Bitcoin could hit $1.5 million by 2030 in a best-case scenario, predicts Cathie Wood, whose name has become synonymous with high-conviction bets on disruptive technologies. The founder of ARK Invest has cemented her position as one of the most influential voices in cryptocurrency investment, advocating for a future where digital assets reshape global financial systems.

Born in Los Angeles in 1955, Wood built her investment career over four decades before founding ARK Invest in 2014. Her educational foundation — graduating summa cum laude from the University of Southern California with a degree in finance and economics — combined with mentorship from famed economist Arthur Laffer, established the intellectual framework for her later contrarian investment approaches.

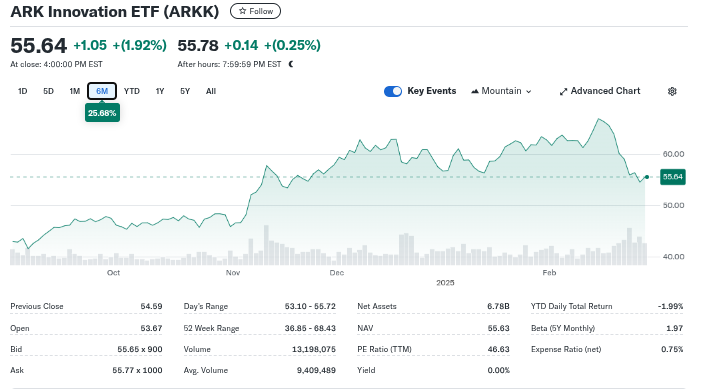

Wood’s flagship ARK Innovation exchange-traded fund has surged 17% since President Donald Trump’s November election victory, outpacing the S&P 500’s modest 1.7% gain during the same period. This performance reflects what market analysts call the “Trump bump,” particularly benefiting two of ARK’s top holdings – Tesla and Coinbase – which jumped 54% and 7% respectively since the election.

Cathie Wood’s Path to ARK Invest

Wood’s professional journey began at Capital Group as an assistant economist in the late 1970s. She spent 18 years at Jennison Associates before co-founding hedge fund Tupelo Capital Management. Later, as chief investment officer for global thematic strategies at AllianceBernstein, Wood cultivated the investment philosophy that would define her approach at ARK Invest.

Frustrated by conventional investment models, Wood launched ARK Invest in 2014 to focus exclusively on disruptive innovation. Her firm employs not just financial analysts but scientists and technologists to better understand emerging technologies, including cryptocurrency and blockchain.

“We’re telling people that, hey, we offer a highly differentiated exposure to innovation,” Wood told Reuters. “Yes, we’re going to be volatile.”

Pushing the Trump Administration on Crypto Policy

Now, just over a month into President Trump’s term, Wood is actively engaging with the administration, advocating for the backdating of tax cuts to January 1, 2025.

“I’m trying to communicate that pretty regularly to anyone who will listen,”

she said in December, arguing that such measures would provide market certainty and prevent companies from delaying investment decisions.

Though campaign finance records indicate that Wood did not financially back Trump in the 2024 election cycle, she maintains strategic connections with key policy shapers in the new administration. According to Reuters, Wood has met Trump once at his Florida home and stays in contact with Tesla CEO Elon Musk and Wyoming Republican Senator Cynthia Lummis, both instrumental in shaping the president’s crypto policies.

Wood has publicly supported Trump’s economic platform, arguing his plans to promote innovation in cryptocurrency and artificial intelligence while reducing regulations will benefit American businesses. She believes the crypto crackdown under the previous administration put the United States in a vulnerable position, but President Trump’s team “will not want to lose innovation to the rest of the world.”

The Bitcoin Bull Thesis

ARK Invest launched a spot Bitcoin ETF in January, just before Trump’s inauguration, positioning Wood’s firm at the forefront of providing institutional exposure to cryptocurrencies. This move reflects her conviction that digital assets represent a transformative asset class that institutional investors are just beginning to explore.

Wood’s aggressive Bitcoin strategy is supported by extensive research. ARK’s data shows Bitcoin reached all-time highs in 2024, with spot Bitcoin ETFs attracting over $4 billion in inflows on their first day of trading, outpacing gold ETFs. Following Bitcoin’s fourth halving, its annual inflation dropped to approximately 0.9%, below gold’s long-term supply growth rate.

Her specific Bitcoin price targets are striking: $300,000 in a bear case scenario, $710,000 as a base case, and $1.5 million in a bull case – all projected for 2030. These forecasts assume institutional investors will allocate between 1% and 6.5% of their portfolios to Bitcoin.

Wood predicts central banks may eventually hold Bitcoin, potentially challenging traditional reserve currencies. She sees Bitcoin as a hedge against inflation and counterparty risk, representing not just a speculative instrument but the future of money.

ARK’s Expanding Crypto Strategy

ARK’s crypto strategy extends beyond Bitcoin to include stablecoins and blockchain technologies. The firm’s research indicates stablecoins overtook both Mastercard and Visa in transaction value in 2024, processing an annualized $15.6 trillion – 119% of Visa’s volume and 200% of Mastercard’s.

The stablecoin supply reached $203 billion in 2024 and is projected to grow to $1.4 trillion by 2030, representing a 38% compound annual growth rate. This market is currently dominated by Tether (USDT) and Circle (USDC), which generated $6.7 billion in annual revenue during the second half of 2024.

Wood’s firm has created multiple investment vehicles to capitalize on these trends, including the ARK 21Shares Active Bitcoin Futures Strategy ETF (ARKA) and the ARK 21Shares Active On Chain Bitcoin Strategy ETF (ARKC).

Weathering Criticism

Despite her confident predictions, Wood’s investment performance has faced scrutiny. Investors have withdrawn approximately $3.5 billion from her flagship fund over the past two years, including $300 million in recent weeks.

“That’s an atypical pattern for most ETFs and mutual funds, but typical of the contrarian pattern we’ve seen for Cathie Wood’s funds,” said Robby Greengold, a Morningstar analyst.

Morningstar labeled ARK Innovation ETF the third highest “wealth destroyer” for the period 2014-2023, citing $7.1 billion in lost shareholder value. However, Wood remains undeterred by criticism or volatility, maintaining her long-term investment perspective.

Reshaping Institutional Perceptions

Wood’s persistent advocacy has influenced broader market perceptions of cryptocurrency. Her bullish outlook and active involvement in crypto-related ETFs have helped accelerate institutional adoption, with a growing percentage of financial advisors now incorporating crypto into client portfolios.

By framing cryptocurrency as a core component of modern investment strategies, Wood has helped legitimize Bitcoin and other digital assets for mainstream investors. This is reflected in the growth of assets under management in crypto ETFs, which now rival traditional asset classes.

Rather than passively holding positions, ARK Invest continuously rebalances its portfolio, buying aggressively during market downturns and strategically selling overvalued assets to manage risk.

Wood continues to adjust her portfolio strategically, recently selling some Tesla shares to reinvest in companies likely to benefit from artificial intelligence, such as Archer Aviation, a developer of autonomous aircraft.

“I do think that the market is going to continue broadening out,” Wood said. “It’ll definitely favor innovation and anything that has been held back by policies in the last several years.”

As the Trump administration settles into office and begins implementing its promised pro-innovation policies, Wood’s influence as a crypto thought leader appears positioned to grow, potentially reshaping how institutional and retail investors view this emerging asset class for years to come.