The debate over the US Crypto Strategic Reserve is intensifying, with Coinbase CEO Brian Armstrong and Gemini co-founders Tyler and Cameron Winklevoss advocating for a Bitcoin-only approach. Their stance follows President Donald Trump’s announcement of plans to create a crypto reserve, which would include Solana, Cardano, XRP, Ethereum, and Bitcoin. However, Armstrong and the Winklevoss twins argue that only Bitcoin meets the necessary criteria for a national reserve asset.

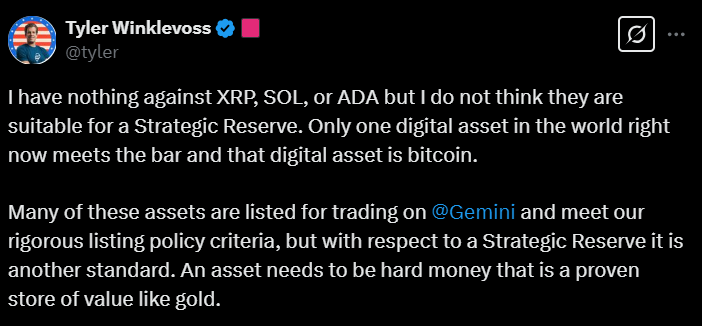

“Only one digital asset in the world right now meets the bar, and that digital asset is Bitcoin,” said Tyler Winklevoss in a March 3 post on X, emphasizing BTC’s superiority as a store of value akin to gold.

Brian Armstrong echoed this sentiment, stating that Bitcoin is the simplest and most reliable choice for a US reserve. “Just Bitcoin would probably be the best option,” Armstrong said, reinforcing the idea that BTC’s decentralization, security, and institutional adoption make it the most resilient reserve asset.

While acknowledging the potential inclusion of multiple cryptocurrencies, Armstrong suggested that if the US opted for more variety, a market-cap-weighted index of cryptocurrencies could be a better approach to ensure neutrality and avoid bias.

Is Ethereum The Only Alternative?

Cameron Winklevoss, Tyler’s twin and Gemini’s other co-founder, stated that only Bitcoin and possibly Ethereum currently qualify as true store-of-value reserve assets.

“Maybe Ethereum. Digital gold and digital oil. Which mirrors America’s physical reserves of gold (Fort Knox, NY Fed, etc.) and oil (Strategic Petroleum Reserve),” he explained.

While the Winklevoss twins believe assets like XRP, ADA, and SOL may have potential, they suggest that stockpiling these assets over time is a better approach than actively purchasing them in open markets.

Proof-of-Work vs. Proof-of-Stake

Samson Mow, CEO of Bitcoin technology firm Jan3, further reinforced the Bitcoin-only stance, arguing that only proof-of-work (PoW) cryptocurrencies should be considered for the reserve.

Under this logic, Litecoin (LTC) another PoW-based asset was suggested as an alternative but did not receive the same level of endorsement as Bitcoin.

Executives from Cardano and Ripple have defended Trump’s decision to include their tokens in the Crypto Strategic Reserve.

Charles Hoskinson, founder of Cardano, responded to critics by stating:

“XRP is great technology, a global standard, survived for a decade through many harsh cycles, and has one of the strongest communities. I think the president made the right decision.”

Meanwhile, Ripple CEO Brad Garlinghouse has long supported the idea of a multi-token US reserve, aligning with Trump’s vision.

What’s Next?

The Crypto Strategic Reserve follows weeks of discussions within Trump’s newly formed Working Group on Digital Assets.

On March 7, Trump will host the first White House Crypto Summit, bringing together industry leaders, policymakers, and officials, including Bo Hines and Trump’s AI and Crypto Czar, David Sacks. Discussions are expected to cover:

- The regulatory framework for digital assets

- Stablecoin oversight and policies

- The role of Bitcoin and other cryptocurrencies in the national economy

Final Takeaway

As the debate over the Crypto Strategic Reserve unfolds, it is clear that Bitcoin remains the dominant choice for industry leaders. Whether the US government ultimately adopts a Bitcoin-only reserve or includes multiple digital assets will shape the future of crypto’s role in national reserves and financial policy.

Will the US take the Bitcoin standard route, or will it diversify its holdings? The upcoming White House Crypto Summit could provide critical answers.