Circle, the issuer of USDC, is making a bold regulatory shift. The company announced on March 13 that it will bring its Hashnote Tokenized Money Market Fund (TMMF) under Bermuda’s Digital Assets Business Act (DABA) framework.

This move falls under Circle’s existing Bermuda DABA license and aims to enhance compliance, transparency, and investor confidence. It paves the way for a deeper integration between USDC and USDY, positioning the latter as the go-to yield-bearing collateral for crypto exchanges, custodians, and brokers.

The Bermuda Monetary Authority (BMA) has pioneered digital asset regulation, making it an attractive jurisdiction for firms seeking clear and progressive crypto laws. Circle was the first crypto firm to obtain a license under Bermuda’s DABA in September 2021, setting a precedent for others in the industry.

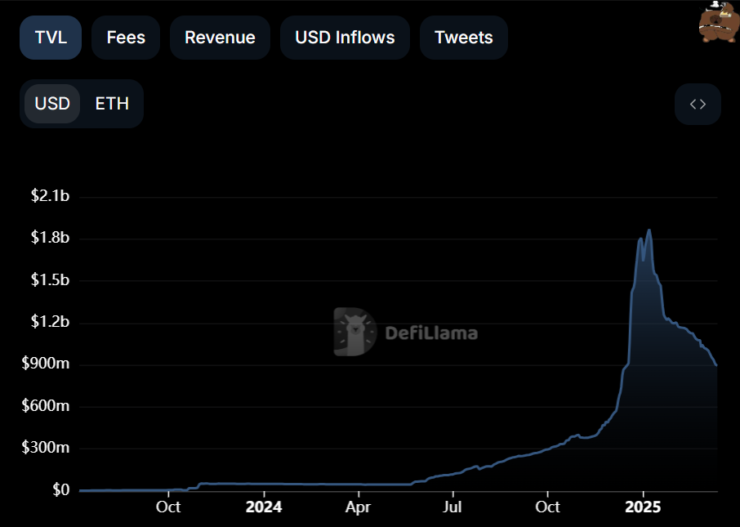

Hashnote is the issuer of USDY, the largest tokenized treasury and money market fund, with a total value locked (TVL) of $900 million, according to DeFiLlama. However, its TVL has fallen sharply from $1.9 billion on January 7, 2025, signaling a shift in market dynamics for tokenized real-world assets (RWAs).

What This Means for Stablecoin Adoption

The move could reshape how stablecoins interact with tokenized assets. By linking USDC with USDY, Circle is positioning itself to create a yield-generating alternative to traditional stablecoin holdings.

- USDC holders could easily access tokenized treasuries, offering yield opportunities without leaving the crypto ecosystem.

- Crypto exchanges, brokers, and custodians would gain access to regulated, yield-bearing collateral, potentially increasing USDY’s utility in decentralized finance (DeFi) and institutional trading.

- More capital could flow into tokenized real-world assets (RWAs) as Circle strengthens the bridge between stablecoins and traditional financial instruments.

Is Tokenized RWAs A $30 Trillion Market Opportunity?

Circle’s push into regulated tokenized assets aligns with broader industry predictions. In August 2024, Polygon’s head of institutional capital, Colin Butler, estimated that tokenized real-world assets (RWAs) represent a $30 trillion global opportunity.

RWAs include tokenized versions of U.S. Treasuries, real estate, gold, carbon credits, and other tangible assets. These assets bring liquidity to traditionally illiquid markets, creating new opportunities for investors and institutions.

The market for tokenized U.S. Treasuries has already exceeded expectations. Originally predicted to reach $3 billion by the end of 2024, the sector has now surpassed $4.2 billion, according to RWA.xyz.

However, Hashnote—now a key part of Circle’s ecosystem—has seen its total value locked (TVL) drop by 21% in the past 30 days, reflecting market fluctuations in the tokenized asset space.

Despite this, the broader RWA market remains strong, recently reclaiming an all-time high of $18.1 billion. Institutional players continue piloting tokenization projects across real estate, gold, and alternative financial assets.

What’s Next for Circle and Stablecoin-Backed Tokenization?

By integrating Hashnote’s USDY with USDC, Circle is positioning itself at the intersection of stablecoins and tokenized finance. If the Bermuda regulatory framework proves successful, this model could become a blueprint for other stablecoin issuers looking to expand into yield-bearing assets while maintaining regulatory clarity.

This development could also pressure competitors like Tether (USDT) to adopt similar compliance-focused strategies to maintain institutional credibility.

For now, Circle’s strategic shift under Bermuda’s DABA license highlights one of the biggest transformations in stablecoin history—bridging traditional finance with crypto-native liquidity solutions.

Will USDC and USDY reshape the way stablecoins function in DeFi and beyond? The next few months will provide crucial insights.