Coinbase CEO Brian Armstrong has made a bold prediction, stating that up to 10% of global GDP could be running on crypto rails by 2030. His remarks came during Coinbase’s Q4 2024 earnings call on February 13, where he framed the current state of the crypto industry as the “dawn of a new era” in the United States.

A $10 Trillion Crypto Economy?

Armstrong compared the increasing adoption of blockchain technology to the early 2000s, when businesses had to adapt to the internet to stay competitive. He emphasized that “onchain is the new online”, suggesting that companies that fail to integrate blockchain-based solutions risk falling behind.

If his prediction materializes, over $10 trillion in value could be tokenized or operated on blockchain infrastructure, based on the World Bank’s estimate of today’s $100 trillion global GDP. This shift would place crypto at the center of financial and economic activities, impacting global trade, banking, and digital asset markets.

Coinbase Positioned as a Market Leader

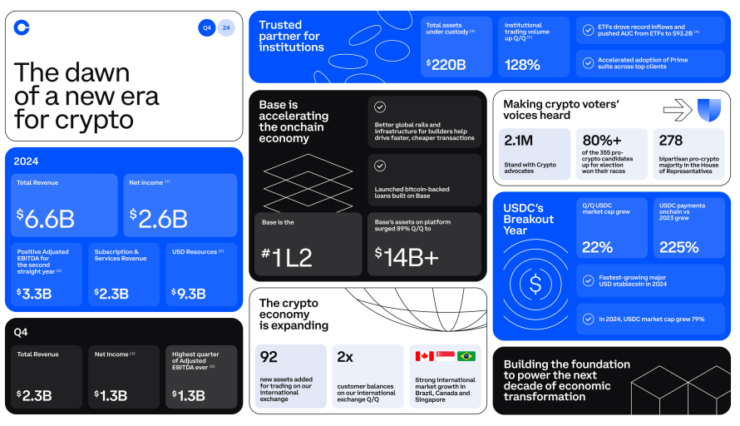

As institutional interest in crypto-based financial systems continues to grow, Armstrong positioned Coinbase as the preferred partner for companies looking to transition to blockchain technology. Coinbase reported Q4 revenue of $2.3 billion, an 88% increase quarter-on-quarter, marking its strongest earnings performance in over a year and far exceeding analyst expectations.

Armstrong remains confident that Coinbase will drive adoption, helping businesses integrate crypto payments, stablecoins, and decentralized finance (DeFi) solutions into their operations.

The U.S. as the Crypto Capital?

According to Armstrong, the United States will lead the way in crypto adoption, with 30% of global GDP coming from the country. He credited former President Donald Trump’s policies for accelerating the U.S.’s role in shaping the crypto economy, stating:

“President Trump is moving fast to fulfill his promise of making the US the crypto capital of the planet.”

Additionally, Armstrong highlighted Congress’s shifting stance on digital assets, describing the current legislative environment as the “most pro-crypto Congress” the industry has seen.

This comes in light of Federal Reserve Governor Christopher Waller’s recent call for regulatory clarity on stablecoins, which could allow banks to issue their own digital dollar-pegged assets.

Challenges and Considerations

While Armstrong’s vision for a crypto-powered economy is ambitious, several challenges remain:

- Regulatory uncertainty: Governments and financial regulators worldwide are still working on clear and cohesive policies for stablecoins, DeFi, and tokenized assets.

- Scalability: Blockchain networks must enhance transaction speeds, security, and interoperability to handle global financial transactions at scale.

- Institutional adoption: While firms like Coinbase, BlackRock, and Fidelity are leading the charge, broader adoption by corporations and financial institutions is still in progress.

What’s Next for Coinbase and the Crypto Industry?

Looking ahead, Armstrong outlined a three-pronged focus for Coinbase in 2025:

- Growing revenue through existing products.

- Expanding crypto’s real-world utility by supporting DeFi, NFTs, and onchain financial services.

- Building infrastructure to power the next decade of crypto adoption.

With Coinbase posting record-breaking earnings, beating analyst projections, and expanding its institutional partnerships, the company is well-positioned to be at the forefront of this transformation. However, achieving $10 trillion in crypto-driven GDP by 2030 will depend on regulatory progress, technological innovation, and continued market acceptance.

As global economies evolve, crypto’s role in finance is becoming harder to ignore, setting the stage for a blockchain-powered future, whether or not it reaches 10% of global GDP in just six years.