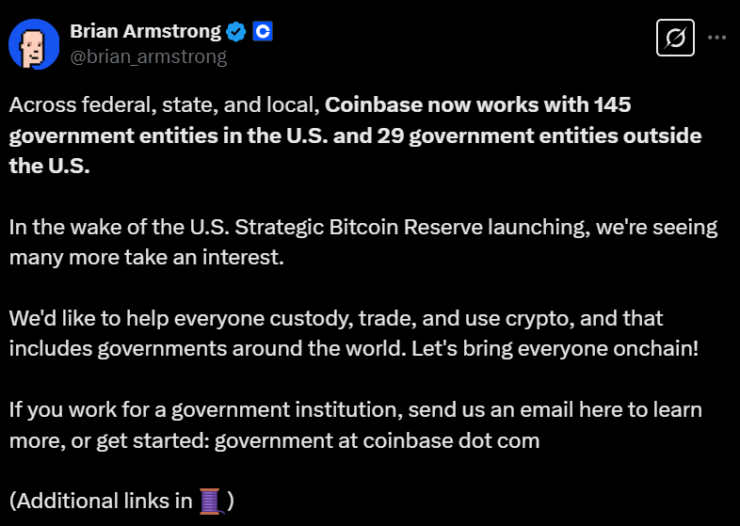

Coinbase CEO Brian Armstrong has revealed a surge in government interest in crypto, citing the U.S. Strategic Bitcoin Reserve as a catalyst. In a recent post on X, Armstrong stated that Coinbase is now collaborating with 145 government entities in the U.S. and 29 internationally, offering services such as custody, trading, and blockchain infrastructure.

The move signals a growing shift among governments toward digital asset integration, as countries look to leverage Bitcoin as a strategic reserve asset and blockchain technology for operational efficiency.

Governments worldwide are exploring ways to incorporate crypto into financial frameworks. Coinbase has positioned itself as a primary partner for public institutions seeking secure and compliant access to digital assets.

Armstrong noted that the launch of the U.S. Strategic Bitcoin Reserve has increased institutional confidence, pushing more government bodies toward Bitcoin adoption. This aligns with broader trends, where countries actively diversify reserves, test blockchain-based solutions, and seek crypto-driven financial innovations.

Coinbase Strengthens International Presence

Coinbase’s expansion isn’t limited to U.S. partnerships. The exchange recently secured registration with India’s Financial Intelligence Unit (FIU), a crucial step in resuming operations in the country. Despite regulatory hurdles, India represents a massive crypto adoption market, and Coinbase’s return underscores its long-term commitment to global expansion.

The exchange’s entry into regulated markets like India highlights how major economies are moving toward structured crypto integration, favoring compliant platforms over unregulated alternatives.

While Bitcoin’s role as a store of value is gaining traction among sovereign entities, governments are also exploring blockchain for secure financial management. Public institutions are adopting blockchain for:

- Secure transactions and payments

- Tamper-proof record-keeping

- Enhanced transparency in public finance

Coinbase has been instrumental in helping government entities navigate crypto adoption, offering:

- Portfolio management solutions

- Due diligence support

- Technical integration services

With over 13 years of experience and a spotless security record, Coinbase remains a trusted custodian for digital assets.

Regulatory Clarity Fuels Expansion

Coinbase is shifting focus toward scaling its U.S. operations as regulatory clarity improves. Armstrong recently announced plans to hire 1,000 employees in 2025, signaling confidence in the regulatory environment and increasing demand for institutional crypto services.

The increasing collaboration between crypto firms and government agencies is reshaping how digital assets are viewed globally. As more nations explore Bitcoin reserves and blockchain-driven efficiencies, partnerships like those with Coinbase will play a pivotal role in mainstream adoption.

With governments integrating digital assets accelerating, the question isn’t if crypto will become a core financial instrument—but when.