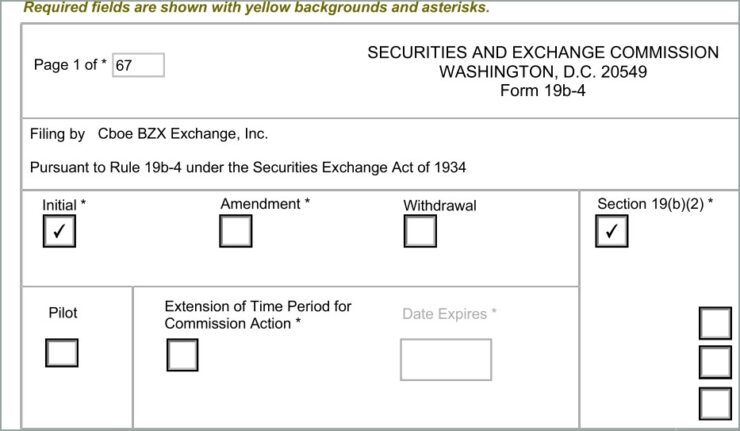

Plans for a U.S.-listed SUI exchange-traded fund (ETF) have advanced as the Chicago Board Options Exchange (Cboe) filed a 19b-4 form with the Securities and Exchange Commission (SEC), seeking permission to list the product. The ETF, proposed by Nashville-based Canary Capital, would provide regulated exposure to the SUI token—a layer-1 blockchain aiming to compete with Ethereum and Solana.

This move marks the second step in the ETF approval process, following Canary Capital’s initial filing last month. If approved, the ETF would make SUI accessible to a broader class of investors through traditional financial markets, eliminating the need for direct token management.

SUI, launched in May 2023, is a proof-of-stake blockchain developed by former Meta engineers. The network has positioned itself as a scalable alternative in the smart contract space and has already attracted early attention for its DeFi and staking capabilities.

Cboe’s acceleration of the process signals growing institutional confidence in second-tier blockchain ecosystems, as exchanges and asset managers move beyond Bitcoin and Ethereum to package newer digital assets into structured investment products.

SEC Review Begins as SUI ETF Awaits Decision

Following Cboe’s formal submission, the proposed SUI ETF now enters the regulatory review phase as the exchange awaits a decision from the SEC. If approved, the product—developed in partnership with Canary Capital—would become one of the first ETFs to offer direct exposure to the SUI token on U.S. markets.

Canary Capital, based in Nashville, has also filed for several other altcoin ETFs, including products tied to Solana, XRP, and even Pudgy Penguins—a growing NFT-linked brand. These filings reflect increasing demand for regulated crypto investment vehicles that allow traditional investors to gain exposure to digital assets without managing private keys or custody solutions.

As of April 8, SUI was trading at approximately $1.98, with a market cap of $6.4 billion—ranking it 22nd among cryptocurrencies by market size, according to CoinGecko data. While daily price action remains relatively stable, institutional efforts to onboard SUI into ETF frameworks could have broader implications for its market liquidity and mainstream relevance.

SEC Weighs Multiple Altcoin ETF Applications

The Securities and Exchange Commission is currently reviewing a growing number of altcoin ETF proposals submitted by major asset managers, including VanEck, 21Shares, and Bitwise. These filings reflect renewed optimism in the digital asset sector following the landmark approvals of spot Bitcoin and Ethereum ETFs in early 2024. Fund managers are now seeking to extend that momentum to a broader range of tokens, positioning their firms to meet increasing investor appetite for diversified crypto exposure.

The recent wave of altcoin ETF filings—such as Canary Capital’s SUI proposal—is unfolding against a backdrop of heightened enthusiasm in the digital asset space, largely fueled by the regulatory posture of President Trump’s second term. Since returning to office with a pro-crypto agenda, the administration has taken steps to ease restrictions on blockchain access, scale back enforcement-led regulation, and encourage innovation within U.S. markets.

This policy shift has emboldened both traditional finance firms and crypto-native asset managers to pursue ETF products with greater confidence, anticipating a regulatory environment more receptive to structured, compliant crypto offerings.

Quick Facts

- Cboe has filed with the SEC to list Canary Capital’s proposed SUI ETF.

- The SUI blockchain, launched in May 2023, aims to compete with Ethereum and Solana.

- Canary Capital is pursuing multiple altcoin ETFs, including those for Solana and XRP.

- The SEC is reviewing various digital asset ETF applications amid growing market interest.