The application makes a strong case for staking Solana, arguing that not staking SOL would be equivalent to an equity ETF refusing dividends from the companies it holds. This marks a new frontier for crypto ETFs, as no existing spot Bitcoin or Ethereum ETF includes staking rewards.

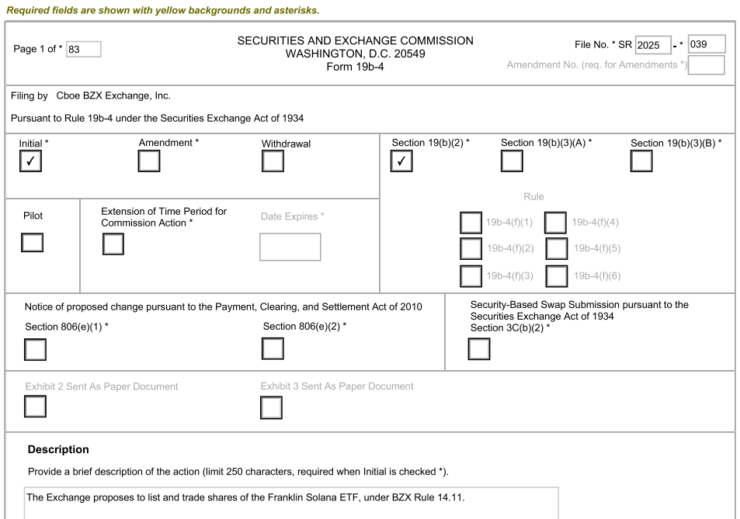

Franklin Templeton’s move aligns with its broader push into blockchain-based investment vehicles. The firm registered a Solana trust on 10 February, joining a growing list of asset managers, Grayscale, Bitwise, VanEck, 21Shares, and Canary Capital, betting on Solana’s institutional adoption.

Solana’s inclusion in Franklin Templeton’s investment strategy is particularly noteworthy given its brief mention in U.S. President Donald Trump’s proposed crypto reserve. While Trump later scaled back this proposal to include only tokens seized through enforcement actions, Solana’s initial consideration signals growing mainstream recognition of the asset’s utility.

The application also follows a wave of crypto ETF filings that surged after SEC Chair Gary Gensler’s resignation in January 2025. Many in the industry believe his departure will usher in a more crypto-friendly regulatory environment, making approvals more likely than ever before.

SEC Delays Altcoin ETF Decisions—But Approval Odds Remain High

Despite the flurry of filings, the SEC announced on 11 March that it would delay decisions on several altcoin ETFs, including Solana, Litecoin (LTC), Dogecoin (DOGE), and XRP (XRP).

The regulator cited the need for further evaluation before deciding on a rule change to approve these products. However, Bloomberg ETF analyst James Seyffart reassured investors that the delay was standard procedure, not a signal of rejection. He noted that the final deadline for approval remains October 2025 and believes approval odds remain high.

Franklin Templeton’s CEO, Jenny Johnson, remains bullish on blockchain integration into traditional finance. In a January 21 interview with Bloomberg, she stated:

“I do think that it’s likely that ETFs and mutual funds will ultimately be built on blockchain just because it’s an incredibly efficient technology.”

Her comments reflect a broader trend—Wall Street firms are no longer just experimenting with blockchain but actively integrating it into future financial products.

What’s Next?

The Solana ETF proposal represents a major shift in how institutional investors may gain exposure to crypto assets. If the staking provision is approved, it could set a new precedent for future crypto ETFs, potentially expanding staking rewards into mainstream financial products.

However, the SEC’s stance on staking remains uncertain. Previous regulatory scrutiny of staking services—including actions against Kraken and Coinbase raises questions about whether the commission will permit ETFs to engage in staking.

For now, investors and asset managers are closely watching how the SEC handles the evolving crypto ETF landscape. If Franklin Templeton’s Solana ETF moves forward, it could pave the way for a new era of blockchain-powered investment products.