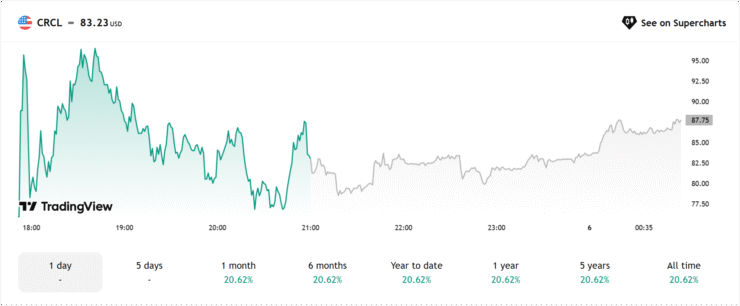

Circle Internet Financial, the company behind the USDC stablecoin, made a blockbuster debut on the New York Stock Exchange Thursday, with its shares—trading under the ticker CRCL—skyrocketing past expectations. By early afternoon, the stock surged above $90, nearly tripling its IPO price of $31 and prompting a temporary trading halt due to heightened volatility.

The impressive debut came just days after Circle finalized the terms of its long-awaited IPO. Initially planning to price shares between $24 and $26, the company raised the range to $27–$28 earlier in the week, ultimately selling 34 million shares at $31 each. The offering raised approximately $1.1 billion, signaling strong institutional confidence in Circle’s business model and its strategic role in the digital asset economy.

The bullish market response underscores investor optimism around the stablecoin sector and crypto infrastructure more broadly. Circle’s transparent reserve disclosures, U.S.-compliant frameworks, and deep partnership network likely contributed to investor enthusiasm.

Despite headwinds for USDC—including declining market share and fierce competition from dominant rival Tether (USDT)—Circle’s IPO suggests equity investors are betting on the long-term viability of regulated stablecoins. This is especially relevant as U.S. lawmakers prepare to vote on the GENIUS Act, legislation that could provide long-awaited clarity for the stablecoin industry.

As of market close, Circle’s debut ranks among the year’s top-performing IPOs, raising expectations for a wave of future public listings from other crypto and fintech firms.

Circle Becomes Wall Street’s Latest Bet on Crypto Infrastructure

Circle’s IPO is being widely viewed as a landmark in crypto’s deeper integration into traditional finance. Nearly four years after Coinbase’s splashy Nasdaq direct listing, Circle’s decision to go public via a conventional IPO illustrates a maturing strategy for digital asset companies entering the public markets.

While Coinbase has become synonymous with retail crypto trading, Circle represents the infrastructure layer powering stablecoin issuance, cross-border payments, and on-chain liquidity. As VanEck’s Matthew Sigel aptly described, “If Coinbase is the storefront, then Circle is the payments pipework running beneath it.”

USDC currently holds about 25% of the $230 billion stablecoin market, behind only Tether, which commands more than $150 billion in capitalization. However, analysts have begun to note the incredible profitability of stablecoins as financial products. In Q1 2025, Tether posted over $1 billion in net profit, rivaling the earnings of several traditional banks. That sets a high bar for Circle’s public reporting and investor performance expectations.

Circle now joins a growing cohort of crypto-native firms trading on U.S. exchanges. In recent weeks, Galaxy Digital and DeFi Technologies also completed listings, expanding the range of equity-based exposure available to institutional investors seeking to participate in the digital asset ecosystem.

With regulatory guardrails forming and stablecoins increasingly used in international payments, Circle’s IPO could prove to be a bellwether for how the next generation of crypto infrastructure firms are priced and positioned in global capital markets.

Quick Facts

- Circle raised $1.1 billion by selling 34 million shares at $31.

- CRCL stock surged over 170%, peaking above $90 on day one.

- USDC holds a 25% share of the global stablecoin market.

- The IPO follows recent listings from Galaxy Digital and DeFi Technologies.

- The GENIUS Act may soon bring legal clarity to the stablecoin sector.