Just 11 days after Circle’s public debut on the New York Stock Exchange, Cathie Wood’s ARK Invest has begun profit-taking—offloading 342,658 shares worth approximately $51.7 million. The move marks ARK’s first divestment from what had been one of its most closely watched crypto-linked positions this quarter.

The shares were sold across three of ARK’s exchange-traded funds: ARK Innovation (ARKK), ARK Fintech Innovation (ARKF), and ARK Next Generation Internet (ARKW). At their peak, Circle represented up to 6.7% of some fund portfolios, reflecting the firm’s confidence in the stablecoin issuer’s long-term value.

ARK originally acquired 4.49 million shares of Circle during its June 5 IPO, establishing a $373.4 million position based on that day’s closing price. The decision to trim exposure while the stock trades at all-time highs signals a disciplined strategy to lock in early gains while maintaining meaningful upside potential.

Circle Still Dominates ARK’s Portfolio Despite Partial Sell-Off

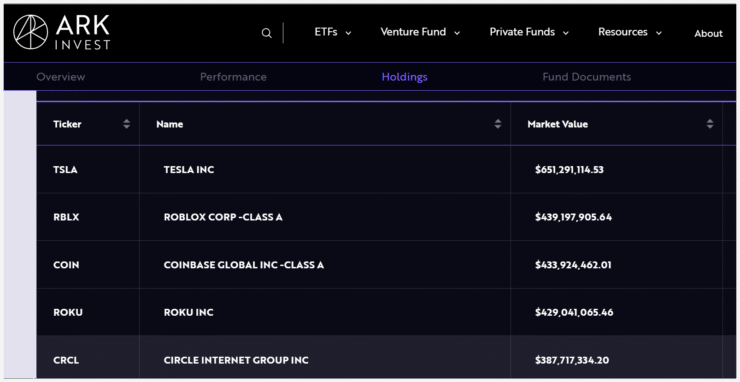

Despite the $51.7 million sale, ARK Invest continues to hold a significant stake in Circle across its flagship funds. The stablecoin issuer (CRCL) remains one of the top-weighted assets in the ARK portfolio—underlining Cathie Wood’s sustained conviction in its role within the evolving digital finance ecosystem.

ARKK, the firm’s largest ETF with $5.6 billion in assets under management, retains a $387.7 million position in Circle, representing 6.6% of its portfolio. ARKW holds $124 million in Circle stock (6.7%), ranking just behind Coinbase, the fund’s top holding at 6.8%. Even in ARKF, Circle commands a $72 million stake, also weighted at 6.7%.

The figures suggest that the recent divestment was a strategic partial exit rather than a step back, aimed at realizing profits while keeping strong exposure to the stablecoin sector’s long-term potential.

Circle Stock Soars 118% Since IPO as ARK Doubles Down

Circle’s rapid post-IPO performance has validated the confidence of early institutional investors like ARK. Initially priced at $69 per share, Circle surged as high as $164 within days—marking a 118% gain. It closed at $151 on June 16, buoyed by robust investor interest.

ARK was among the early institutional buyers, pledging up to $150 million ahead of the IPO. That commitment deepened as Circle upsized its offering multiple times to meet surging demand, reflecting one of the most enthusiastic receptions for a crypto-linked stock in recent quarters.

In a June 9 research note, ARK analysts framed stablecoins as the next chapter in digital asset utility—complementing Bitcoin’s original promise of financial sovereignty with more stable, practical instruments. They argued that while Bitcoin pioneered digital ownership, stablecoins now offer scalable solutions for blockchain-native finance.

Founder Cathie Wood, a longtime Bitcoin advocate, has forecast that BTC could reach $1.5 million by 2030. Circle’s strong market debut appears to strengthen that narrative—positioning stablecoins not only as critical digital infrastructure but also as prime vehicles for long-term investment.

Quick Facts

- ARK Invest sold 342,658 Circle shares worth $51.7 million across three ETFs just 11 days after the company’s IPO.

- Despite the partial exit, Circle remains one of ARK’s top holdings, with positions totaling over $583 million across ARKK, ARKW, and ARKF.

- Circle stock has surged 118% since its $69 IPO debut, closing at $151 on June 16 amid strong institutional demand.

- ARK analysts view stablecoins as a key blockchain utility layer, likening their rise to Bitcoin’s foundational mission of digital financial sovereignty.