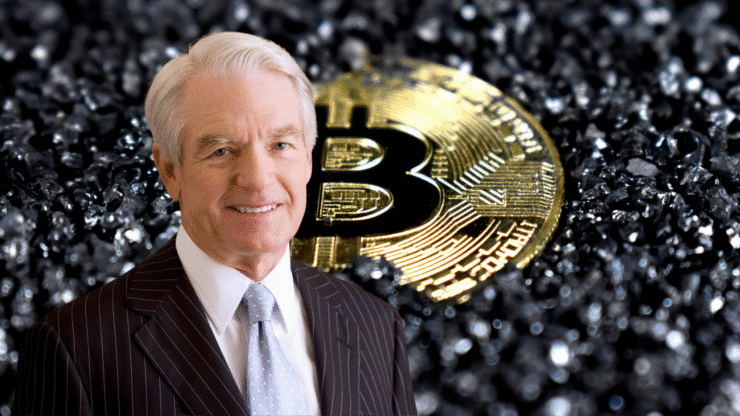

Charles Schwab CEO Rick Wurster has revealed the firm is aiming to roll out spot Bitcoin trading services for its clients by April 2026, signaling a major step forward in the company’s cautious but calculated move into digital assets.

In comments reported by RIABiz, Wurster pointed to a dramatic 400% increase in visits to Schwab’s crypto-dedicated website as a key indicator of growing retail and institutional appetite for crypto exposure. He noted that the firm’s roadmap is contingent on regulatory clarity but expressed confidence in a favorable shift.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto. Our goal is to do that in the next 12 months, and we are on a great path to be able to do that,” Wurster said.

The move aligns with a broader wave of traditional finance players integrating crypto services, as major institutions increasingly look to offer secure, regulated access to digital asset markets. For Schwab—a household name in retail and institutional investing—the launch could represent a pivotal moment in bridging Wall Street with the crypto frontier.

New CEO Signals Shift in Crypto Strategy

Since stepping into the CEO role in early 2025, Rick Wurster has steered Charles Schwab toward a more forward-leaning stance on cryptocurrency—marking a notable shift for one of America’s largest financial institutions. In a prior interview with Yahoo Finance, Wurster expressed interest in offering crypto directly to Schwab clients but emphasized that regulatory conditions would need to improve first.

Now, following Donald Trump’s re-election and early signs of a more crypto-friendly regulatory climate, Schwab appears poised to accelerate its digital asset initiatives. Wurster has signaled growing optimism about the path ahead, stating that the firm anticipates “a much better environment” for integrating crypto products into its core service offerings.

Interestingly, the Schwab CEO also admitted he personally missed the crypto wave. He stated that he feels “kind of silly” for not having invested earlier.

Schwab-TMTG Alliance Powers Truth.Fi Rollout

In a move that blends finance, politics, and digital innovation, Charles Schwab announced in January 2025 a strategic partnership with the Trump Media and Technology Group (TMTG) to help power the upcoming Truth.Fi platform—a hybrid financial service offering that will feature both traditional investment tools and cryptocurrency access.

The partnership includes support for customized ETFs and digital asset services tailored to users of the Truth.Fi ecosystem, which is being marketed as a decentralized alternative to legacy financial institutions.

According to TMTG CEO and former Congressman Devin Nunes, the goal is to serve individuals increasingly concerned about privacy issues, censorship, and “debanking” by major corporations and tech platforms. The platform, he said, is designed to offer financial sovereignty for users wary of what he described as “woke” corporate overreach.

For Schwab, the collaboration not only reflects a willingness to innovate within a politically charged space but also aligns with its broader push to tap into the growing demand for digital asset exposure—especially among retail investors seeking platforms outside traditional finance.

Quick Facts

- Charles Schwab plans to launch spot Bitcoin trading by April 2026.

- A 400% increase in crypto-related web traffic signals rising client interest.

- The company is awaiting regulatory clarity to move forward.

- Partnership with Trump Media aims to expand digital asset offerings.